- United States

- /

- Biotech

- /

- NasdaqGS:IONS

A Fresh Look at Ionis Pharmaceuticals (IONS) Valuation After Positive Olezarsen Trial and DAWNZERA Regulatory Update

Reviewed by Simply Wall St

Ionis Pharmaceuticals (IONS) recently grabbed investor attention thanks to positive Phase 3 results for olezarsen, along with a favorable regulatory opinion in Europe for DAWNZERA to prevent hereditary angioedema attacks.

See our latest analysis for Ionis Pharmaceuticals.

Ionis Pharmaceuticals has been on a tear lately, with major clinical wins and a green light from European regulators for DAWNZERA helping fuel a dramatic rally. Over the past year, shares have delivered a remarkable 123.7% total shareholder return. The stock’s momentum remains strong as investors respond to growing confidence in its expanding pipeline and commercialization prospects.

Looking for more healthcare names benefiting from breakthrough approvals and new market opportunities? Discover See the full list for free.

With shares at multi-year highs and optimism swirling around the company’s pipeline breakthroughs, the key question is whether Ionis is still trading at a bargain or if the market has already priced in its next wave of growth.

Most Popular Narrative: 7.4% Undervalued

With a fair value of $82.15 set by the most widely followed narrative, Ionis Pharmaceuticals’ last close of $76.09 suggests upside potential still remains. The underlying narrative frames the stock as poised for more growth, thanks to changing expectations and powerful business drivers.

The rapid revenue growth and positive launch trajectory for Tryngolza in familial chylomicronemia syndrome (FCS), along with the imminent launch of Donidalorsen for HAE and multiple late-stage pipeline assets reading out or launching by 2027, are set to drive sustained, stepwise increases in top-line revenue and operating leverage as Ionis transitions from being R&D-focused to a commercial-stage company. Expanding addressable patient populations, from rare diseases to larger segments like severe hypertriglyceridemia (sHTG), combined with favorable physician feedback and significant unmet need, position Ionis to capture substantial market share and revenue growth from trends tied to the rise in chronic disease and an aging population.

Want to know the bold revenue and earnings milestones that shaped this bullish outlook? The narrative banks on aggressive top-line acceleration and a future profit multiple rarely seen outside high-growth innovators. One controversial assumption could flip the valuation script. Curious what drives the lofty target? Unlock the full narrative and spot what the crowd believes Ionis may achieve.

Result: Fair Value of $82.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risk remains. Setbacks in pivotal trial data or pricing pressures in broader indications could quickly reverse the bullish narrative investors are buying into.

Find out about the key risks to this Ionis Pharmaceuticals narrative.

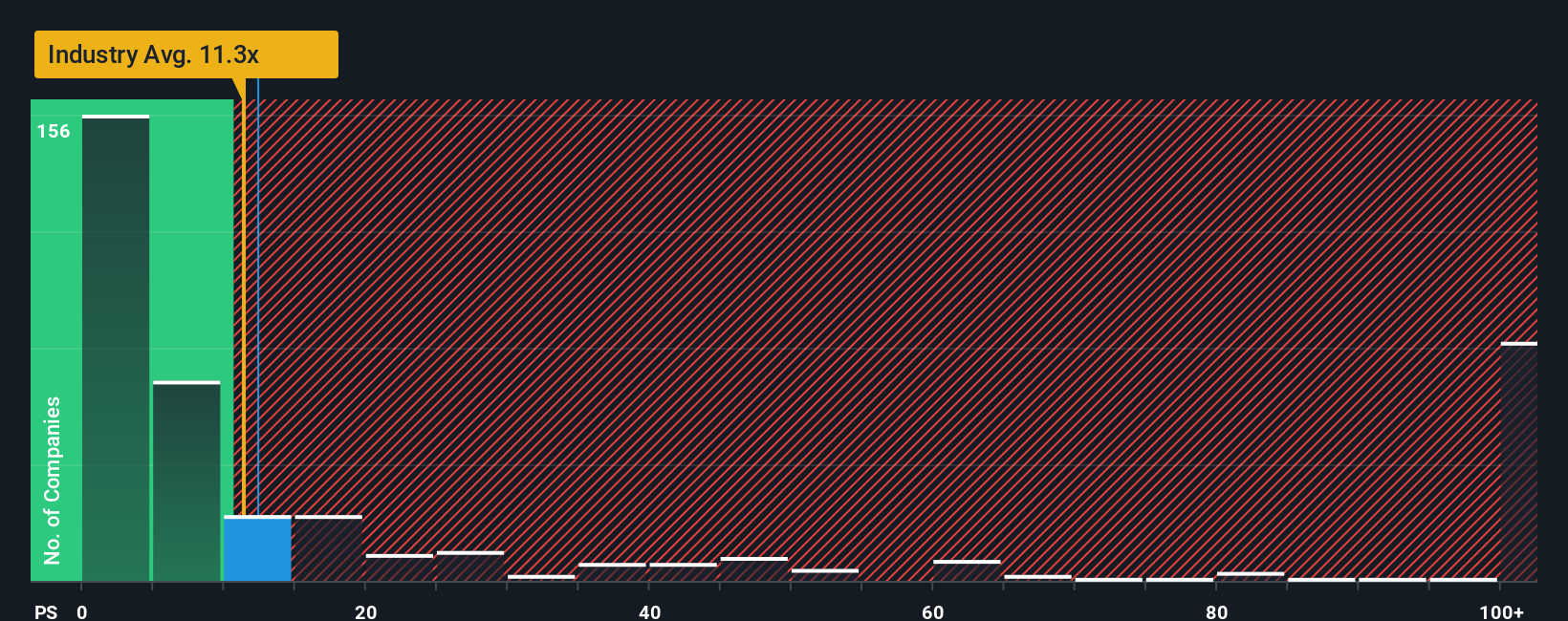

Another View: High Sales Multiple Points to Caution

While several narratives highlight Ionis Pharmaceuticals as undervalued, our look at its sales multiple tells a different story. The company trades at 12.7 times sales, which is well above the U.S. Biotech industry average of 11.5 and its peer group’s 5. This sharp gap raises the risk that the shares are priced for near-perfect execution and future growth.

If the market were to shift towards the fair ratio of 4, investors could see a significant re-rating. Can Ionis keep defying the odds, or will valuation multiples play catch-up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ionis Pharmaceuticals Narrative

If you see things differently or want to chart your own view based on the numbers, you can shape your own Ionis story in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ionis Pharmaceuticals.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Don’t miss your chance to spot winners riding the next big wave. Gain an edge by exploring more top picks below.

- Capitalize on market swings and find overlooked gems through these 3605 penny stocks with strong financials, which show impressive growth potential in unexpected places.

- Earn steady income and boost your portfolio’s reliability with these 17 dividend stocks with yields > 3%, offering consistently strong yields above 3%.

- Tap into next-generation tech by jumping on these 25 AI penny stocks, featuring companies leading AI breakthroughs and transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IONS

Ionis Pharmaceuticals

A commercial-stage biotechnology company, provides RNA-targeted medicines in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives