- United States

- /

- Biotech

- /

- NasdaqGS:IBRX

ImmunityBio (IBRX) Valuation: Assessing the Stock After Strong Revenue Growth and Narrowed Losses

Reviewed by Simply Wall St

ImmunityBio (IBRX) has just released its third-quarter earnings, showing revenue increasing to $32 million from $6 million last year, with a narrowed net loss for the same period. Investors are watching these improvements closely.

See our latest analysis for ImmunityBio.

ImmunityBio’s financial improvements have caught attention, but investors remain cautious as the stock’s share price has fallen sharply. Its 1-year total shareholder return stands at -61.8%, reflecting lingering uncertainty even amid real business gains.

If you’re exploring what’s possible in healthcare innovation, now's the perfect chance to discover See the full list for free.

The question now is whether ImmunityBio’s current valuation underestimates its turnaround potential, or if the recent gains are fully reflected in its share price. Does this set up a compelling buying opportunity, or has the market already priced in future growth?

Price-to-Sales of 36.2x: Is it justified?

ImmunityBio is trading at a price-to-sales ratio of 36.2x, which is far above both the US Biotechs industry average and its direct peer group. This high ratio stands in sharp contrast to its last close price of $2.08 and raises questions around whether the market is overestimating the company's growth narrative.

The price-to-sales ratio reveals how much investors are willing to pay for each dollar of ImmunityBio's revenue. This measure is especially relevant for early-stage biotech firms that are not yet profitable. By paying this premium, the market is betting on significant future revenue expansion or major milestones ahead.

With the industry average at just 10.3x and the peer group at 6.8x, ImmunityBio's valuation looks lofty by every conventional benchmark. Even compared to the estimated fair ratio of 31x, the current multiple sits at an elevated level. This suggests the market could eventually move closer to the fair value as expectations recalibrate.

Explore the SWS fair ratio for ImmunityBio

Result: Price-to-Sales of 36.2x (OVERVALUED)

However, ongoing net losses and a sharply negative one-year return signal real risks that could quickly derail ImmunityBio's turnaround narrative.

Find out about the key risks to this ImmunityBio narrative.

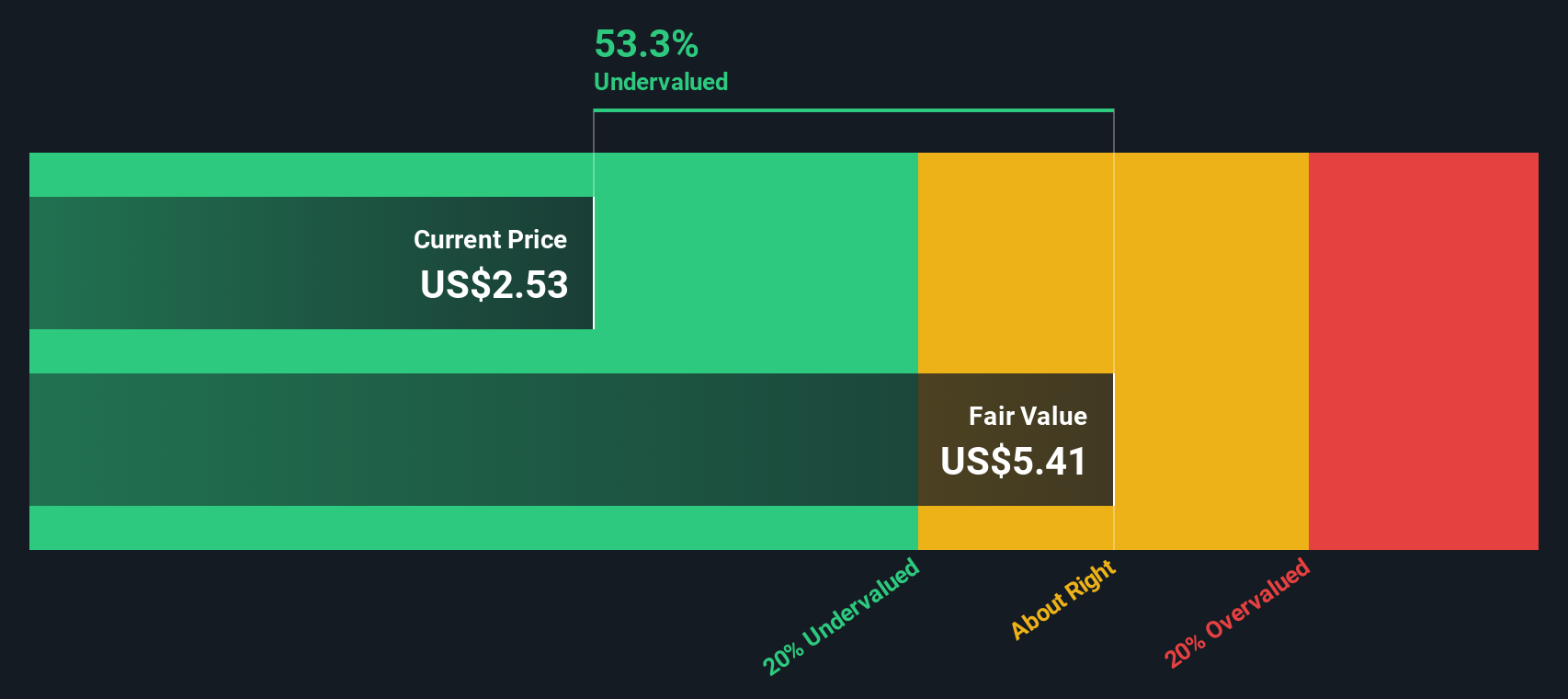

Another View: SWS DCF Model Signals Undervaluation

While the current market multiple looks high, the SWS DCF model presents a different perspective. According to this approach, ImmunityBio is trading at $2.08, which is 58.7% below the estimated fair value of $5.03. This suggests possible upside if growth materializes as forecasted. Should investors trust the DCF, or is the market right to be skeptical?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ImmunityBio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 842 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ImmunityBio Narrative

If you want to challenge this perspective or conduct your own research, crafting your own narrative takes just a few minutes. Do it your way

A great starting point for your ImmunityBio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t let great investments pass you by. Seize this moment to find high-potential stocks and bold themes that could transform your portfolio’s future.

- Unlock potential gains with these 842 undervalued stocks based on cash flows, where you’ll find companies trading below their intrinsic value and ready for a market re-rating.

- Tap into passive income streams by exploring these 20 dividend stocks with yields > 3%, offering yields above 3% for those wanting returns that pay you back.

- Ride the wave of innovation with these 26 AI penny stocks and get ahead on AI breakthroughs reshaping industries right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBRX

ImmunityBio

A commercial stage biotechnology company, develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives