- United States

- /

- Life Sciences

- /

- NasdaqGS:ICLR

Evaluating ICON Stock After 24% Drop and Industry Consolidation in 2025

Reviewed by Bailey Pemberton

- Wondering if ICON stock might be undervalued, or if it is a hidden opportunity waiting to be discovered? You are not alone, as many investors are keen to know whether now is the right time to take a closer look at ICON.

- The share price has seen some turbulence lately, dropping 1.1% over the past week and down 24.0% year-to-date. These moves catch the eye of anyone tracking long-term value or short-term momentum.

- Recent industry headlines have highlighted ongoing changes in the clinical research sector, with consolidation among ICON’s peers and broader market shifts influencing sentiment. This context can play a big role in how investors weigh ICON against its competitors and the rest of the healthcare field.

- According to our valuation checks, ICON scores a 6 out of 6 for being undervalued, an impressive number by any standard. Next, we will walk through the main approaches to valuing ICON, but stick around because there is an even deeper way to look at fair value that we will reveal at the end of this article.

Find out why ICON's -17.4% return over the last year is lagging behind its peers.

Approach 1: ICON Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's value. For ICON, this approach provides a forward-looking perspective and focuses on the company's ability to generate cash over time.

ICON's current Free Cash Flow stands at $980.9 million, based on the latest available figures. Analyst forecasts extend out to 2029 and suggest steady growth, with Free Cash Flow projected to reach about $1.15 billion by that year. It is important to note that while analyst estimates cover the next five years, Simply Wall St extrapolates further growth into the next decade, providing a holistic view of potential cash generation.

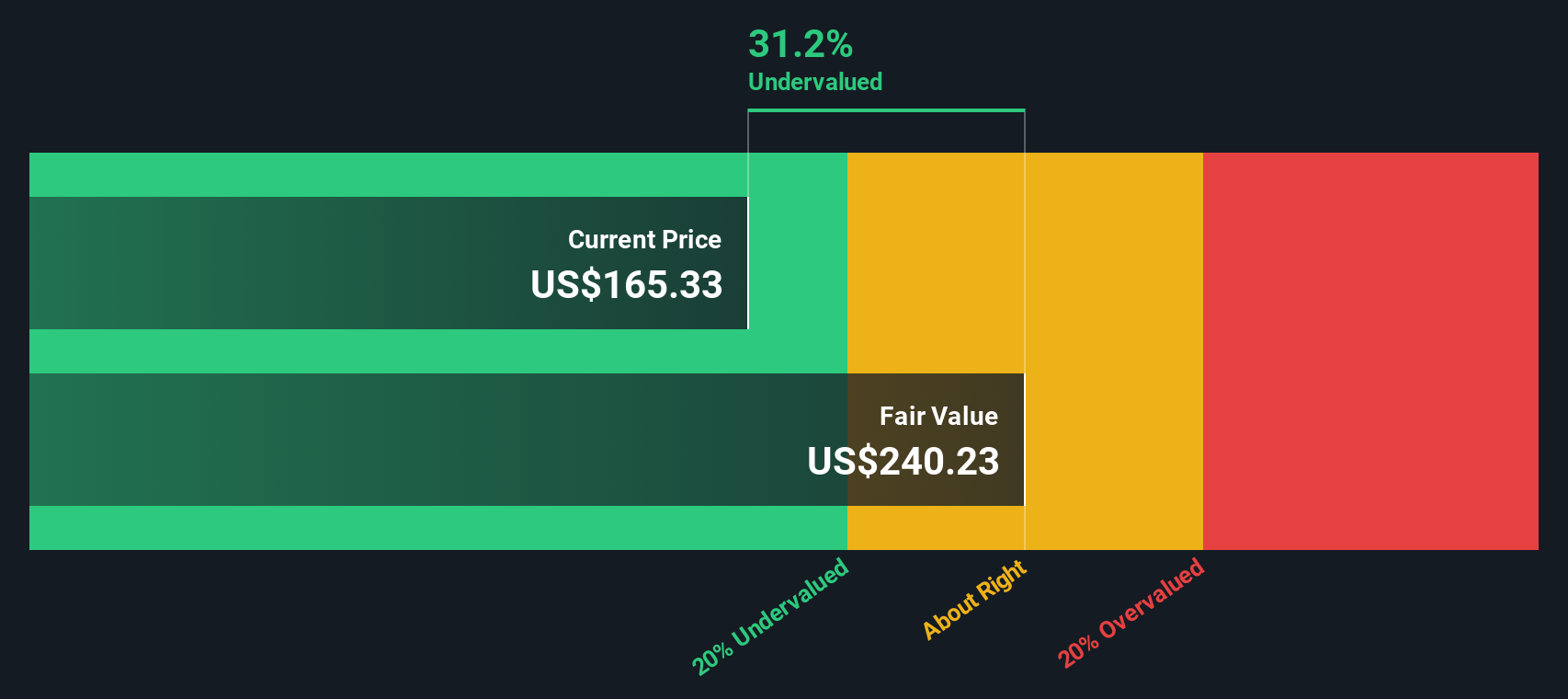

Applying these estimates, the DCF analysis arrives at an intrinsic value of $238.53 per share for ICON. This represents a 32.3% discount to the current share price and implies the stock is significantly undervalued at the moment.

For investors looking for value, this DCF analysis presents ICON as an appealing opportunity compared to its current market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ICON is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: ICON Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used metrics to value profitable companies like ICON because it directly ties a company's market value to its current earnings. This ratio offers a quick perspective on how much investors are willing to pay for a dollar of earnings, making it especially useful for companies with steady profitability.

Expected earnings growth and underlying business risks play major roles in determining what a “normal” or “fair” PE ratio looks like. Companies seen as higher growth or lower risk generally command higher PE multiples. Those with slower growth or more uncertainty tend to trade at lower multiples.

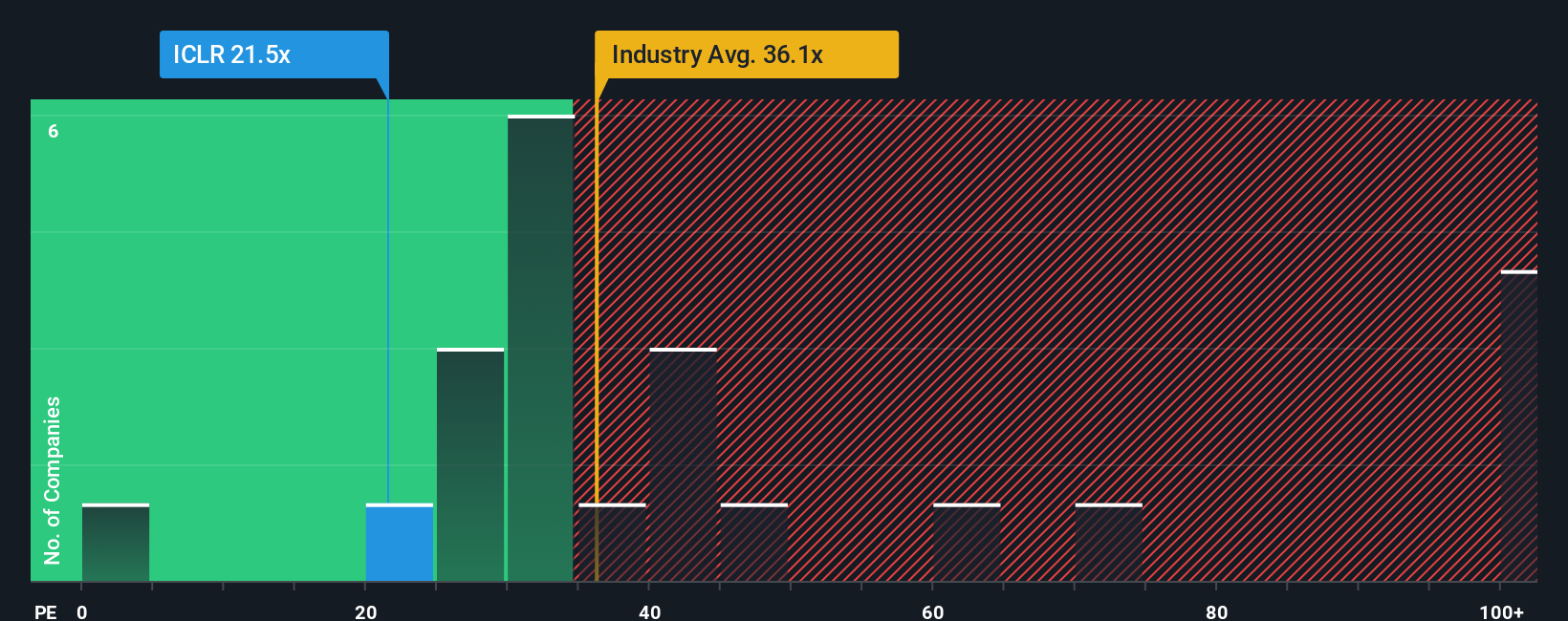

Currently, ICON trades at a PE ratio of 20.6x. This is noticeably lower than the Life Sciences industry average of 36.0x and well below the average of its direct peers at 55.9x. These comparisons might suggest that ICON is undervalued, but simple benchmarks do not tell the whole story, as each company’s prospects can differ widely.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio is a proprietary measure based on a comprehensive view of the company’s specific earnings growth, profit margins, industry dynamics, market capitalization, and risk profile. Because it combines all these factors, it can provide a more accurate assessment than basic peer or industry comparisons.

For ICON, the Fair Ratio stands at 23.9x, compared to its current 20.6x PE. Since ICON’s current multiple is below its Fair Ratio by a meaningful amount, this suggests the stock is undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ICON Narrative

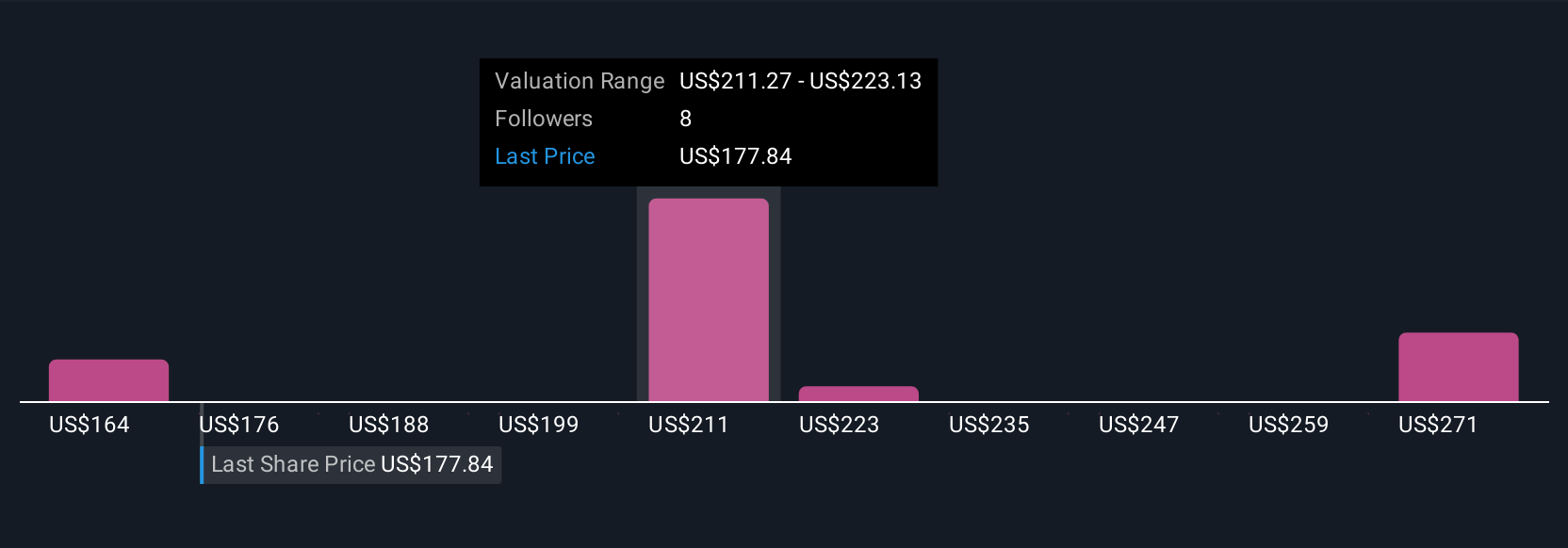

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story of a company, your personal perspective that connects what you expect for ICON’s future revenue, earnings, and margins to the fair value you believe it deserves.

Unlike traditional methods, Narratives help you connect the dots. You choose your own assumptions about a business and instantly see how your story drives forecasts, valuation, and a buy or sell signal. On Simply Wall St’s Community page, millions of investors easily create and update Narratives as new earnings reports or news events come in, making their investment decisions smarter, faster, and tailored to their beliefs.

This means Narratives are always dynamic and up to date, so when the situation for ICON changes, your investment thesis automatically does too. For example, some users have a bullish ICON Narrative with a fair value as high as $243 per share, factoring in operational improvements and strong partnerships. Others are more cautious, setting it as low as $180, reflecting margin concerns and industry challenges. Narratives put you in the driver’s seat by combining the numbers with the story you believe in, allowing you to act with confidence when fair value and market price diverge.

Do you think there's more to the story for ICON? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICLR

ICON

A clinical research organization, provides outsourced development and commercialization services in Ireland, rest of Europe, the United States, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives