- United States

- /

- Life Sciences

- /

- NasdaqGS:ICLR

Why ICON (ICLR) Is Down 7.3% After Goodwill Impairment and Raised Revenue Guidance

Reviewed by Sasha Jovanovic

- ICON Public Limited Company recently reported its third quarter 2025 results, including revenue of US$2,042.81 million and a significant goodwill impairment of US$165.3 million related to its Data Solutions Reporting Unit, while also raising its full-year revenue guidance and completing a major share buyback program.

- The sharp decline in quarterly net income to US$2.36 million compared to last year, combined with a substantial share repurchase and an increased revenue outlook, signals management's focus on supporting earnings and shareholder value despite operational headwinds.

- We'll explore how the goodwill impairment and raised revenue guidance may influence ICON's evolving investment narrative and risk profile.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

ICON Investment Narrative Recap

To be an ICON shareholder, you need to believe the company can overcome sector headwinds such as clinical trial delays, elevated cancellations, and heightened competition, while capitalizing on process improvements and growing its midsized pharma base. The recent goodwill impairment and drop in net income signal ongoing operational hurdles, though the raised full-year revenue guidance suggests near-term optimism. Neither announcement appears to materially change the most important short-term catalyst, operational standardization, and the immediate risk remains soft or volatile trial demand.

The goodwill impairment of US$165.3 million in ICON’s Data Solutions Reporting Unit stands out among recent news items. This non-cash charge, while significant for quarterly earnings, does not directly threaten forward revenue growth prospects tied to operational efficiencies and partnerships, which management continues to target as key drivers.

By contrast, investors should be aware that recent revenue guidance increases may not fully offset the underlying softness in new trial bookings and cancellation rates...

Read the full narrative on ICON (it's free!)

ICON's outlook anticipates $8.8 billion in revenue and $1.0 billion in earnings by 2028. This is based on a 2.9% annual revenue growth rate and a $205.8 million earnings increase from the current earnings of $794.2 million.

Uncover how ICON's forecasts yield a $208.93 fair value, a 24% upside to its current price.

Exploring Other Perspectives

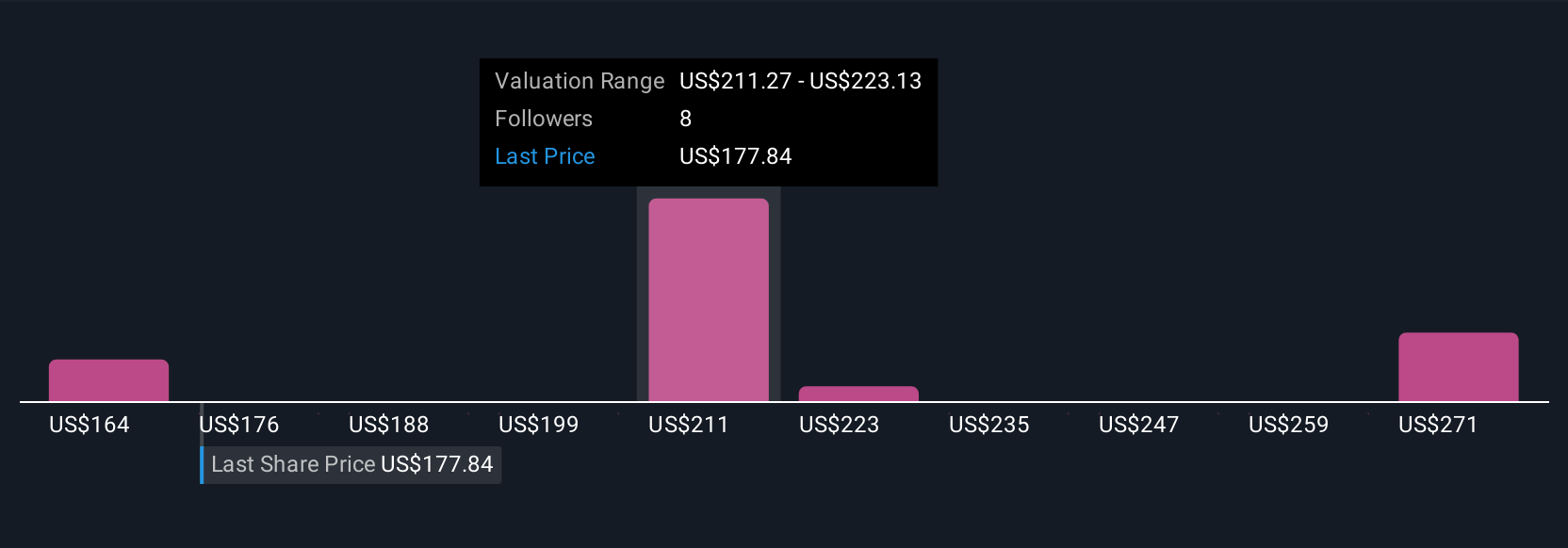

Five members of the Simply Wall St Community placed ICON’s fair value between US$163.85 and US$233.02. Opinions vary widely, and with the company’s raised revenue guidance facing persistent sector challenges, you can review these alternate viewpoints and draw your own conclusions.

Explore 5 other fair value estimates on ICON - why the stock might be worth just $163.85!

Build Your Own ICON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICON research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ICON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICON's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICLR

ICON

A clinical research organization, provides outsourced development and commercialization services in Ireland, rest of Europe, the United States, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives