- United States

- /

- Biotech

- /

- NasdaqGS:IDYA

IDEAYA Biosciences (IDYA) Is Down 5.1% After Return to Profitability and Strong Q3 Earnings - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- IDEAYA Biosciences reported strong third-quarter results, posting US$207.83 million in revenue and a net income of US$119.24 million, marking a turnaround from a net loss one year ago.

- This shift to profitability, highlighted by improved per-share earnings, has drawn continued positive commentary from major Wall Street analysts.

- We'll examine how IDEAYA Biosciences' newfound profitability sharpens its investment narrative for investors interested in oncology and precision medicine.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is IDEAYA Biosciences' Investment Narrative?

To invest in IDEAYA Biosciences, you need to believe in the long-term potential of its precision oncology pipeline, as well as the company's ability to translate scientific advancements and promising clinical trial data into real-world adoption and sustainable commercial success. The company's recent third-quarter results mark a significant shift, posting a solid US$119.24 million net income and a clear path to profits, at least for now, on the back of its licensing deal for darovasertib. This change could meaningfully alter the near-term narrative, with the move to profitability highlighting successful deal-making and enhancing IDEAYA's balance sheet for future research investments. However, while analyst sentiment remains upbeat and the share price has responded positively, risks around durability of profitability, reliance on partner milestones, and eventual regulatory outcomes are still front and center. The Q3 results haven't erased these risks but do provide new optimism that could impact short-term catalysts, particularly as the company advances its late-stage trials and pushes closer to potential FDA approvals.

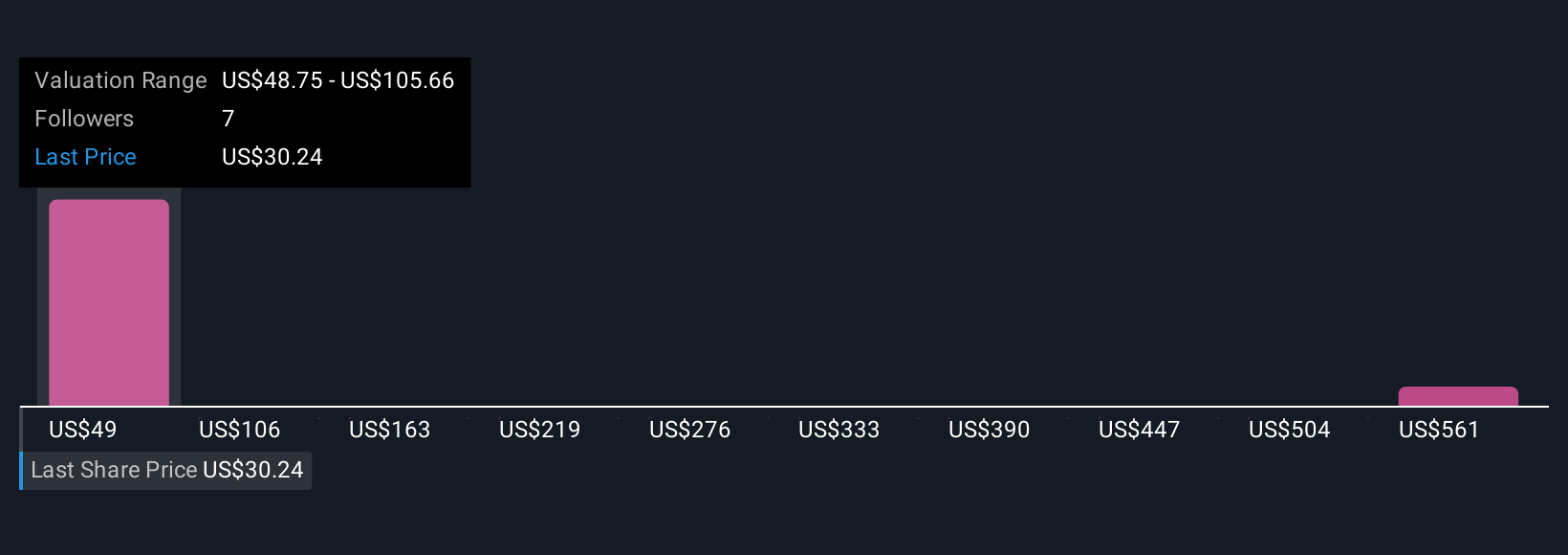

But, ongoing reliance on external deals and regulatory outcomes remains a crucial risk investors should watch. Our valuation report here indicates IDEAYA Biosciences may be overvalued.Exploring Other Perspectives

Explore 2 other fair value estimates on IDEAYA Biosciences - why the stock might be a potential multi-bagger!

Build Your Own IDEAYA Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IDEAYA Biosciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free IDEAYA Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IDEAYA Biosciences' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDYA

IDEAYA Biosciences

A precision medicine oncology company, discovers and develops targeted therapeutics for patient populations selected using molecular diagnostics in the United States.

Flawless balance sheet with concerning outlook.

Market Insights

Community Narratives