- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

Illumina (ILMN): A Fresh Look at Valuation as Protein Prep Gains Ground in Global Research Labs

Reviewed by Simply Wall St

Illumina (ILMN) just shared that its Protein Prep platform is now used by more than 40 customers in 16 locations worldwide, including renowned labs in Australia and Singapore. This signals increasing demand for accessible proteomics.

See our latest analysis for Illumina.

After a tough stretch for shareholders, Illumina’s recent buzz around Protein Prep arrives as its share price has surged nearly 24% over the past month and 25% in the last 90 days. Despite that short-term momentum, the one-year total shareholder return remains firmly negative at -13.9%, underscoring both the volatility and potential upside that come with big new launches and fresh partnerships. Investors have shown renewed interest lately, but the long-term narrative is still taking shape.

If Illumina’s latest moves have you eyeing other innovators in healthcare, our free Healthcare Stocks Screener is packed with companies breaking ground in research and diagnostics. See the full list for free.

But given this rally and Illumina’s big promises, is the stock still trading at an attractive valuation? Or has the market already started to price in all the anticipated growth and turnaround potential?

Most Popular Narrative: 5.2% Overvalued

At $123.85, Illumina trades above the most closely watched narrative's fair value estimate of $117.74. With the market now ascribing a modest premium, analysts believe the current price reflects optimism about operational improvements, but comes with increased expectations going forward.

"Operational efficiencies, disciplined cost controls, and targeted share repurchases have already resulted in notable operating margin and EPS improvements. Further scaling, along with tax headwinds turning into tailwinds, sets the stage for continued net margin and earnings growth over the next several years."

Curious what metrics are powering that premium? The fair value rests on future profit margins, steady revenue gains, and a lower earnings multiple than the industry's usual level. Want to see how all these puzzle pieces combine to drive the valuation? The math behind the market’s excitement might surprise you.

Result: Fair Value of $117.74 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty in China and persistent competition from rival sequencing platforms continue to have the potential to disrupt Illumina’s earnings story.

Find out about the key risks to this Illumina narrative.

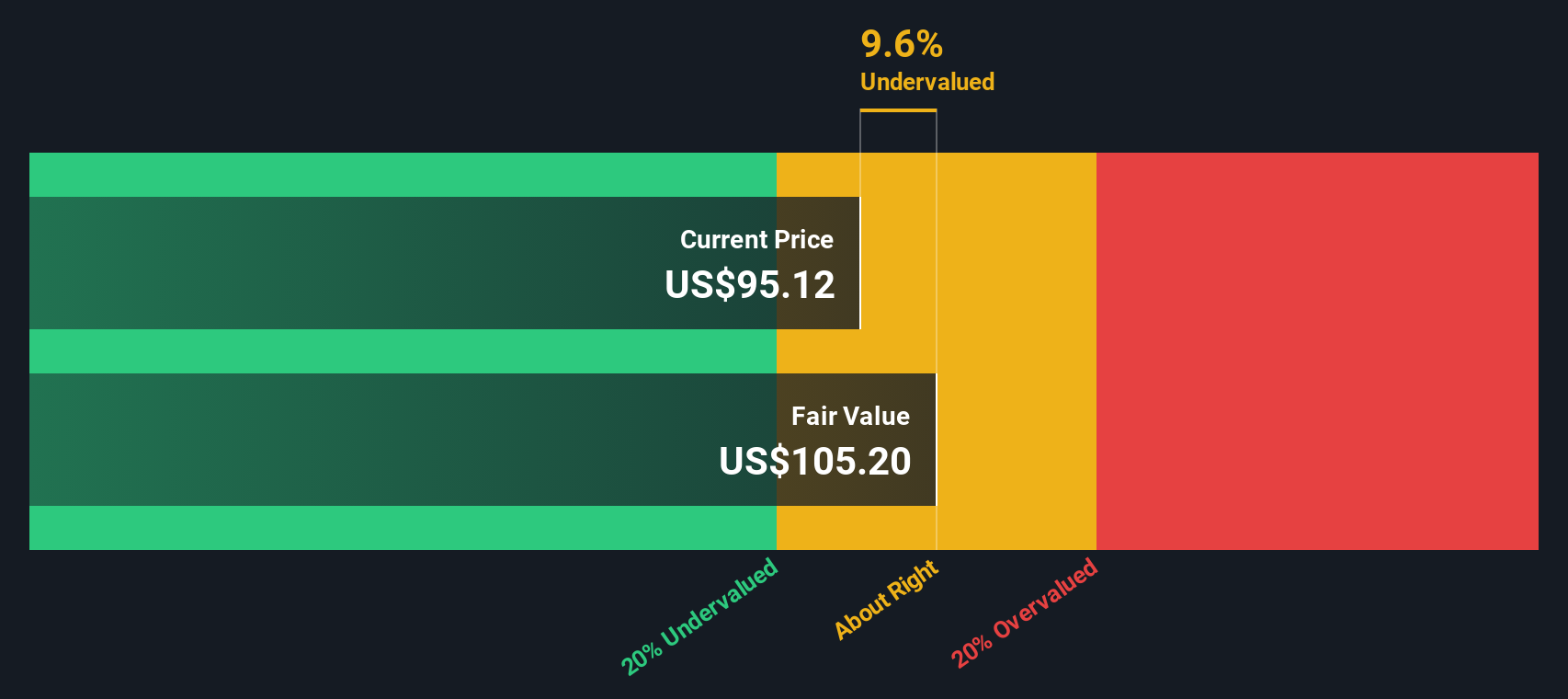

Another View: Discounted Cash Flow Model Signals Opportunity

While most narratives suggest Illumina's price is running ahead of fair value, our DCF model paints a different picture. Based on projected future cash flows, Illumina is trading at a significant discount, approximately 20% below its fair value estimate of $155.59. This signals that, at current levels, some long-term upside may remain overlooked by the market.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Illumina for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Illumina Narrative

If you have a different perspective or want to see how your own take stacks up, you can create your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Illumina.

Looking for More Smart Investment Ideas?

If you want more ways to spot the next big winner, put Simply Wall St’s screeners to work and sharpen your strategy before opportunities pass you by.

- Boost your search for reliable income by checking out these 15 dividend stocks with yields > 3% with yields above 3% that could add steady cash flow to your portfolio.

- Step ahead of the crowd by reviewing these 925 undervalued stocks based on cash flows that may have hidden upside, flagged by rigorous cash flow analysis.

- Spark your portfolio’s potential in booming tech sectors. Start with these 26 AI penny stocks and find AI innovators gaining traction in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives