- United States

- /

- Biotech

- /

- NasdaqGM:IRON

Why Disc Medicine (IRON) Is Up 7.3% After FDA Priority Review and $250M Capital Raise

Reviewed by Sasha Jovanovic

- In the past week, Disc Medicine announced the initiation of a Phase 1b clinical trial for DISC-3405 in adults with sickle cell disease and reported the FDA's priority review of its New Drug Application for bitopertin in erythropoietic protoporphyria, alongside a public offering of approximately US$250 million in support of commercialization and R&D.

- A key insight is that these clinical and regulatory advances highlight Disc Medicine’s emphasis on expanding its pipeline for hematological conditions, reflecting the company’s approach to addressing major unmet medical needs.

- We’ll explore how the FDA’s priority review for bitopertin adds momentum to Disc Medicine’s portfolio of hematological disease treatments.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Disc Medicine's Investment Narrative?

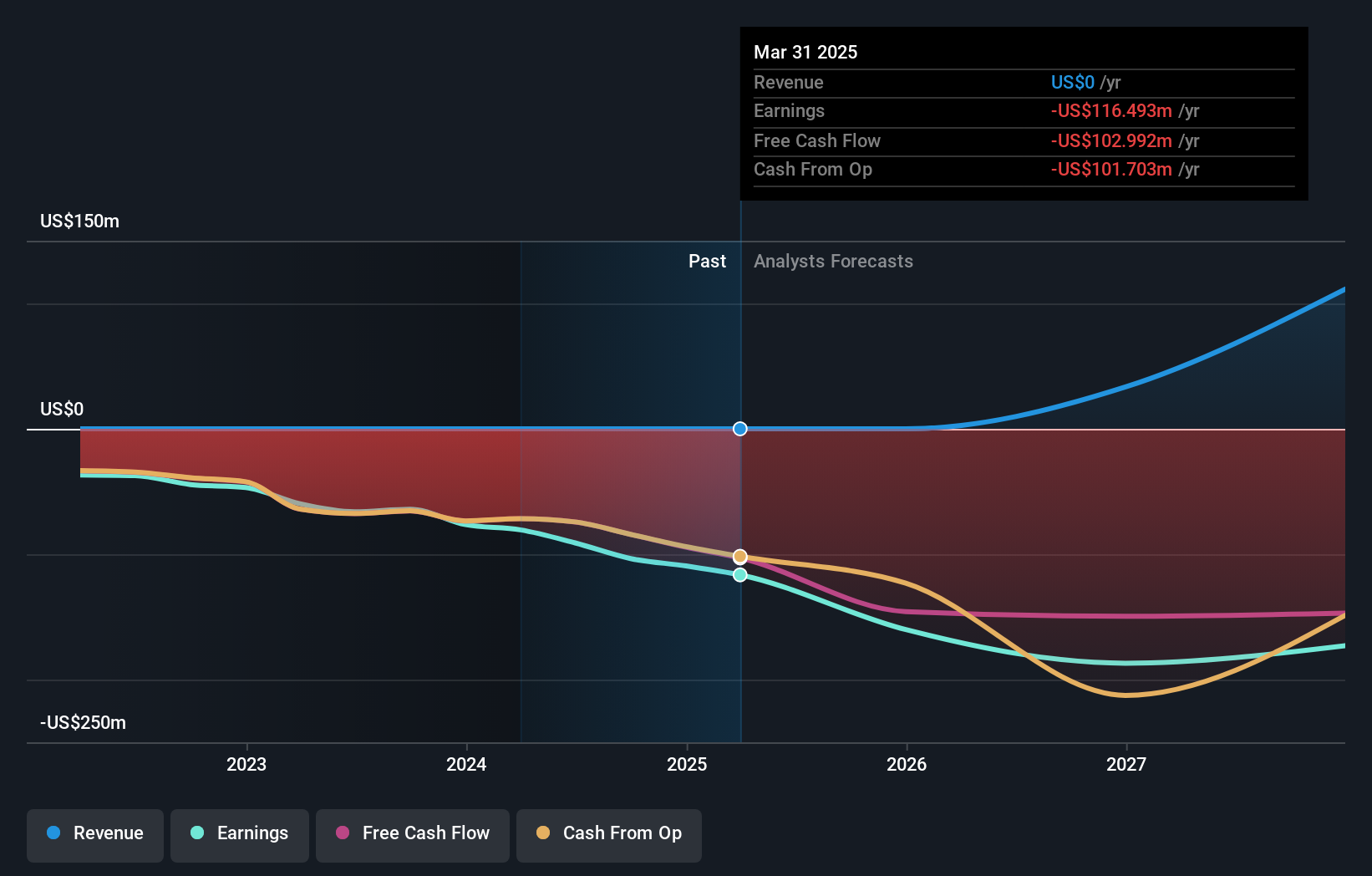

In considering Disc Medicine as a potential investment, the central belief to hold is confidence in the company’s ability to bring innovative hematological treatments to market, despite currently having no revenue and widening losses. The recent FDA priority review for bitopertin and the launch of a Phase 1b trial for DISC-3405 have put clear near-term catalysts in the spotlight, especially with bitopertin’s regulatory review possibly concluding by early 2026. The US$250 million capital raise provides crucial backing for commercialization and R&D, but it also reinforces a key risk: ongoing dilution for shareholders as Disc Medicine remains dependent on external financing. The lock-up expiration in December could introduce added volatility. The short-term outlook is now strongly tied to regulatory and clinical milestones, and this update may relieve some financing risk, while amplifying execution risk around product approval and market launch.

But consider that ongoing dilution is still something investors should be closely watching. Disc Medicine's shares have been on the rise but are still potentially undervalued by 10%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Disc Medicine - why the stock might be worth as much as 24% more than the current price!

Build Your Own Disc Medicine Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Disc Medicine research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Disc Medicine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Disc Medicine's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRON

Disc Medicine

A clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives