- United States

- /

- Biotech

- /

- NasdaqGS:IONS

Did Breakthrough CHMP Opinion and Phase 3 Data Just Shift Ionis Pharmaceuticals' (IONS) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Ionis Pharmaceuticals and partner Otsuka Pharmaceuticals announced that the European Medicines Agency’s CHMP adopted a positive opinion for DAWNZERA (donidalorsen) in hereditary angioedema, while Ionis separately reported highly positive Phase 3 results for olezarsen in severe hypertriglyceridemia.

- An important insight is that these advances could open Ionis to new patient populations in both rare and broader cardiometabolic disease indications, supporting upcoming regulatory filings and commercial launches across multiple major markets.

- We’ll explore how the strong Phase 3 data for olezarsen could shape Ionis Pharmaceuticals’ outlook for broader market expansion and pipeline value.

Find companies with promising cash flow potential yet trading below their fair value.

Ionis Pharmaceuticals Investment Narrative Recap

Owning Ionis Pharmaceuticals typically means seeing value in its RNA-targeted drug pipeline, regulatory momentum, and the potential for expanded market reach. This month’s positive clinical data for olezarsen in severe hypertriglyceridemia, alongside regulatory progress for DAWNZERA in hereditary angioedema, strengthen the near-term outlook, but do not fully offset the main risks surrounding drug pricing and the dependence on key product launches for growth.

Amid these developments, Ionis recently completed a US$700 million convertible note offering due 2030. While this move provides additional funding to support commercialization efforts for the new indications, it also highlights the capital intensity and execution risks associated with launching multiple late-stage assets at once.

Yet, investors should also take note of the risks around pricing pressure as Ionis moves beyond rare diseases into much broader patient segments...

Read the full narrative on Ionis Pharmaceuticals (it's free!)

Ionis Pharmaceuticals' outlook projects $1.5 billion in revenue and $241.3 million in earnings by 2028. This is based on analysts expecting 16.7% annual revenue growth and an increase in earnings of about $509.5 million from current earnings of -$268.2 million.

Uncover how Ionis Pharmaceuticals' forecasts yield a $82.15 fair value, a 12% upside to its current price.

Exploring Other Perspectives

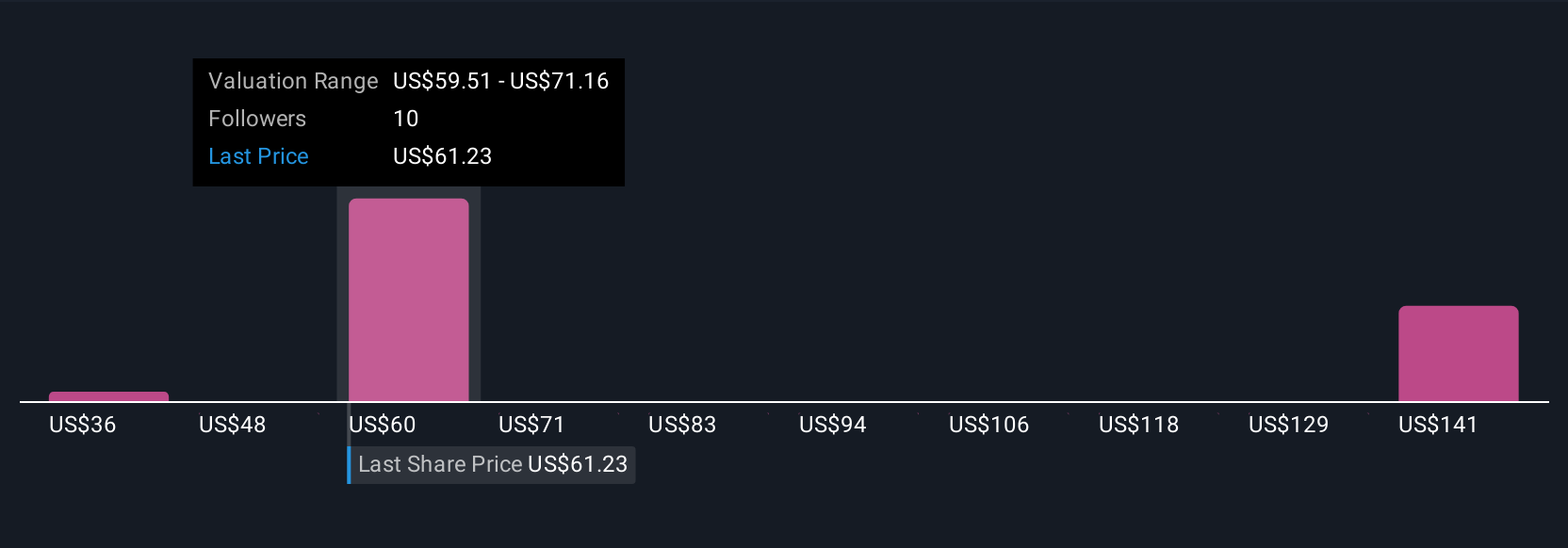

Four private investors in the Simply Wall St Community estimate Ionis’ fair value anywhere from US$36.19 to US$222.33 per share. While optimism about new clinical successes runs high, you should consider that expanding into larger markets may bring significant pricing and reimbursement hurdles that could affect future returns.

Explore 4 other fair value estimates on Ionis Pharmaceuticals - why the stock might be worth over 3x more than the current price!

Build Your Own Ionis Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ionis Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Ionis Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ionis Pharmaceuticals' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IONS

Ionis Pharmaceuticals

A commercial-stage biotechnology company, provides RNA-targeted medicines in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives