- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

Illumina (ILMN) Valuation: How Recent Earnings and China Export News Are Shaping Investor Expectations

Reviewed by Simply Wall St

Illumina has captured fresh attention this week after delivering strong third quarter earnings and raising its full-year revenue outlook. The Chinese Ministry of Commerce's move to lift the export ban on Illumina products is also coming into focus.

See our latest analysis for Illumina.

Illumina’s week has been anything but quiet, with a powerful 22.3% seven-day share price return as investors respond to headline earnings and the positive turn in China’s regulatory stance. Despite recent momentum, it is worth noting that Illumina’s one-year total shareholder return sits deep in the red at -21.9%. This puts the current surge into perspective alongside longer-term challenges.

If Illumina’s rebound makes you curious about which other healthcare names are picking up steam, check out the latest movers with our curated list: See the full list for free.

With shares rebounding after a tough year and regulatory headwinds easing, the question for investors becomes clear: is Illumina’s current run just the start of a lasting recovery, or has the market already factored in its future growth?

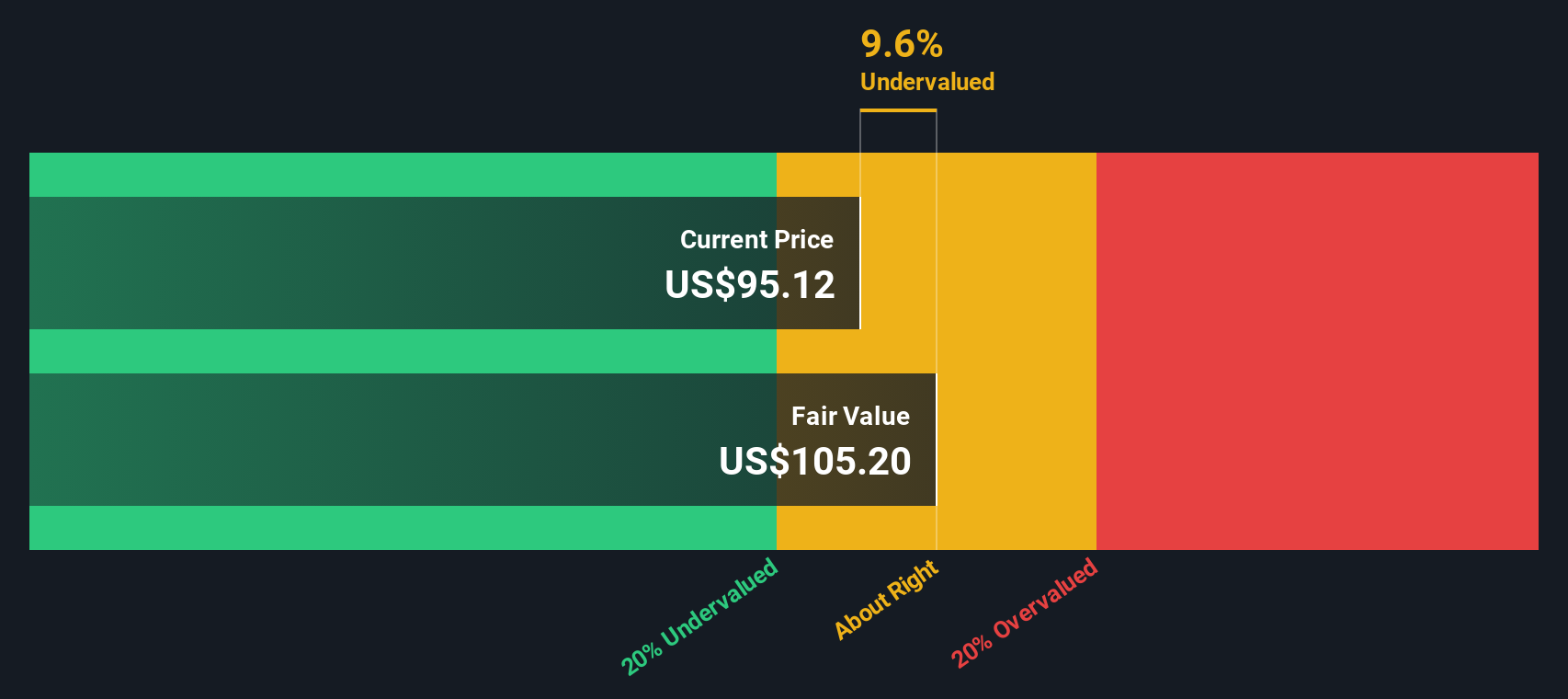

Most Popular Narrative: 6.6% Overvalued

With Illumina’s most followed narrative setting fair value at $113.58, the current share price of $121.11 now sits noticeably above consensus. This spread shows that analysts view recent business gains as only partially offsetting sector risks and ongoing uncertainties.

Ongoing innovation, multiomics expansion, and operational efficiency are enhancing gross margins and creating new growth opportunities. Strategic expansion into multiomics, notably the planned acquisition of SomaLogic and integration of proteomics capabilities, creates incremental growth opportunities by increasing the breadth of Illumina's data and platform offerings. This is contributing to future revenue and operating margin expansion.

Curious what hidden assumptions boost Illumina’s price? Behind this narrative is a blend of bold margin improvement, breakthrough expansion bets, and sharply debated future earnings power. Dive in to see the financial levers analysts believe could change everything.

Result: Fair Value of $113.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent research budget constraints and intensifying competition could easily derail Illumina’s recovery and prompt a reassessment of its valuation narrative.

Find out about the key risks to this Illumina narrative.

Another View: What About the SWS DCF Model?

While Illumina's valuation looks stretched against analyst consensus, our SWS DCF model presents a different perspective. It values shares at $155.91, making the current price appear undervalued by more than 22%. Could the market be underestimating Illumina's long-term earnings power?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Illumina Narrative

Keep in mind, if these narratives do not align with your perspective or you want to form your own opinion, you can craft a personal view from scratch in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Illumina.

Looking for More Investment Ideas?

Smart investors do not wait for opportunities to come to them. Take the lead and broaden your horizons with unique stock ideas you will not want to miss:

- Boost your returns by tapping into budding companies with strong fundamentals using these 3598 penny stocks with strong financials before they catch the market’s attention.

- Enhance your portfolio’s income potential by reviewing these 17 dividend stocks with yields > 3% which offers robust yields and reliable payouts well above 3%.

- Ride the wave of tomorrow’s tech by targeting these 25 AI penny stocks at the forefront of artificial intelligence innovation and rapid growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives