- United States

- /

- Pharma

- /

- NasdaqGS:INDV

Indivior (INDV): Assessing Valuation After 34% Monthly Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Indivior.

Indivior’s recent 34% share price return over the past month builds on an already dramatic rally this year, with a year-to-date share price jump of 160%. Factoring in dividends, the total shareholder return over the past 12 months stands at an impressive 208%, reflecting a surge in optimism around the company’s growth prospects and risk profile.

If Indivior’s momentum has you looking for fresh opportunities, now is an appealing moment to broaden your search and discover fast growing stocks with high insider ownership

With Indivior’s remarkable rally showing little sign of slowing, investors are left to wonder whether the stock is still undervalued at current levels or if the market has already factored in the company’s future growth.

Price-to-Earnings of 55x: Is it justified?

Indivior currently trades at a price-to-earnings (P/E) ratio of 55x, a significant premium to both the US Pharmaceuticals industry average and its closest peers, despite recent impressive earnings growth. At the last close price of $32.60, markets are paying a steep premium for anticipated future profits.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of current earnings and is a critical yardstick in industries where profitability is key. A higher P/E can signal expectations of superior growth, but also means higher risk if targets are not met.

Indivior's 55x multiple is markedly higher than the pharmaceuticals industry average of 19.4x and well above the peer average of 32.1x. This suggests that the stock is being valued well above typical sector benchmarks. Compared to the estimated Fair Price-to-Earnings Ratio of 32.9x, Indivior is also expensive on a stand-alone fair value basis. The market could recalibrate if growth expectations shift.

Explore the SWS fair ratio for Indivior

Result: Price-to-Earnings of 55x (OVERVALUED)

However, slowing revenue growth or a shift in market sentiment could quickly challenge Indivior’s premium valuation and strong momentum.

Find out about the key risks to this Indivior narrative.

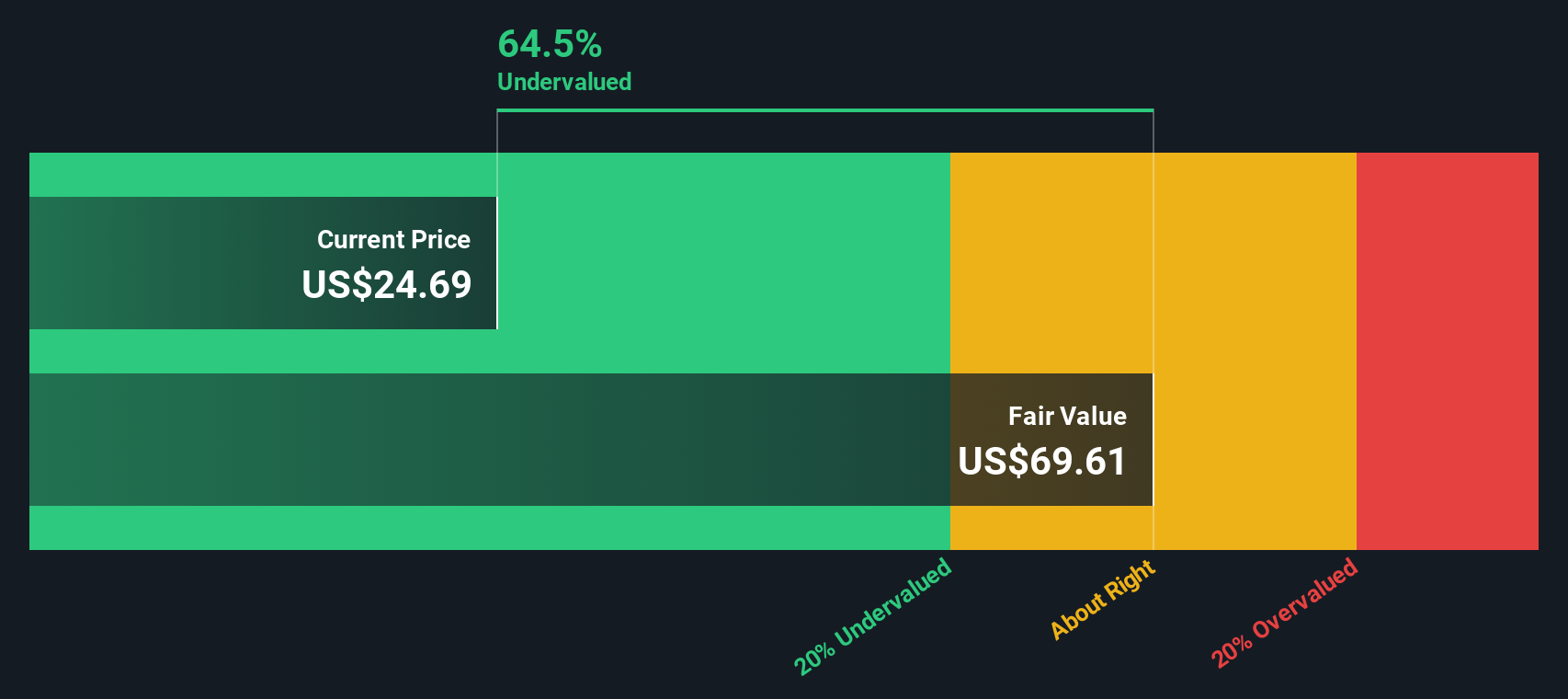

Another View: Discounted Cash Flow Suggests Undervaluation

While Indivior’s price-to-earnings ratio appears high compared to its industry peers, our DCF model presents a very different perspective. Based on this approach, the shares trade well below an estimated fair value of $105.33, suggesting significant undervaluation. Could the market be missing something important here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Indivior for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Indivior Narrative

If you have a different perspective or want to dig into the details for yourself, you can build your own view of Indivior in just a few minutes. Do it your way

A great starting point for your Indivior research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

When you want to widen your horizons, Simply Wall Street’s screener connects you instantly to exciting stocks built for growth, innovation, and future trends. Don’t let the best opportunities pass you by.

- Capitalize on emerging technologies by tapping into these 27 AI penny stocks, which are driving artificial intelligence breakthroughs in every sector.

- Boost your income strategy and scan for the highest yields among these 15 dividend stocks with yields > 3%, offering consistent payouts over 3%.

- Take the lead in digital innovation and spot the next big winners with these 81 cryptocurrency and blockchain stocks, shaping the world of blockchain and cryptocurrency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives