- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

How Will Analyst Reactions to ILMN’s Wolfe Conference Pitch Shape Confidence in Its Turnaround Plan?

Reviewed by Sasha Jovanovic

- Illumina, Inc. recently presented at the 7th Annual Wolfe Research Healthcare Conference in New York, where company leaders highlighted strategies to address challenges such as the Grail spin-off and ongoing policy changes.

- The company's foray into the spatial market with new technology has drawn both optimism and skepticism, reflecting broad interest and debate on Illumina's growth trajectory.

- We'll explore how renewed analyst sentiment following Illumina’s conference appearance may influence future market expectations for the company.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Illumina Investment Narrative Recap

To be a shareholder in Illumina, you need confidence in the company's ability to sustain leadership in next-generation sequencing as it tackles margin pressures, fierce competition, and regulatory headwinds. The latest conference appearance offered useful insights, but did not fundamentally alter the most important near-term catalyst, clinical market adoption remains the key driver, nor did it materially reduce exposure to the risk of further research funding uncertainty.

Among recent developments, the lifting of the export ban by China's Ministry of Commerce stands out, as it directly addresses one of Illumina’s biggest risks: ongoing regulatory uncertainty in a vital growth market. While positive, the business still faces cautious sentiment and volatility, especially with uneven profit results and changing analyst signals around margins and demand trends.

On the other hand, investors should be aware of how persistent research budget constraints in the US could still ...

Read the full narrative on Illumina (it's free!)

Illumina's narrative projects $4.8 billion in revenue and $873.5 million in earnings by 2028. This requires 3.6% yearly revenue growth and a decrease of $426.5 million in earnings from the current $1.3 billion.

Uncover how Illumina's forecasts yield a $117.74 fair value, a 7% downside to its current price.

Exploring Other Perspectives

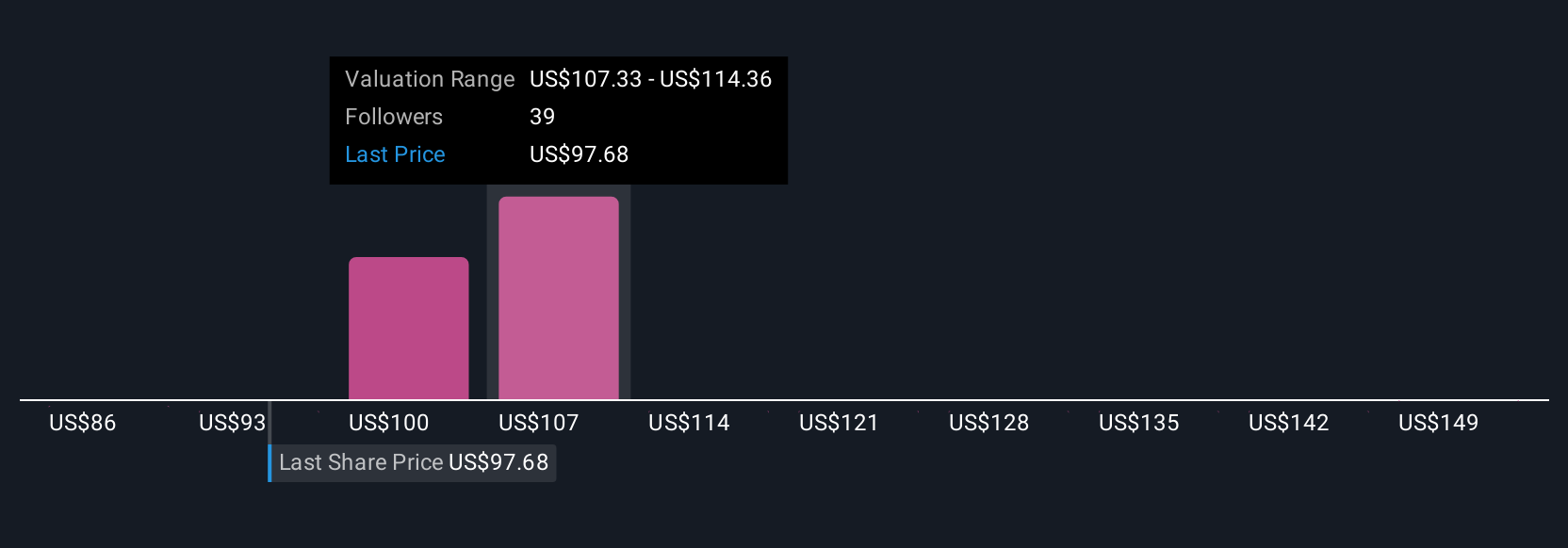

The Simply Wall St Community’s fair value estimates for Illumina range widely from US$86.26 to US$156.51 across five contributor analyses. With research end-market softness and regulatory hurdles still a concern, these diverse perspectives highlight how differently you and other market participants may assess Illumina’s long-term outlook.

Explore 5 other fair value estimates on Illumina - why the stock might be worth as much as 24% more than the current price!

Build Your Own Illumina Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Illumina research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Illumina research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Illumina's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success