- United States

- /

- Biotech

- /

- NasdaqGS:IBRX

ImmunityBio (IBRX): Losses Worsen While 54.9% Projected Revenue Growth Tests Bullish Narratives

Reviewed by Simply Wall St

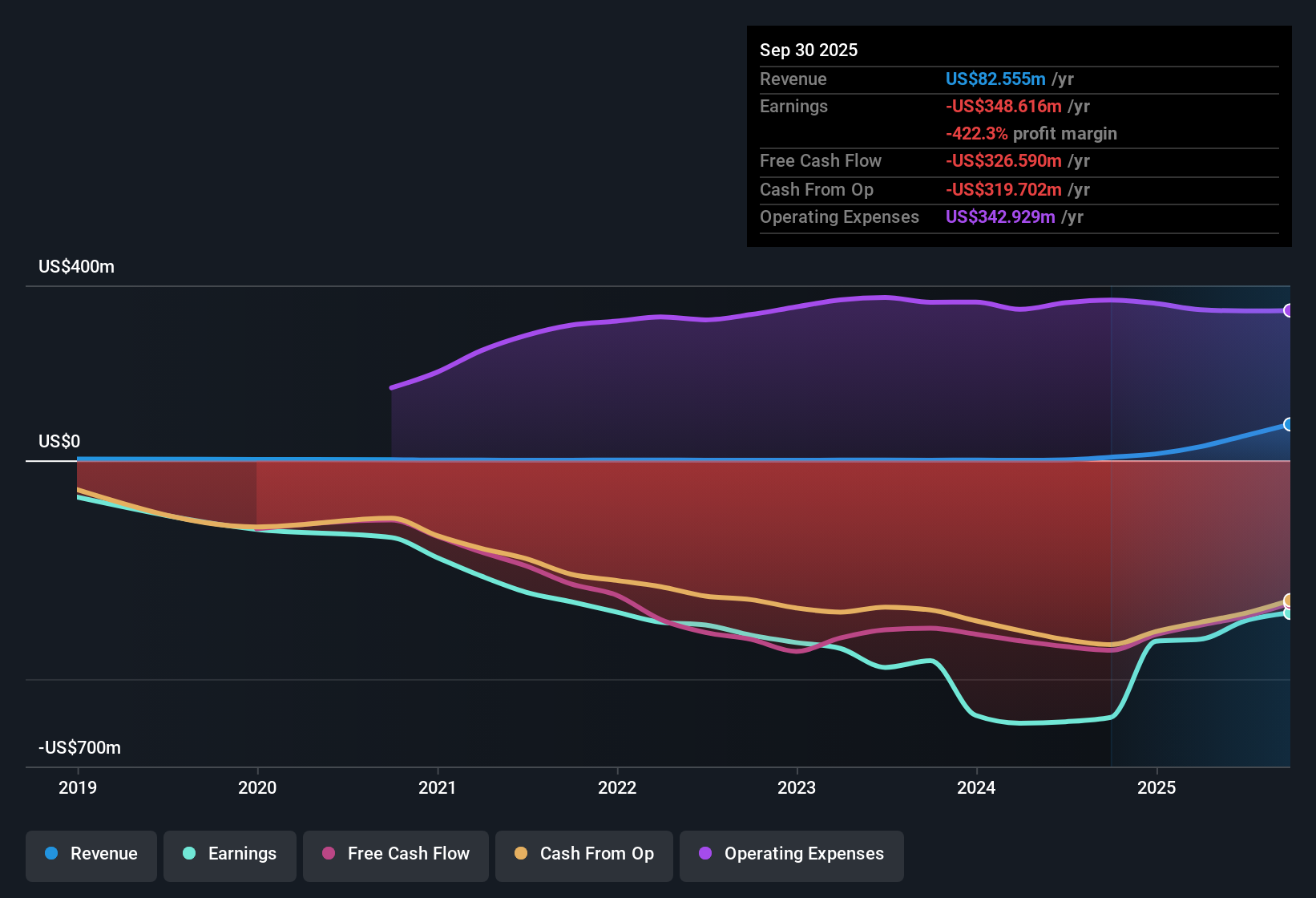

ImmunityBio (IBRX) reported another unprofitable period, with losses accelerating at a 15% annual rate over the past five years and net profit margins failing to show improvement. Forecasts suggest the company will remain unprofitable for at least the next three years. However, revenue is projected to surge by 54.9% per year, far outpacing the broader US market's 10.4% average growth rate. Investors now face the challenge of weighing a robust revenue outlook against ongoing losses and high valuation multiples.

See our full analysis for ImmunityBio.Next, we will look at how these headline figures compare to the market’s narratives and see which perspectives are likely to shift in light of the latest results.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Deepen Despite Fast Revenue Growth

- ImmunityBio’s net losses have grown at a 15% annual rate over the last five years, with profit margins showing no meaningful improvement during this period, even though forecasts call for continued top-line expansion.

- Rapid projected revenue growth, at 54.9% annually, heavily supports bullish arguments that the company’s pipeline or addressable market could eventually shift the path toward profitability.

- However, the inability to deliver margin improvements so far adds tension to hopes that aggressive growth alone will secure future profits.

- Bulls point to the industry’s pattern of late-stage turnarounds, but ImmunityBio has yet to demonstrate such an inflection point in its filings.

Premium Valuation Versus Peers

- The price-to-sales ratio stands at 37.4x, a significant premium compared to the US biotechs industry average of 10.3x and a peer group average of 6.7x. This indicates that investors pay far more for each dollar of sales than at most competitors.

- The prevailing market view notes that, even with ImmunityBio’s current share price of $2.15 trading below its DCF fair value of $4.98, the stock’s elevated valuation multiples require exceptional growth or a clear path to profitability to justify this premium.

- Investors may view the gap to DCF fair value as a longer-term opportunity, but the high sales multiple and lack of profit make value realization challenging without clear execution.

- Rapid revenue growth could ease concerns over valuation, but only if it translates into improved margins or a timeline to break-even, which remains missing in current summaries.

Share Dilution Adds to Headwinds

- Shareholders have faced dilution over the past year as ImmunityBio issued more stock, adding to concerns about unprofitability and stretching existing ownership in the pursuit of funding ongoing losses.

- Prevailing market commentary notes that continued share issuance, combined with persistent negative profit margins, puts pressure on management to justify raising capital at premium valuations.

- Some investors argue dilution erodes upside from future share price appreciation if current fundamentals do not improve.

- Market observers debate whether the rapid revenue growth forecast can eventually outweigh dilution’s impact or if more capital raises will be necessary before break-even.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ImmunityBio's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

ImmunityBio’s persistent unprofitability, rising losses, and heavy reliance on dilutive funding highlight ongoing challenges with financial health and sustainability.

If you want to prioritize companies with stronger balance sheets and less dilution risk, look for those with healthier fundamentals using solid balance sheet and fundamentals stocks screener (1979 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBRX

ImmunityBio

A commercial stage biotechnology company, develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives