- United States

- /

- Pharma

- /

- NasdaqGS:INDV

Indivior (NasdaqGS:INDV): Is the Stock’s Valuation Justified After Upgraded Earnings Outlook?

Reviewed by Simply Wall St

Indivior (NasdaqGS:INDV) raised its full-year earnings outlook after reporting third quarter results. Net income climbed to $42 million from $22 million a year ago. Investors often watch these guidance updates closely.

See our latest analysis for Indivior.

Indivior’s sharp 134.96% share price return year-to-date stands out, especially after the company’s upgraded outlook and improved third quarter profits. The momentum has clearly accelerated in recent weeks, and the 219.93% total shareholder return over the past year makes Indivior one of the sector's star performers.

If you’re interested in what’s fueling breakouts elsewhere, now is a perfect time to broaden your focus and see other opportunities through our See the full list for free.

With the stock already showing explosive gains and analysts forecasting further growth, the key question is whether Indivior is still trading below its true value or if the market has already priced in all the good news.

Price-to-Earnings of 49.6x: Is it justified?

Indivior currently trades at a price-to-earnings (P/E) ratio of 49.6x, which is substantially higher than both its direct sector peers and the broader US pharmaceuticals market. At the last close of $29.37, investors are paying a steep premium relative to expected earnings.

The price-to-earnings ratio compares a company’s market price to its per-share earnings, serving as a quick snapshot of how much investors are willing to pay per dollar of profit. For high-growth pharmaceutical firms, elevated P/E ratios often reflect optimism about future profit expansion. However, they may also signal heightened expectations that the company must meet or exceed to justify its valuation.

Indivior’s P/E outpaces the US pharmaceuticals industry average of 18.1x, as well as the estimated fair P/E ratio of 33.2x suggested by our model. This positions Indivior’s stock as expensive not just against its listed competitors, but also relative to what the market might consider a fair multiple for its growth profile. Any reversion towards the fair ratio could have notable implications for the share price.

Explore the SWS fair ratio for Indivior

Result: Price-to-Earnings of 49.6x (OVERVALUED)

However, slowing annual revenue growth and a lofty valuation mean that Indivior's performance could quickly reverse if market optimism wanes.

Find out about the key risks to this Indivior narrative.

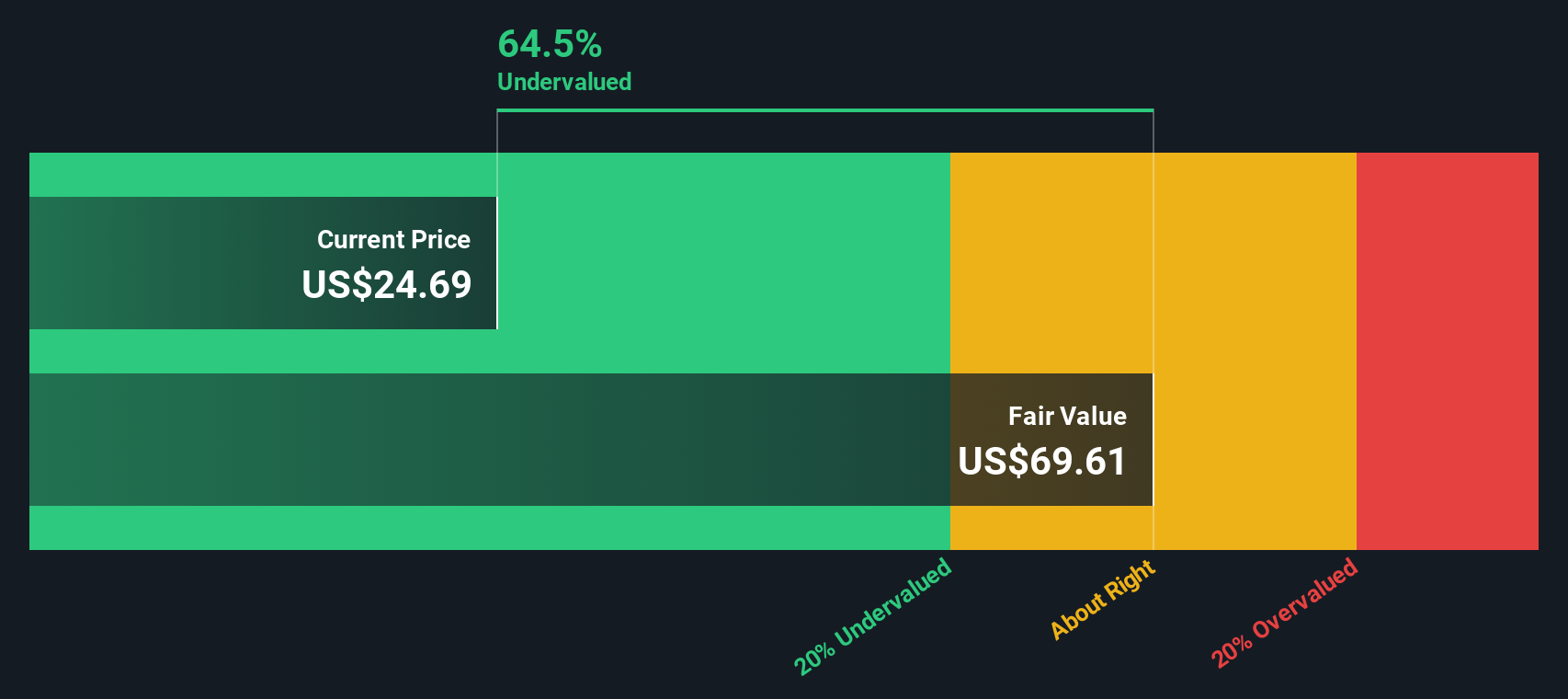

Another View: SWS DCF Model Suggests Deep Undervaluation

While the steep price-to-earnings multiple raises eyebrows, our SWS DCF model offers a very different perspective. It suggests Indivior is actually trading 72.2% below its fair value, even though its valuation appears high when measured against earnings. Could the market be overlooking an important factor, or is this a risk that warrants attention?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Indivior for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 844 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Indivior Narrative

If you see the story differently or want to dive deeper into the data, you can shape your own analysis in just a few minutes, and Do it your way.

A great starting point for your Indivior research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investment universe and stay ahead of the curve by checking out these unique stock ideas that could redefine your portfolio’s potential.

- Capitalize on tomorrow’s breakthroughs by checking out these 27 AI penny stocks in artificial intelligence for innovative growth opportunities.

- Maximize your yield with these 20 dividend stocks with yields > 3%, which offers consistent income and strong fundamentals to help boost your returns.

- Seize early momentum by scanning these 3587 penny stocks with strong financials, which are poised for rapid gains with strong financials behind the headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives