- United States

- /

- Biotech

- /

- NasdaqGS:IDYA

Can IDEAYA Biosciences (IDYA) Redefine Innovation in Rare Cancer Treatment With Darovasertib Progress?

Reviewed by Sasha Jovanovic

- IDEAYA Biosciences recently presented positive clinical results from its darovasertib trials in uveal melanoma at leading medical conferences, including new data on tumor response, eye preservation, and survival benefits.

- The findings highlight darovasertib’s potential to address a significant unmet need in primary and metastatic uveal melanoma, particularly related to preserving vision and improving patient outcomes.

- We’ll examine how strong tumor shrinkage and vision preservation data from darovasertib trials help shape IDEAYA’s investment narrative.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is IDEAYA Biosciences' Investment Narrative?

If you’re looking at IDEAYA Biosciences today, the most important thing to believe in as a shareholder is that darovasertib can become a first-in-class therapy for uveal melanoma, changing the standard of care for patients with limited options. The recent wave of clinical data, especially the strong tumor shrinkage, eye preservation, and visual acuity results just presented, could move the needle on the company’s biggest short-term catalyst: advancing darovasertib through pivotal Phase 3 trials and, potentially, into regulatory review. If these positive results hold in larger, later-stage studies, they may also help de-risk the path to approval and accelerate timelines. At the same time, IDEAYA remains unprofitable with expanding losses and is exposed to the risks facing clinical-stage biotechs, such as trial setbacks or shifts in regulatory expectations. The upcoming survival data and further readouts on darovasertib will be closely watched to confirm durability of benefits and safety, both crucial for building long-term value and supporting the current valuation premium over the sector.

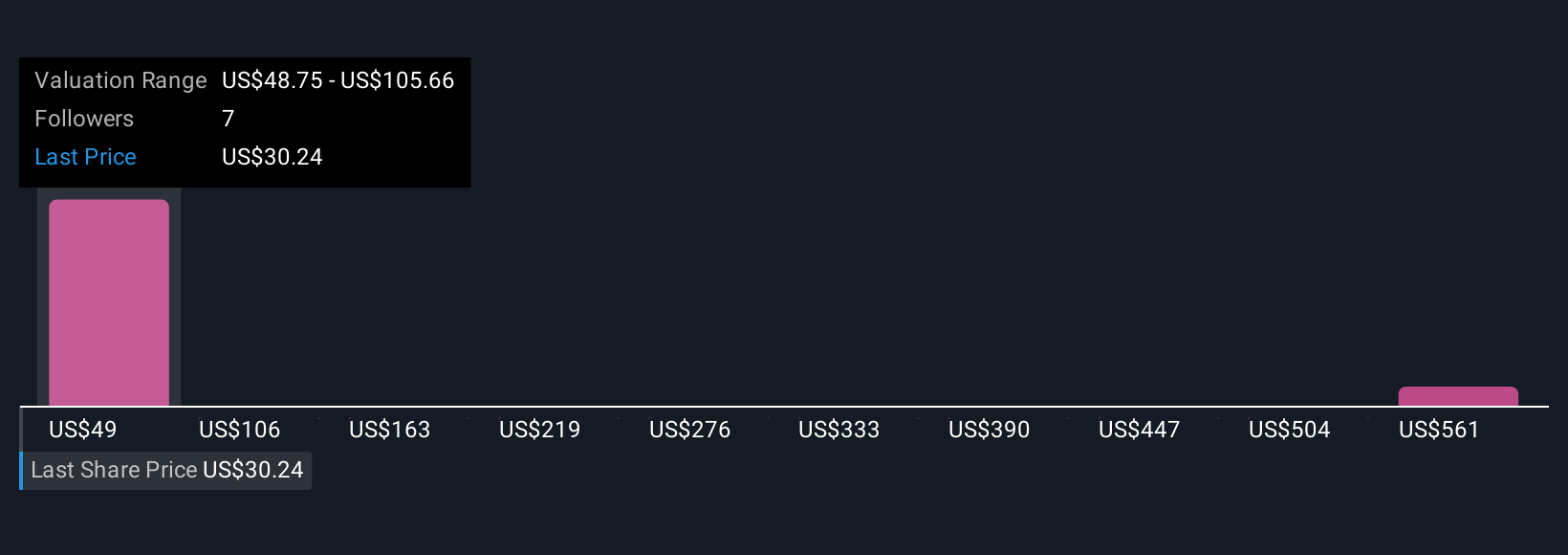

But there’s still concern about IDEAYA’s ability to turn scientific progress into sustained financial returns. Upon reviewing our latest valuation report, IDEAYA Biosciences' share price might be too optimistic.Exploring Other Perspectives

Explore 2 other fair value estimates on IDEAYA Biosciences - why the stock might be a potential multi-bagger!

Build Your Own IDEAYA Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IDEAYA Biosciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free IDEAYA Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IDEAYA Biosciences' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDYA

IDEAYA Biosciences

A precision medicine oncology company, discovers and develops targeted therapeutics for patient populations selected using molecular diagnostics in the United States.

Flawless balance sheet with concerning outlook.

Market Insights

Community Narratives