- United States

- /

- Biotech

- /

- NasdaqGM:IOVA

Iovance Biotherapeutics Shares Drop 85% as Investors React to Clinical Trial Updates

Reviewed by Bailey Pemberton

- Curious if Iovance Biotherapeutics might be deeply undervalued, or if there's a catch behind the low share price? You're not alone. We're diving straight into what might be driving investor interest right now.

- The stock has had a rough ride, losing 9.5% in the past week and a staggering 85.1% over the last year, so there’s no denying that volatility and risk perception are front of mind for investors.

- Recently, clinical trial updates related to Iovance’s cancer immunotherapy platform and regulatory feedback have caught the eye of both bulls and bears. This has sparked renewed debate around its pipeline potential. Big swings in market sentiment have followed each headline, making it all the more important to consider what’s truly baked into the current share price.

- Iovance scores a solid 5 out of 6 on our value checks, which hints at meaningful undervaluation. However, how we arrive at that number (and whether the market has missed something even bigger) is the key question, so let’s dig into the valuation methods and finish with an even smarter lens at the end.

Find out why Iovance Biotherapeutics's -85.1% return over the last year is lagging behind its peers.

Approach 1: Iovance Biotherapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true value by forecasting future cash flows and then discounting them back to today’s value. This gives investors a sense of what the business is fundamentally worth right now.

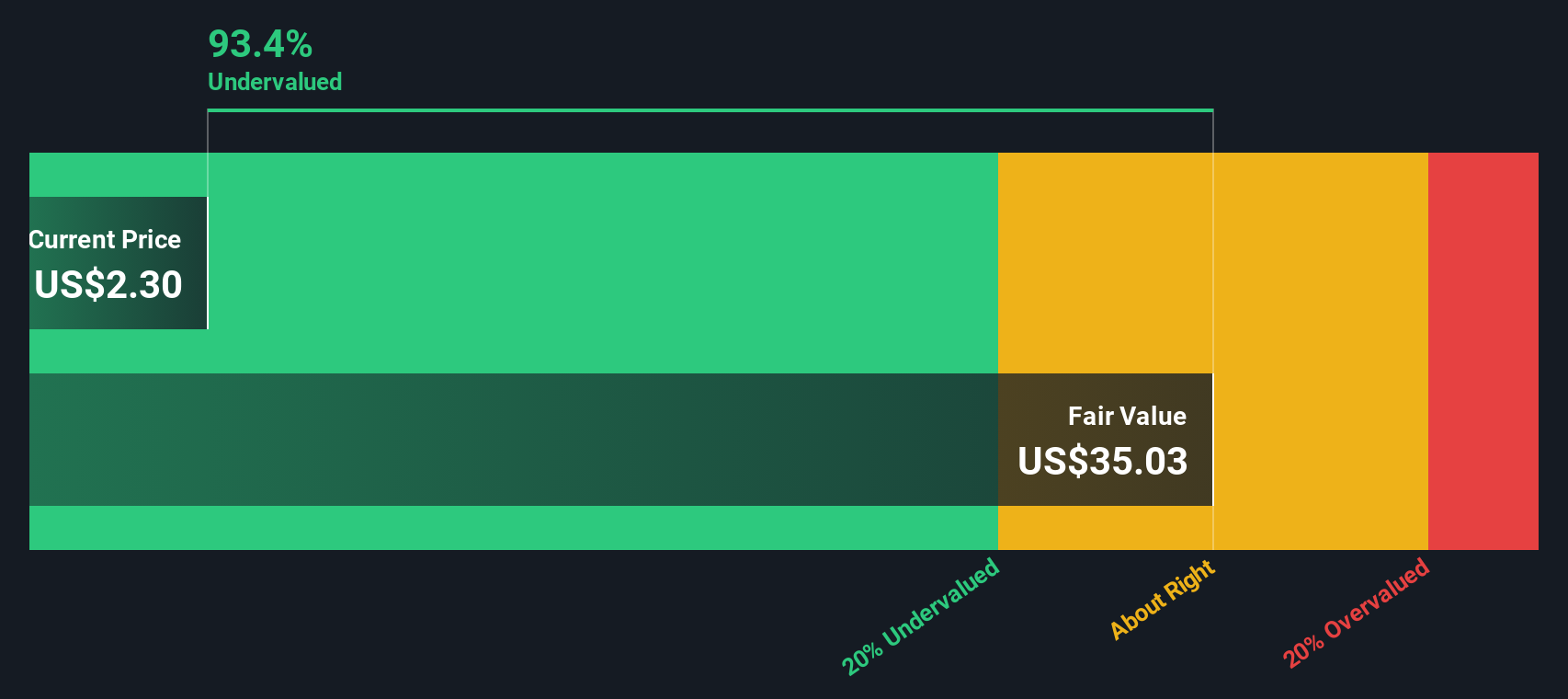

For Iovance Biotherapeutics, the DCF approach relies on current and projected Free Cash Flow (FCF) figures. Currently, the company’s FCF is a negative $348.7 million, reflecting significant investment and cash burn as it builds out its cancer immunotherapy pipeline. While only a few years of analyst forecasts are available, the model extrapolates further using industry-standard methods. In 2029, FCF is projected to reach $296 million, and by 2035, it could rise to nearly $830 million according to these estimates.

Based on these projections, the intrinsic value of Iovance Biotherapeutics is estimated at $38.19 per share, which is 95.3% above the current market price. This suggests the stock could be deeply undervalued if the company can deliver on its ambitious growth expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Iovance Biotherapeutics is undervalued by 95.3%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Iovance Biotherapeutics Price vs Sales

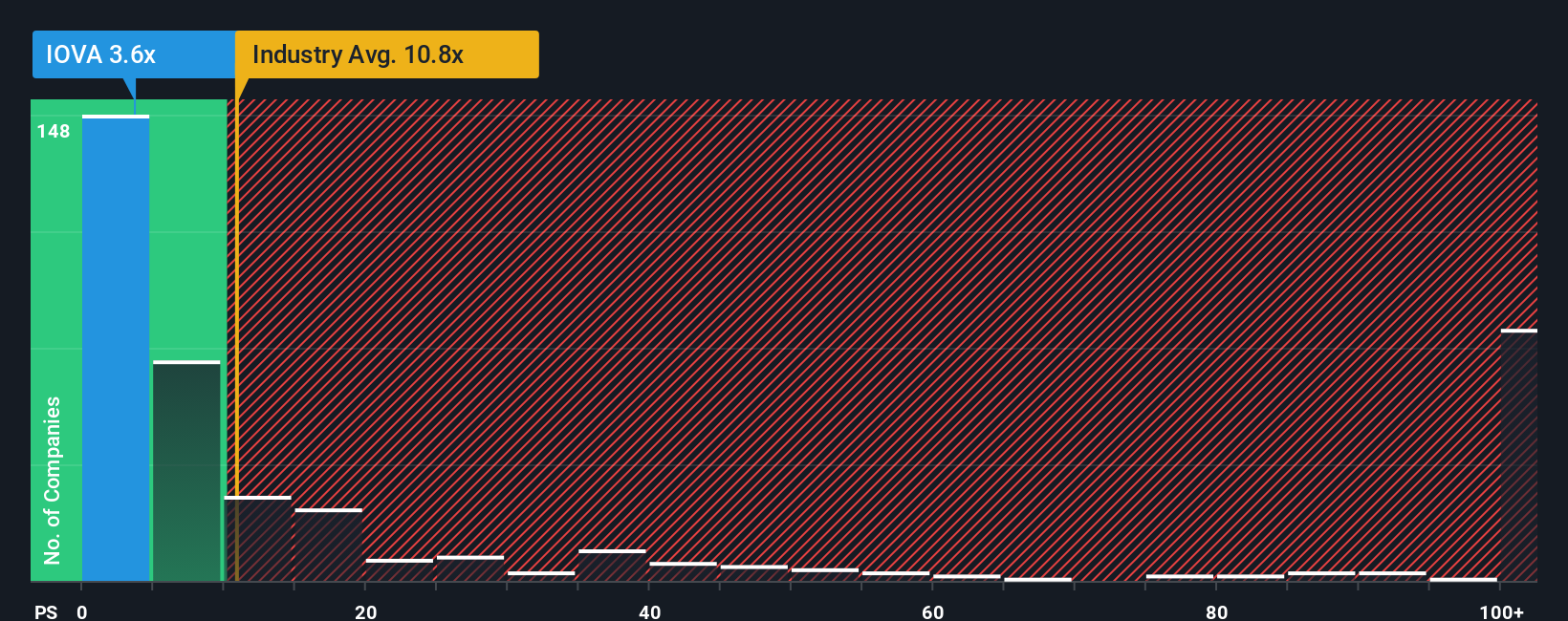

The Price-to-Sales (P/S) ratio serves as a vital valuation tool for companies like Iovance Biotherapeutics that are not yet profitable. Since earnings may be negative, evaluating the stock in terms of its revenue provides a clearer view of what investors are paying for each dollar of sales. The P/S ratio is especially helpful for young biotechs still scaling their pipeline, as it sidesteps profit volatility and focuses on top-line potential.

Growth expectations and risk play a big part in what counts as a “normal” P/S ratio. Fast-growing or less risky companies often trade at higher multiples. Those facing bigger uncertainties or slower growth typically command lower ratios.

Currently, Iovance trades at a P/S ratio of 2.7x. This is well below both the industry average of 10.3x and the peer average of 5.4x, signaling the market is pricing in significant caution or skepticism about future revenue growth. However, Simply Wall St calculates a “Fair Ratio” of 3.8x for Iovance, factoring in not only industry and size but also the company’s growth outlook, profit margins, and risk profile. Unlike simple industry or peer comparisons, the Fair Ratio provides a more nuanced benchmark by adjusting for both what makes Iovance unique and broader market conditions.

Since Iovance’s actual P/S ratio of 2.7x is notably below the Fair Ratio of 3.8x, the stock appears undervalued based on sales multiples and growth-adjusted risk.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Iovance Biotherapeutics Narrative

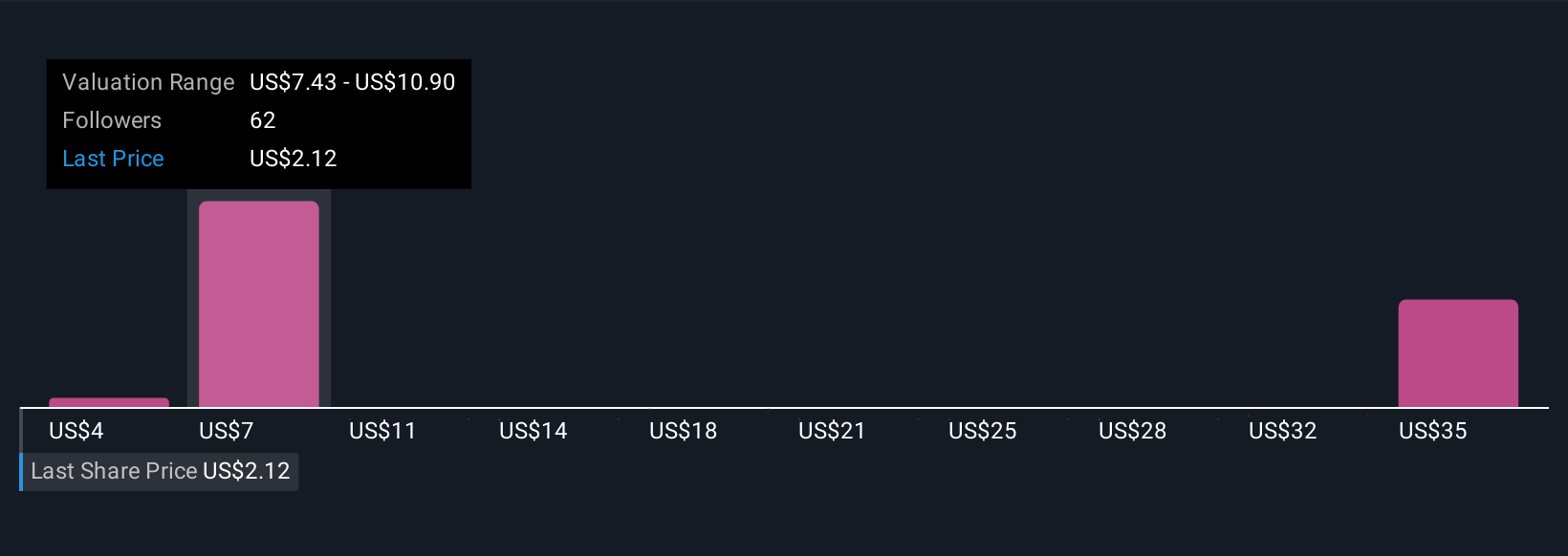

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company's future, such as how fast you think Iovance Biotherapeutics can grow sales, improve margins, and reach profitability. Narratives help connect your vision for a company's progress to specific financial forecasts, and then link those to a fair value estimate. This makes it easy to lay out your thesis and see how it translates into price potential.

Narratives are a key feature on Simply Wall St’s Community page, where millions of investors worldwide create, share, and refine their perspectives on companies in real time. This tool lets you quickly compare your own view to others, showing how the current share price stacks up against your fair value and helping clarify when a stock may be worth buying or selling.

Since Narratives update as new data or news is released, you’ll always see a live reflection of the latest facts alongside your (or others’) evolving investment thesis. For Iovance Biotherapeutics, for example, one Narrative may project rapid adoption of Amtagvi driving revenues to $745 million and a fair value near $20 per share. A more cautious Narrative may highlight ongoing risks, expecting earnings to remain negative and a fair value closer to $1.

Do you think there's more to the story for Iovance Biotherapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IOVA

Iovance Biotherapeutics

A commercial-stage biopharmaceutical company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives