- United States

- /

- Biotech

- /

- NasdaqCM:HRTX

Why Investors Shouldn't Be Surprised By Heron Therapeutics, Inc.'s (NASDAQ:HRTX) 30% Share Price Plunge

The Heron Therapeutics, Inc. (NASDAQ:HRTX) share price has fared very poorly over the last month, falling by a substantial 30%. The good news is that in the last year, the stock has shone bright like a diamond, gaining 137%.

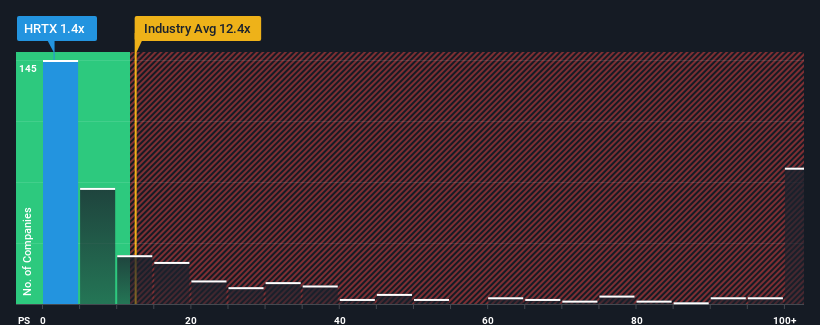

Following the heavy fall in price, Heron Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 12x and even P/S higher than 66x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Heron Therapeutics

How Has Heron Therapeutics Performed Recently?

With revenue growth that's inferior to most other companies of late, Heron Therapeutics has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Heron Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Heron Therapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The strong recent performance means it was also able to grow revenue by 64% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 18% each year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 111% per annum, which is noticeably more attractive.

With this in consideration, its clear as to why Heron Therapeutics' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Heron Therapeutics' P/S Mean For Investors?

Heron Therapeutics' P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Heron Therapeutics maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 3 warning signs we've spotted with Heron Therapeutics (including 1 which shouldn't be ignored).

If you're unsure about the strength of Heron Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Heron Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HRTX

Heron Therapeutics

A commercial-stage biotechnology company, engages in developing and commercializing therapeutic that enhances medical care.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives