- United States

- /

- Biotech

- /

- NasdaqGS:HUMA

Could Humacyte's (HUMA) High-Risk Patient Focus Redefine Its Competitive Edge in Biotech?

Reviewed by Sasha Jovanovic

- Humacyte recently announced positive two-year results from its Phase 3 V007 clinical trial, showing that its acellular tissue engineered vessel (ATEV) provided superior duration of use in high-risk hemodialysis patients compared to the standard autogenous fistula, with findings presented at the American Society of Nephrology’s Kidney Week 2025.

- A notable insight from the data is that the ATEV offered a substantially longer average access duration for female, obese, and diabetic patients, subgroups known to experience poorer outcomes with traditional fistulas, while maintaining a comparable safety profile.

- We'll explore how Humacyte's focus on high-need patient groups highlights a pivotal evolution in its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Humacyte's Investment Narrative?

For anyone considering Humacyte, the big picture centers on belief in the clinical and commercial potential of tissue-engineered blood vessels, particularly for patients who have limited options with current standards of care. The positive two-year V007 trial results mark a turning point and could strengthen the company's hand as it pursues further regulatory approvals and potential commercial partners, especially given the clear benefit for female, obese, and diabetic hemodialysis patients, a group representing a significant share of the addressable market. Short-term catalysts now include upcoming regulatory submissions for the ATEV in hemodialysis access and any clarity on commercial launch timelines, both of which may draw renewed attention following these latest results. However, given Humacyte's continued operational losses, high cash burn, and the history of share dilution, execution risk remains front and center. The new data helps address clinical risk, but margin for financial missteps or further dilution is still a serious consideration. If broader adoption stalls or reimbursement is uncertain, results may not translate to outsized commercial gains as quickly as some hope.

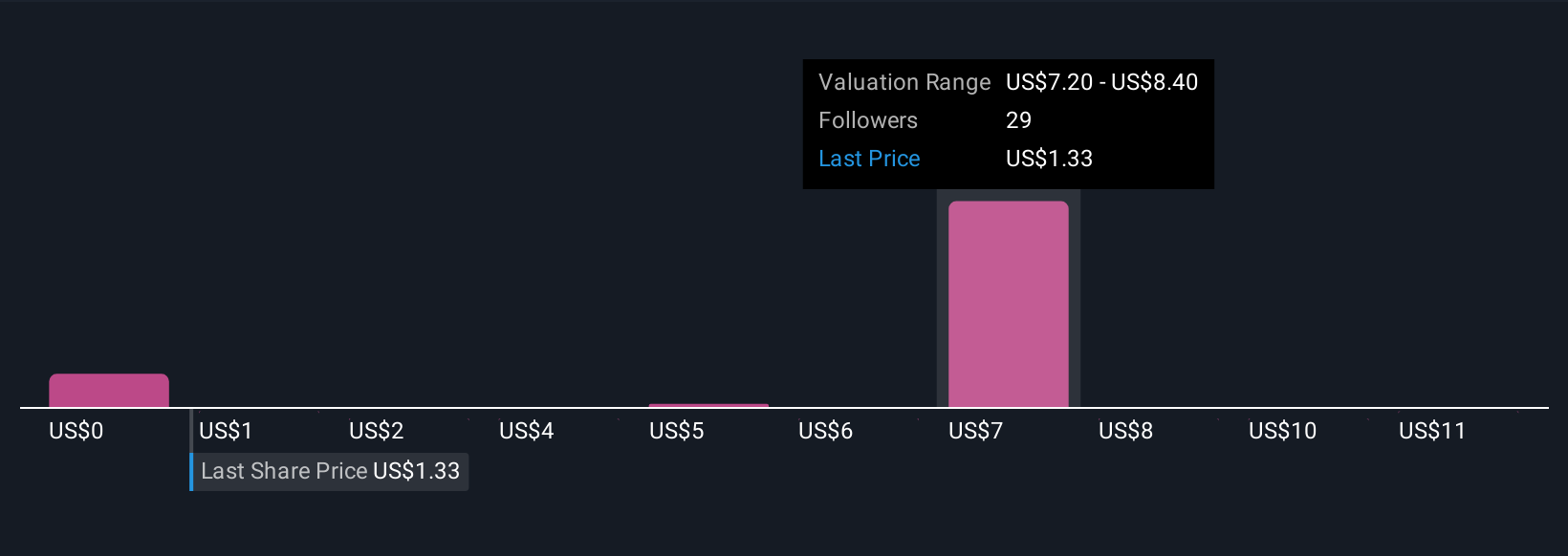

But, compared to the clinical win, the financial risk of further dilution is something investors should keep a close eye on. According our valuation report, there's an indication that Humacyte's share price might be on the expensive side.Exploring Other Perspectives

Explore 11 other fair value estimates on Humacyte - why the stock might be worth over 8x more than the current price!

Build Your Own Humacyte Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Humacyte research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Humacyte research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Humacyte's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humacyte might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUMA

Humacyte

Engages in the development and manufacture of off-the-shelf, implantable, and bioengineered human tissues for the treatment of diseases and conditions across a range of anatomic locations in multiple therapeutic areas.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives