- United States

- /

- Biotech

- /

- NasdaqGS:IRWD

Why Ironwood Pharmaceuticals (IRWD) Is Up 35.3% After Raising 2025 Revenue Guidance on LINZESS Momentum

Reviewed by Sasha Jovanovic

- Ironwood Pharmaceuticals recently reported third-quarter earnings, posting US$122.06 million in revenue and US$40.08 million in net income, along with raising its 2025 full-year revenue guidance to between US$290 million and US$310 million following strong LINZESS sales and expanded FDA approval for pediatric use.

- This combination of significant earnings growth and an upgraded financial outlook reflects both robust operational performance and momentum in the company's core gastrointestinal product line.

- We will explore how Ironwood’s revised financial guidance, notably driven by increased LINZESS sales, could influence its investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Ironwood Pharmaceuticals Investment Narrative Recap

To invest in Ironwood Pharmaceuticals, you need to believe in its ability to sustain LINZESS sales growth while managing headwinds from drug pricing reforms and working toward high-impact pipeline milestones like apraglutide’s approval. The recent Q3 earnings beat and raised 2025 revenue guidance highlight LINZESS as a short-term catalyst, but pricing headwinds from Medicare Part D redesign continue to be the biggest business risk, even strong quarterly performance doesn’t materially eliminate this threat for now. The most relevant recent announcement is the FDA’s expanded approval of LINZESS in pediatric use, which ties directly to the strong revenue growth seen in the latest quarter; this underscores the ongoing importance of LINZESS as both a growth driver and near-term financial anchor, giving Ironwood room to invest in its pipeline while weathering potential pricing pressure. Yet despite upbeat news, investors should be aware that...

Read the full narrative on Ironwood Pharmaceuticals (it's free!)

Ironwood Pharmaceuticals' outlook anticipates $197.3 million in revenue and $27.2 million in earnings by 2028. This reflects a yearly revenue decline of 14.7% and a $59.5 million increase in earnings from the current figure of -$32.3 million.

Uncover how Ironwood Pharmaceuticals' forecasts yield a $0.95 fair value, a 62% downside to its current price.

Exploring Other Perspectives

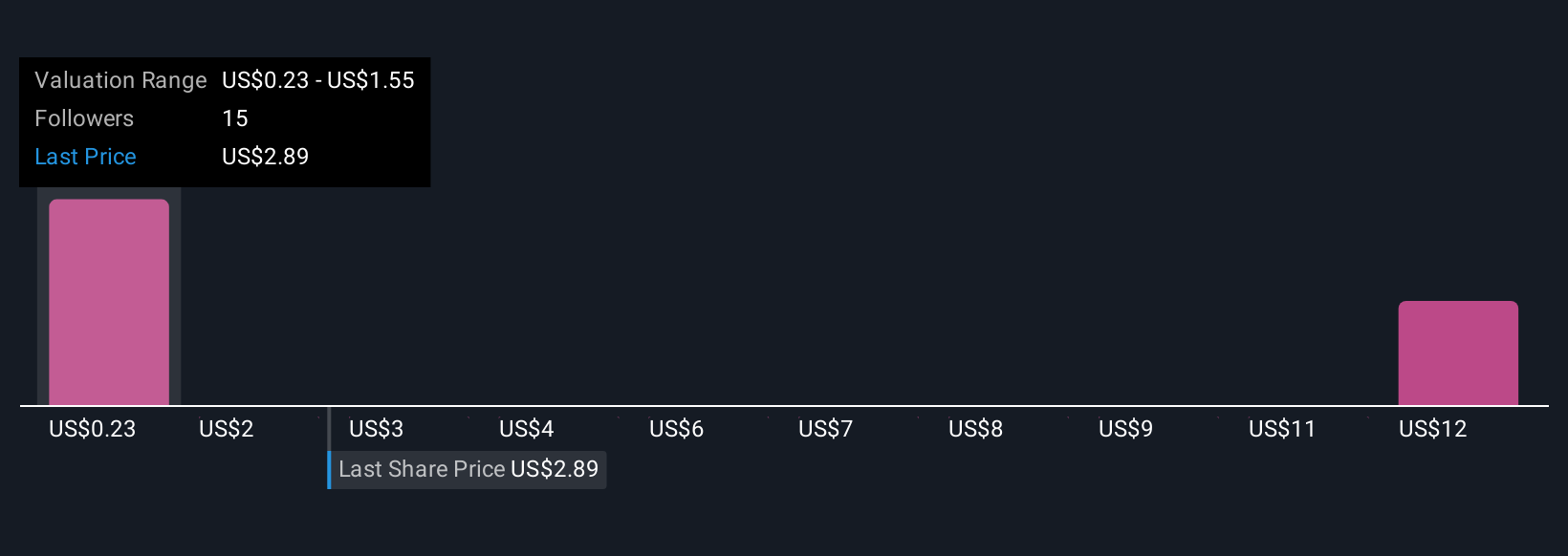

Simply Wall St Community members offer five fair value estimates for Ironwood stock, ranging from US$0.23 to US$12.78 per share. While LINZESS momentum is front of mind, pricing reforms could test the company’s resilience in the months ahead, be sure to compare these perspectives to your own and explore further.

Explore 5 other fair value estimates on Ironwood Pharmaceuticals - why the stock might be worth less than half the current price!

Build Your Own Ironwood Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ironwood Pharmaceuticals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ironwood Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ironwood Pharmaceuticals' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRWD

Ironwood Pharmaceuticals

A biotechnology company, focuses on the development and commercialization of therapies for gastrointestinal (GI) and rare diseases in the United States and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives