- United States

- /

- Biotech

- /

- NasdaqGM:IRON

Disc Medicine (IRON): Assessing Valuation After FDA Priority Review Request for Bitopertin

Reviewed by Kshitija Bhandaru

Disc Medicine (IRON) is drawing attention after submitting a New Drug Application to the FDA for bitopertin and requesting Priority Review. This step could speed up access to a potential therapy for erythropoietic protoporphyria, offering new hope for patients.

See our latest analysis for Disc Medicine.

Momentum seems to be building for Disc Medicine, with the stock delivering a 21% 90-day share price return and a remarkable 46% total shareholder return over the last year. Recent events, including a high-profile director share sale and a board change, have kept the spotlight on IRON as regulatory milestones approach and investor anticipation grows.

If promising FDA news inspires you to look broader, now is a smart time to discover other healthcare innovators. Explore the full landscape via our See the full list for free..

With shares already up strongly and analysts’ targets implying further upside, investors are left to weigh whether Disc Medicine’s growth outlook is fully reflected in the stock price or if there is room for more gains ahead.

Price-to-Book Ratio of 4x: Is it justified?

Disc Medicine’s price-to-book ratio stands at 4x, putting it above the US Biotechs industry average of 2.5x. This highlights a valuation premium at the recent close of $69.90. This figure gives a direct lens into how much investors are willing to pay relative to the company's net assets, signaling heightened optimism or higher perceived potential compared to peers.

The price-to-book ratio is a standard gauge for asset-heavy industries, especially in biotech when companies remain unprofitable and revenue-light. It is an important metric to watch here given the firm’s ongoing research orientation and lack of current profits, as it helps compare potential rather than actual returns right now.

At 4x, Disc Medicine's valuation exceeds the industry’s norm of 2.5x, showing that the market is already pricing in stronger future growth or success in drug development. However, when measured against the peer average of 8.6x, the stock is not the most expensive in its specialized segment. This suggests some room for interpretation around future opportunities.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 4x (OVERVALUED)

However, risks remain if FDA decisions are delayed or if clinical progress stumbles. These factors could quickly reverse recent momentum and impact sentiment around Disc Medicine.

Find out about the key risks to this Disc Medicine narrative.

Another View: Discounted Cash Flow Perspective

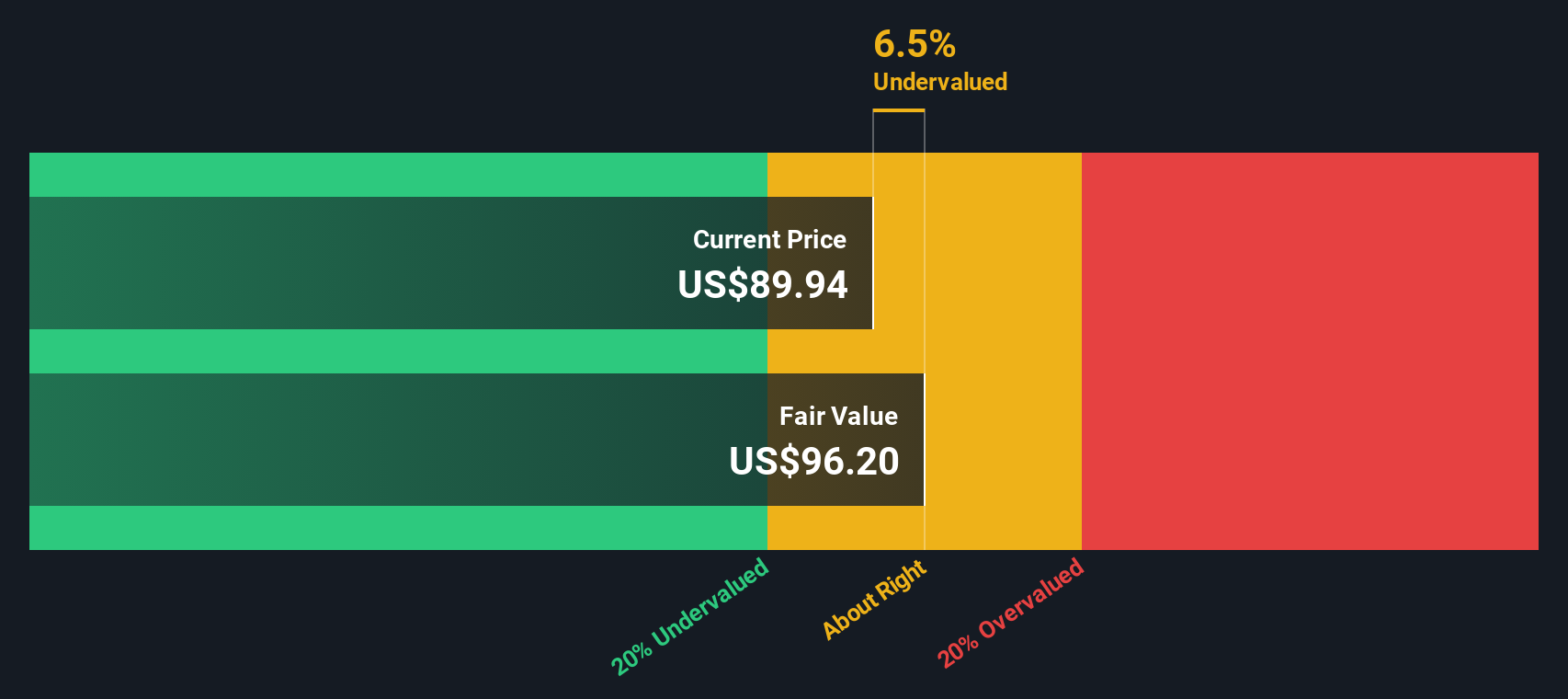

Looking from another angle, our SWS DCF model indicates Disc Medicine could actually be undervalued, trading at $69.90 while our fair value estimate is $98.14. This suggests the market might be overlooking some future potential. Could this contrasting outlook signal untapped opportunity ahead, or is the price premium already justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Disc Medicine for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Disc Medicine Narrative

If our analysis sparks different ideas or you prefer charting your own course, you can assemble a personalized Disc Medicine narrative in just minutes. Do it your way.

A great starting point for your Disc Medicine research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Set yourself up for success by choosing stock ideas backed by data, trends, and real potential. Don’t let this window for smarter moves pass you by.

- Tap into powerful technology transformations when you review these 24 AI penny stocks and see which companies are harnessing artificial intelligence for big gains.

- Capture steady income streams for your portfolio by browsing these 19 dividend stocks with yields > 3% with attractive yields and resilient fundamentals.

- Position yourself at the forefront of innovation by checking out these 26 quantum computing stocks, leading the next era of computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IRON

Disc Medicine

A clinical-stage biopharmaceutical company, engages in the discovery, development, and commercialization of novel treatments for patients suffering from serious hematologic diseases in the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives