- United States

- /

- Pharma

- /

- NasdaqGS:INVA

Assessing Innoviva After Acquisition News and Recent 3.8% Stock Climb in 2025

Reviewed by Bailey Pemberton

- Ever wondered if Innoviva might be hiding some real value, or if it is just another biotech stock flying under the radar? You are not alone. Let’s dive in and see what sets it apart right now.

- Innoviva's stock has climbed 3.8% in the past week and 4.8% year-to-date, though it is still down 8.5% over the last year. This shows both recent momentum and a hint of volatility.

- Investors took notice as Innoviva finalized its acquisition of a smaller biotech firm, adding promising drug candidates to its portfolio. This strategic move has fueled renewed interest in the stock and shifted market sentiment in the past few weeks.

- When it comes to valuation, Innoviva scores just 2 out of 6 on our undervaluation checks, which suggests there is room for a closer look at how the market is pricing in its prospects. Let’s break down some valuation methods, and stick around for a fresh perspective at the end.

Innoviva scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Innoviva Discounted Cash Flow (DCF) Analysis

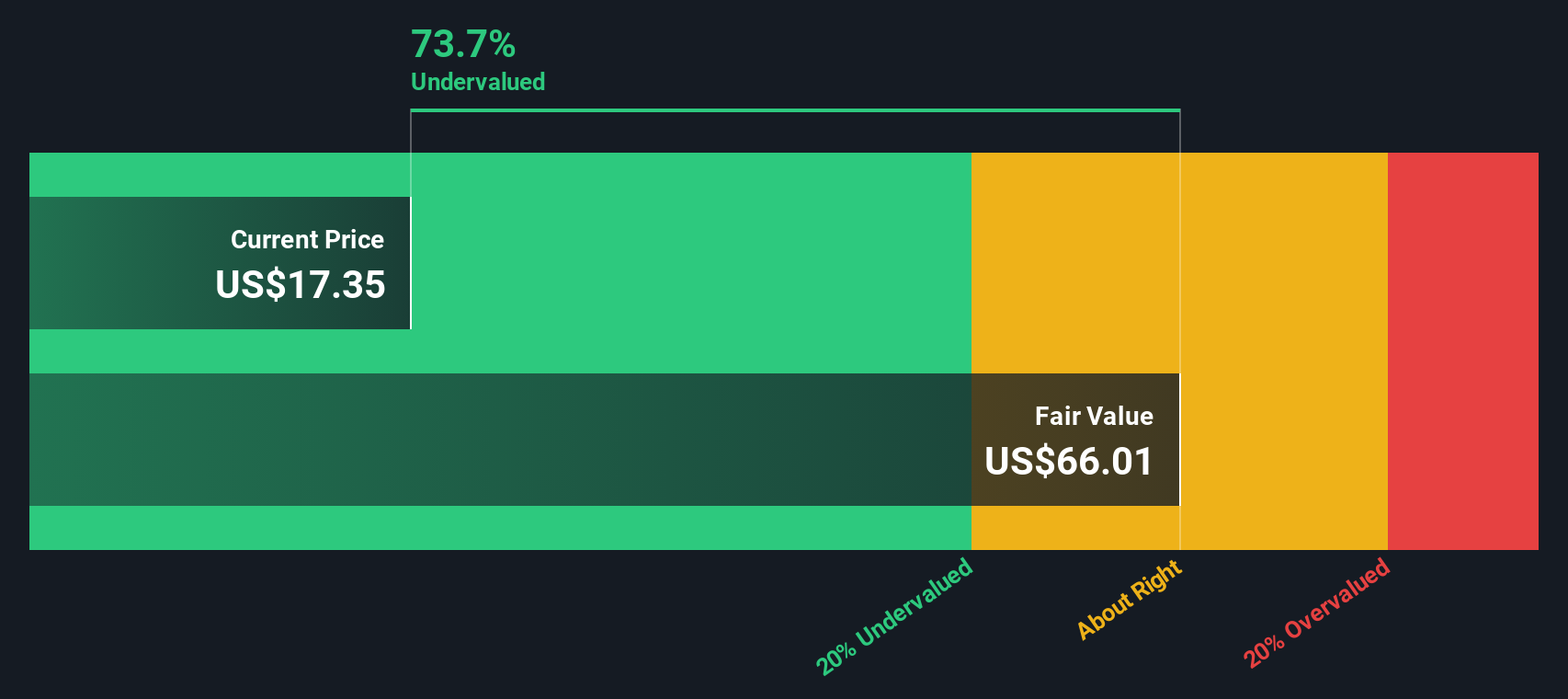

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and discounts them back to today's value, helping gauge what a business is truly worth based on its expected ability to generate cash.

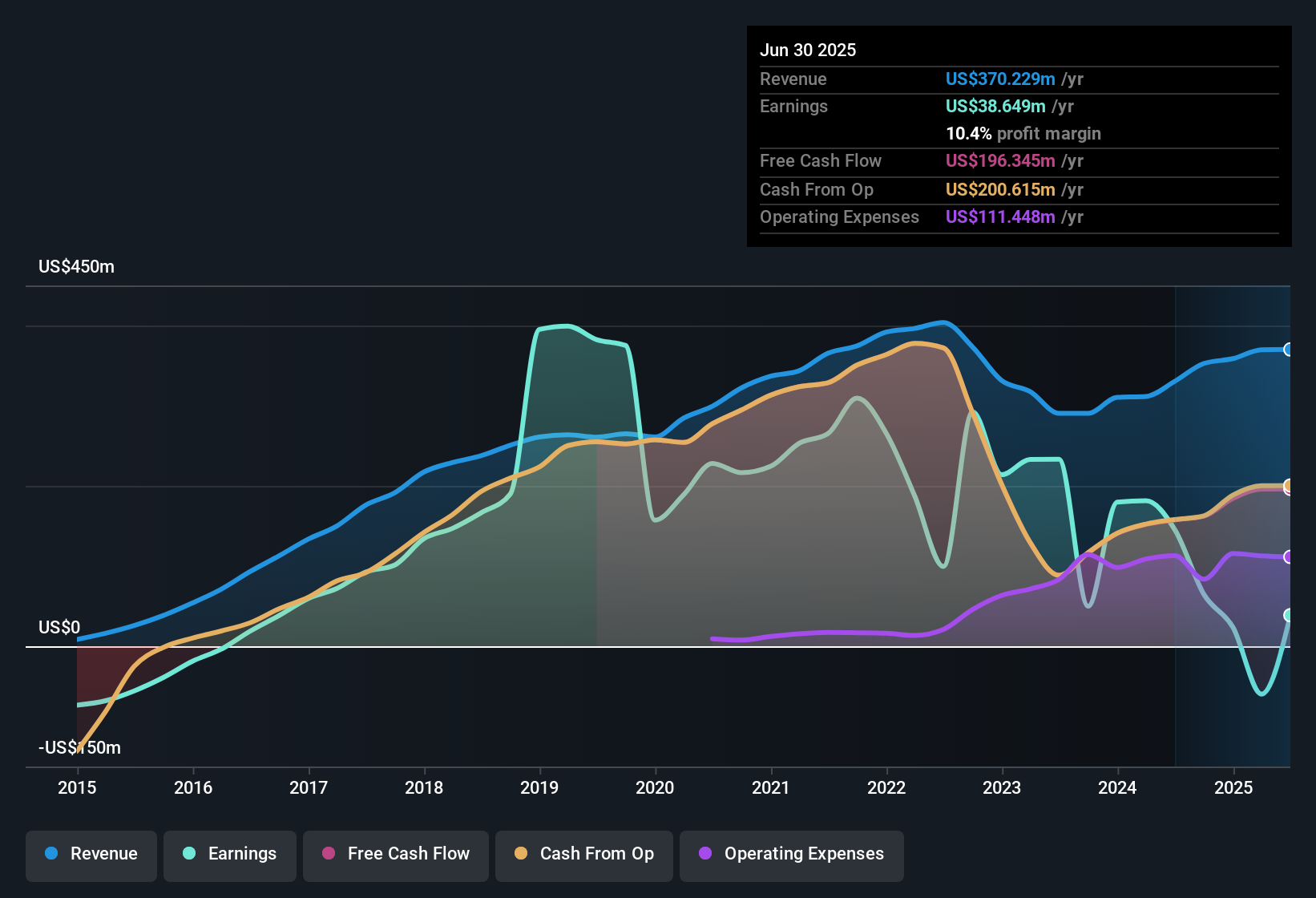

For Innoviva, the most recent Free Cash Flow reported is $195.4 Million. Analyst estimates are available up to five years out, projecting moderate growth, and Simply Wall St has extrapolated further to forecast a Free Cash Flow of $198.6 Million by 2035. All future projections remain in the $170 to $190 Million range, indicating steady, if not breakneck, growth.

According to this DCF model, the estimated intrinsic value per share stands at $66.00. Importantly, this valuation suggests the stock is trading at a 72.4% discount to its fair value based on these discounted cash flows. In short, the DCF model implies Innoviva is significantly undervalued right now when looking purely at future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Innoviva is undervalued by 72.4%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Innoviva Price vs Earnings

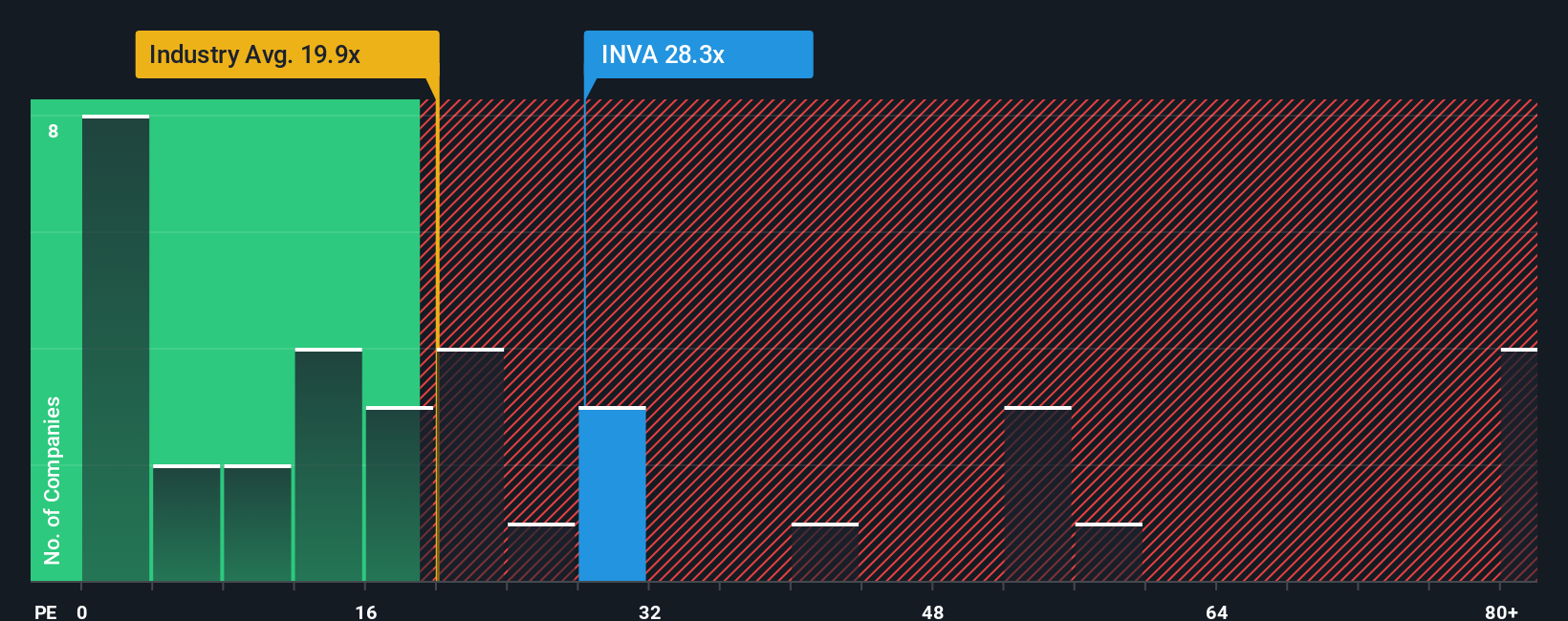

For profitable companies like Innoviva, the Price-to-Earnings (PE) ratio is a classic, widely used valuation tool. The PE ratio tells investors how much they are paying for each dollar of earnings, making it particularly relevant when the company has consistent profits, as is the case here.

The "right" PE ratio for a company is not a fixed number. It is influenced by expectations for future earnings growth and the perceived risks in the business. Generally, higher expected growth or lower risk justifies a higher PE, while slower growth or higher risk suggests a lower one is more appropriate.

As of now, Innoviva trades at a PE ratio of 29.7x. This is substantially above the industry average PE of 17.8x for Pharmaceuticals and even higher than its immediate peer group, averaging 19.2x. At face value, this could make the stock look expensive compared to the sector.

However, Simply Wall St’s proprietary “Fair Ratio” takes the analysis further by estimating what Innoviva’s PE should be after factoring in more specific details like earnings growth forecasts, profit margins, company size, and sector risks. For Innoviva, the Fair Ratio is 18.1x. This model provides a more tailored, accurate assessment than blanket industry or peer averages, as it adjusts for the nuances in Innoviva’s financial outlook and risk profile.

Comparing the Fair Ratio of 18.1x to the current PE of 29.7x, it becomes clear that Innoviva is trading well above its fair value based on earnings fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Innoviva Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, approachable method for investors to tell the story behind a company’s numbers, explaining not just what a business is worth, but why they believe it deserves that value, based on their own assumptions about future revenue, profits, and margins.

Narratives link a company's story to a financial forecast and then connect that to a calculated fair value, helping you see how your unique perspective translates into a price. This tool is available to all investors on the Simply Wall St Community page, where millions of users are already applying Narratives to their investing decisions.

With Narratives, you can easily compare your own fair value estimate to the current stock price and decide whether to buy, sell, or hold. Narratives also update dynamically whenever there is new information, such as fresh news or quarterly earnings.

For Innoviva, one investor’s Narrative might see exceptional growth and set a high fair value, while another could be more cautious and arrive at a lower number, all based on their view of the company’s story and prospects.

Do you think there's more to the story for Innoviva? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INVA

Innoviva

Engages in the development and commercialization of pharmaceutical products in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives