- United States

- /

- Biotech

- /

- NasdaqGM:IRON

Disc Medicine (IRON): Evaluating Valuation Following FDA Application for Bitopertin in Erythropoietic Protoporphyria

Reviewed by Kshitija Bhandaru

Disc Medicine (IRON) has submitted a New Drug Application to the FDA for bitopertin, seeking accelerated approval and priority review as a treatment for erythropoietic protoporphyria. This decision is supported by encouraging Phase 2 trial results.

See our latest analysis for Disc Medicine.

Disc Medicine’s momentum has been building, thanks to a steady drumbeat of clinical and regulatory milestones. With the recent New Drug Application for bitopertin serving as the latest catalyst, Disc’s 1-year total shareholder return sits at an impressive 31.3%. While short-term share price moves have remained modest, investors seem focused on upcoming catalysts and the company’s broader pipeline. These are signs the market is rewarding long-term potential over near-term volatility.

If this kind of forward-looking news appeals to you, now’s a great moment to uncover more high-growth companies with strong insider backing via our fast growing stocks with high insider ownership

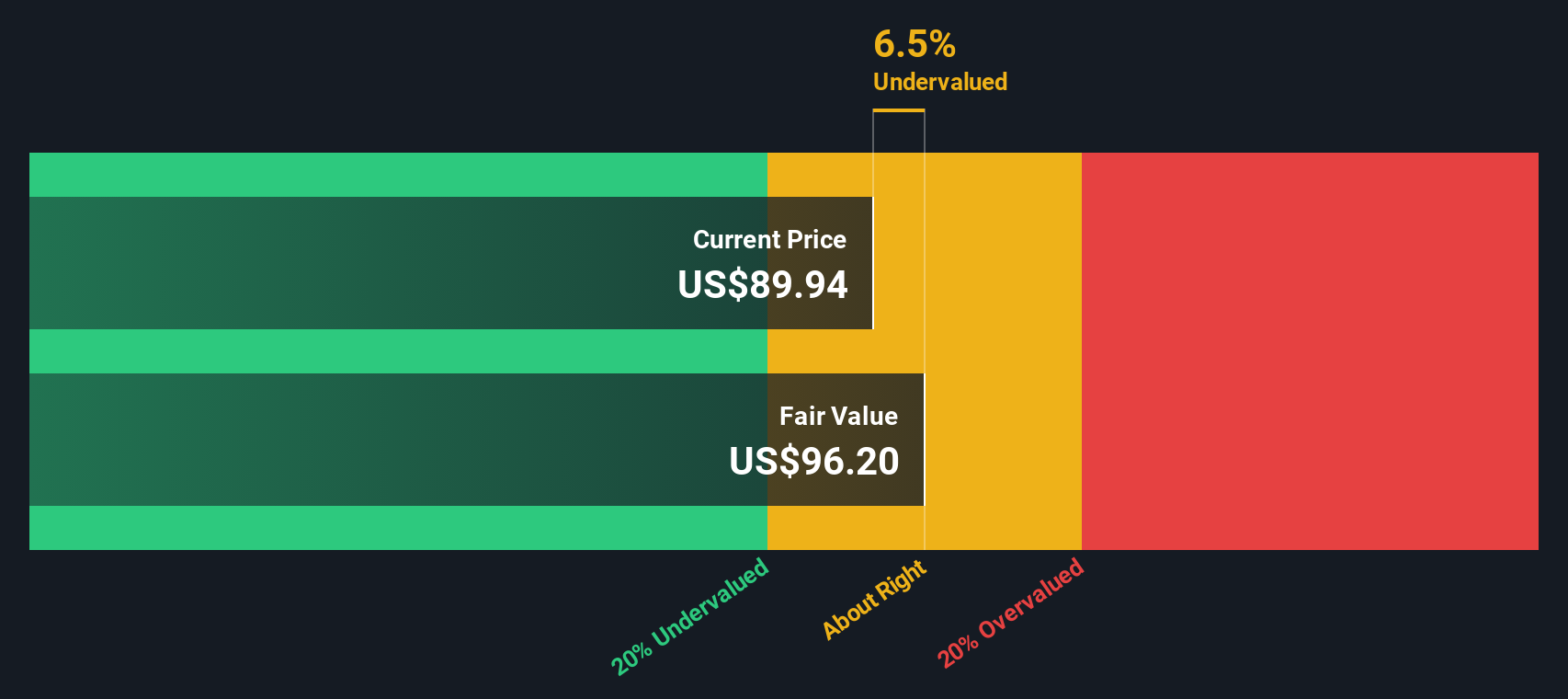

With shares trading more than 30% higher over the past year, and analysts setting price targets that suggest substantial upside remains, the question for investors is clear: Is Disc Medicine undervalued today, or is future growth already reflected in the stock price?

Price-to-Book Ratio of 3.7x: Is it justified?

Disc Medicine currently trades at a price-to-book (P/B) ratio of 3.7x, significantly below the peer average of 30.3x. With a last close price of $65.86, the market is pricing shares well beneath where comparable companies stand relative to their book value.

The price-to-book ratio compares a company's market value to its net assets, providing a snapshot of what investors are willing to pay for each dollar of net assets. This metric is particularly relevant in biotech, where tangible assets often underpin long, research-driven development timelines.

In Disc Medicine's case, the relatively low P/B ratio compared to the lofty peer average suggests investors are cautious, potentially discounting the company’s unprofitable status and lack of meaningful current revenue. Despite promising revenue growth forecasts, market participants may be waiting for clearer profitability or product success before adjusting valuations higher.

It is also notable that while Disc’s P/B is lower than peers, it is above the US Biotechs industry average of 2.4x, highlighting mixed market sentiment. There is insufficient data to calculate the company’s fair P/B ratio, making it difficult to gauge how much room there is for the multiple to move higher or lower.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.7x (UNDERVALUED)

However, ongoing net losses and zero current revenue mean execution risk remains high. This threatens the company’s ability to fulfill its growth potential.

Find out about the key risks to this Disc Medicine narrative.

Another View: Our DCF Model Signals Deeper Value

Looking beyond ratios, our DCF model estimates Disc Medicine’s fair value at $99.12 per share, which is well above its current price of $65.86. This suggests the stock is trading at a 33.6% discount. However, does a strong DCF result outweigh uncertainties around revenue and profitability?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Disc Medicine for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Disc Medicine Narrative

If you see the story differently or want to investigate the numbers for yourself, it only takes a few minutes to shape your own view. Do it your way

A great starting point for your Disc Medicine research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a standout portfolio, now is the time to zero in on stocks reshaping the market. Don’t miss out on opportunities many investors overlook; put your next move into action today.

- Tap into high-potential companies before they break out by scanning these 3563 penny stocks with strong financials, which is packed with strong financials and growth stories waiting to be noticed.

- Target consistent returns and beat low interest rates with these 19 dividend stocks with yields > 3%, offering yields above 3% for a stronger income stream.

- Spot trailblazers in healthcare innovation with these 31 healthcare AI stocks and get ahead of major developments transforming medicine with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRON

Disc Medicine

A clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives