- United States

- /

- Biotech

- /

- NasdaqCM:IMNM

Can Immunome's (IMNM) Reduced Losses Point to a Sustainable Shift in Operational Strategy?

Reviewed by Sasha Jovanovic

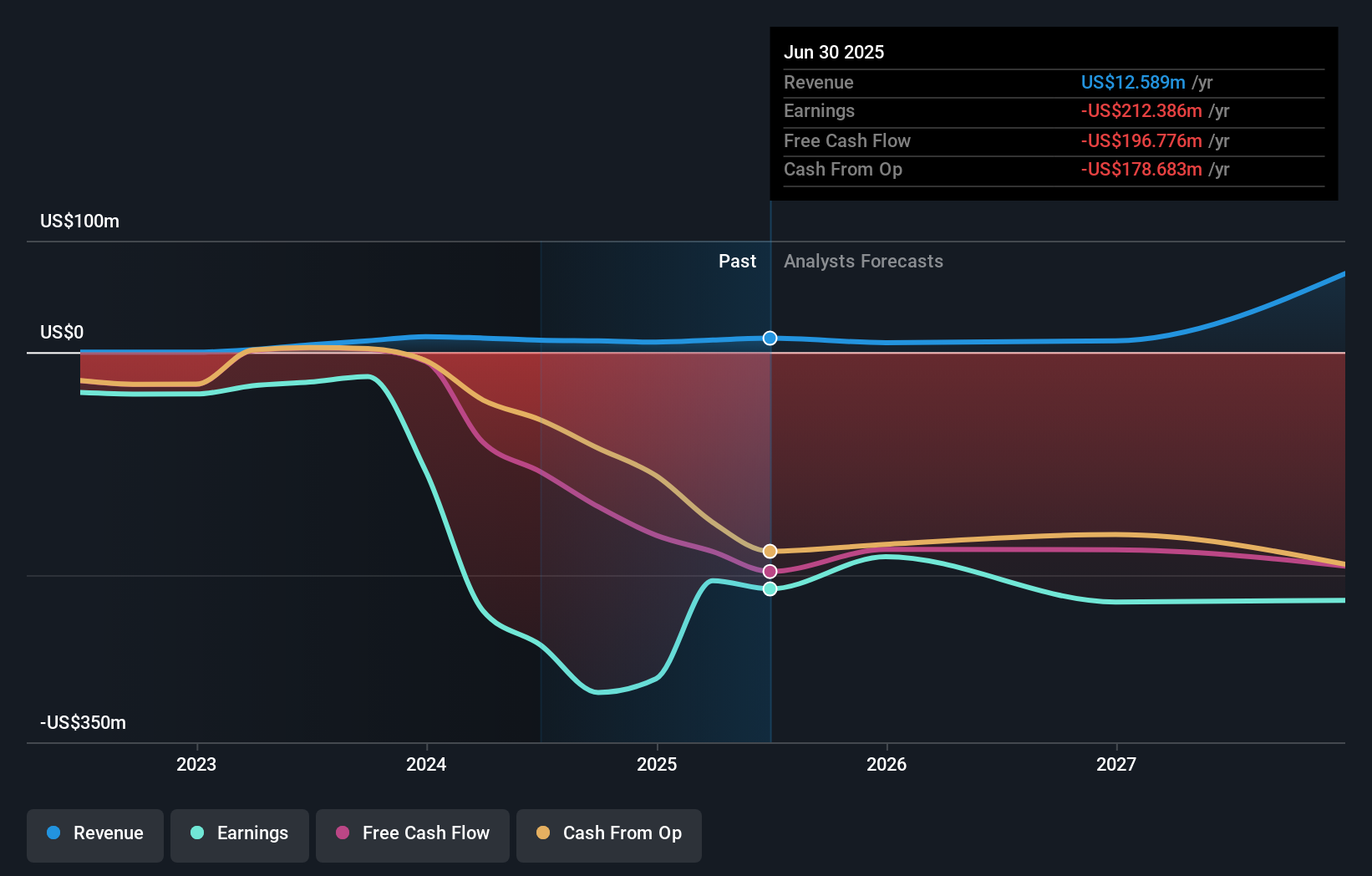

- Immunome, Inc. reported its third quarter 2025 results in early November, with a net loss of US$57.46 million and a basic loss per share of US$0.65, both improved from the previous year.

- The company also posted a significant reduction in its net loss for the nine-month period, highlighting progress in financial management and operational efficiency.

- We will examine how Immunome’s narrowing quarterly and nine-month losses play into its overall investment narrative and sector positioning.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Immunome's Investment Narrative?

To be a shareholder of Immunome, one has to look past near-term unprofitability and focus on the company’s ambitions in antibody discovery and oncology drug development. While the latest quarterly report confirmed continued losses, it also revealed a striking year-over-year improvement over the nine-month period, spotlighting a possible shift in financial discipline. This reduction in cumulative net loss could support Immunome’s key short-term catalyst: advancing its early-stage clinical trials, particularly for its ROR1-targeted ADC candidate. However, an uptick in third-quarter losses and ongoing reliance on equity financing mean significant risks remain, especially around the company’s ability to fund lengthy R&D cycles until any product reaches the market. The most recent earnings do not appear to materially alter the biggest near-term catalysts or threats, but they do reinforce the underlying tension between Immunome’s cash burn and its race to clinical milestones.

In contrast, persistent cash flow demands could affect how long resources last if development is delayed.

The analysis detailed in our Immunome valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Immunome - why the stock might be worth as much as 57% more than the current price!

Build Your Own Immunome Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Immunome research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Immunome research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Immunome's overall financial health at a glance.

No Opportunity In Immunome?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IMNM

Immunome

A clinical-stage biotechnology company, develops targeted cancer therapies.

Flawless balance sheet with low risk.

Market Insights

Community Narratives