- United States

- /

- Biotech

- /

- NasdaqGS:IONS

A Look at Ionis Pharmaceuticals's Valuation Following Strong Phase 3 Data, New Approvals, and Analyst Upgrades

Reviewed by Kshitija Bhandaru

Ionis Pharmaceuticals (IONS) climbed sharply after its recent Innovation Day, as management spotlighted pivotal Phase 3 results for olezarsen and shared early launch progress for DAWNZERA. New FDA approvals and strategic guidance fueled further investor enthusiasm.

See our latest analysis for Ionis Pharmaceuticals.

Investor enthusiasm for Ionis has translated into standout momentum, with the share price up more than 100% year-to-date and driving to a six-year high. Recent milestones, FDA approvals, and blockbuster pipeline updates have all played a role. The total shareholder return over the past year sits at an impressive 82%, reflecting renewed confidence in both the strategy and sustained growth potential.

If Ionis’s recent run has you curious about other biotech movers, check out innovators on our healthcare stocks screener: See the full list for free.

The big question now is whether Ionis’s surge is just the beginning, or if robust clinical wins and analyst upgrades are already fully reflected in the share price. This raises the issue of whether there is still a buying opportunity, or if the market is already pricing in all that future growth.

Most Popular Narrative: 4.2% Undervalued

Ionis Pharmaceuticals’ fair value, according to the most popular narrative, sits at $73.03, just above its last close of $69.97. This slight gap reflects cautious optimism and hinges on forecasts for robust revenue growth and margin expansion.

Ionis is regarded as well-positioned for sustainable revenue growth, especially with an expanding commercial portfolio and pipeline diversification. Approval and strong labels for therapies targeting hereditary angioedema also support this view.

Curious about the uptick driving this valuation? The narrative is built on bold projections of top-line acceleration and margin gains, with a twist on future profit potential. Want a look under the hood at the aggressive analyst assumptions fueling this fair value? Prepare for some surprising growth forecasts.

Result: Fair Value of $73.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant setbacks in pipeline launches or tougher drug pricing negotiations could quickly challenge this bullish outlook and stall Ionis’s upward momentum.

Find out about the key risks to this Ionis Pharmaceuticals narrative.

Another View: Market Ratios Tell a Different Story

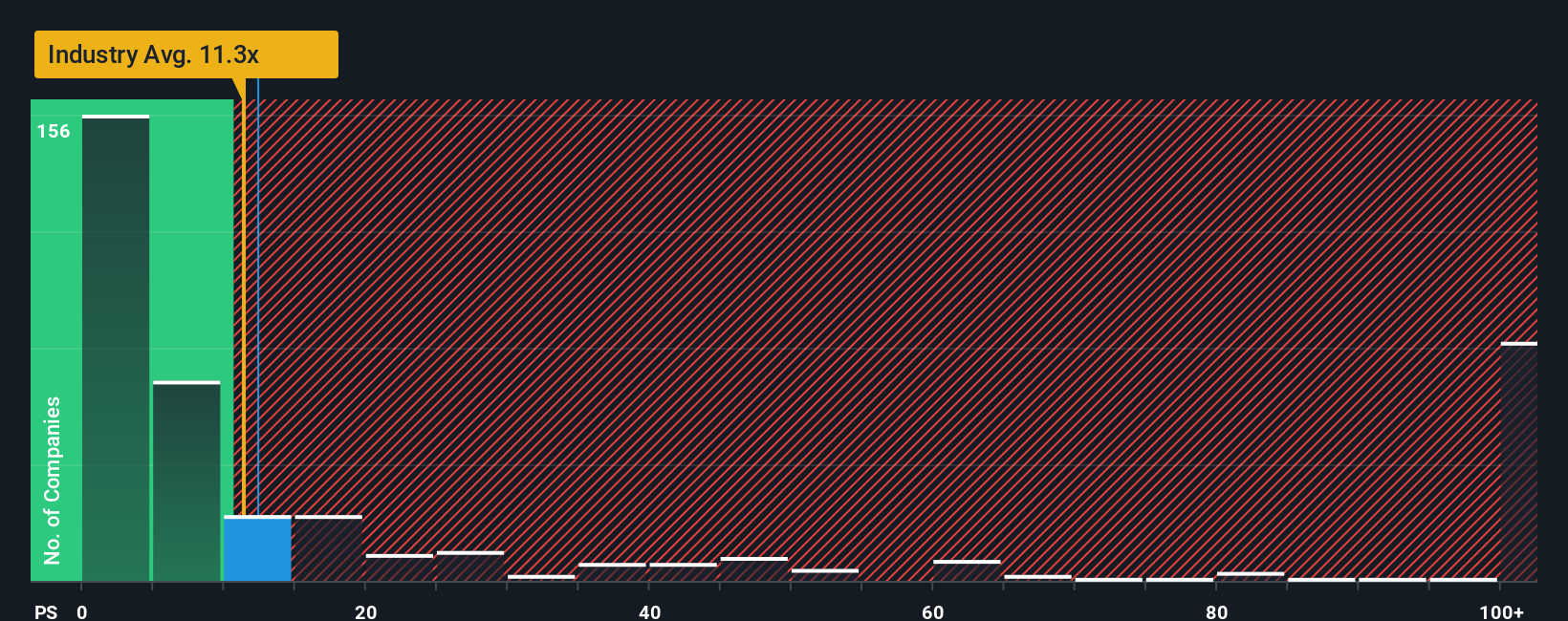

Looking from a market ratio perspective, Ionis Pharmaceuticals trades at a price-to-sales ratio of 11.8x, which is notably higher than the US Biotechs industry average of 10.1x and also above peers averaging 6.9x. The fair ratio, or what the market could move towards, is only 3.8x. This suggests Ionis’s shares may be expensive relative to future sales, raising questions about the margin of safety for new investors. Are market expectations running too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ionis Pharmaceuticals Narrative

If this perspective does not match your own, or you prefer a hands-on approach, you can build your own Ionis Pharmaceuticals story in just a few minutes. Do it your way

A great starting point for your Ionis Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities are waiting beyond Ionis. If you want to stay ahead and seize what others might overlook, take a closer look at fresh stocks using these dynamic tools:

- Spot companies with the strongest cash flow potential by checking out these 892 undervalued stocks based on cash flows. Make your next move backed by solid fundamentals.

- Capitalize on the AI revolution by finding emerging leaders through these 24 AI penny stocks. This is where innovation meets real growth prospects.

- Secure steady income streams by reviewing these 19 dividend stocks with yields > 3%, which offers attractive yields and proven financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IONS

Ionis Pharmaceuticals

A commercial-stage biotechnology company, provides RNA-targeted medicines in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives