- United States

- /

- Pharma

- /

- NasdaqGM:HROW

A Fresh Look at Harrow (HROW) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Harrow.

Harrow’s 1-month share price return of 8% stands out as momentum picks up, even as the one-year total shareholder return sits slightly negative at -2.8%. With a strong run in recent years, investors are weighing both recent price gains and long-term value.

If this resurgence has you keeping an eye on healthcare innovation, now is a great time to discover more with our dedicated screener: See the full list for free.

With Harrow's stock trading well below analyst price targets and posting solid recent momentum, investors are left wondering if the current share price offers a rare undervaluation or if the market has already anticipated upcoming growth.

Most Popular Narrative: 41.5% Undervalued

With a narrative fair value of $70.63 compared to the last close at $41.30, expectations are set high. Strong growth projections and market share expansion support this elevated valuation. Are these forecasts credible?

Strategic expansion into new indications and broader patient segments (for example, TRIESENCE's expected launch into the large ocular inflammation market and BYQLOVI's entry into the post-operative care segment), along with rising healthcare access and coverage in the U.S., should increase prescription volumes and elevate top-line performance.

How do analysts justify that significant upside? The bold valuation is fueled by very high revenue projections and ambitious profit margin improvements, all expected within just a few years. Curious which key metrics see the biggest jump? Explore the narrative to see what drives that price increase and what would have to go right for it to happen.

Result: Fair Value of $70.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, such as heavy reliance on flagship products and the challenge of sustaining rapid recent growth if demand returns to typical levels.

Find out about the key risks to this Harrow narrative.

Another View: Market Ratios Signal Caution

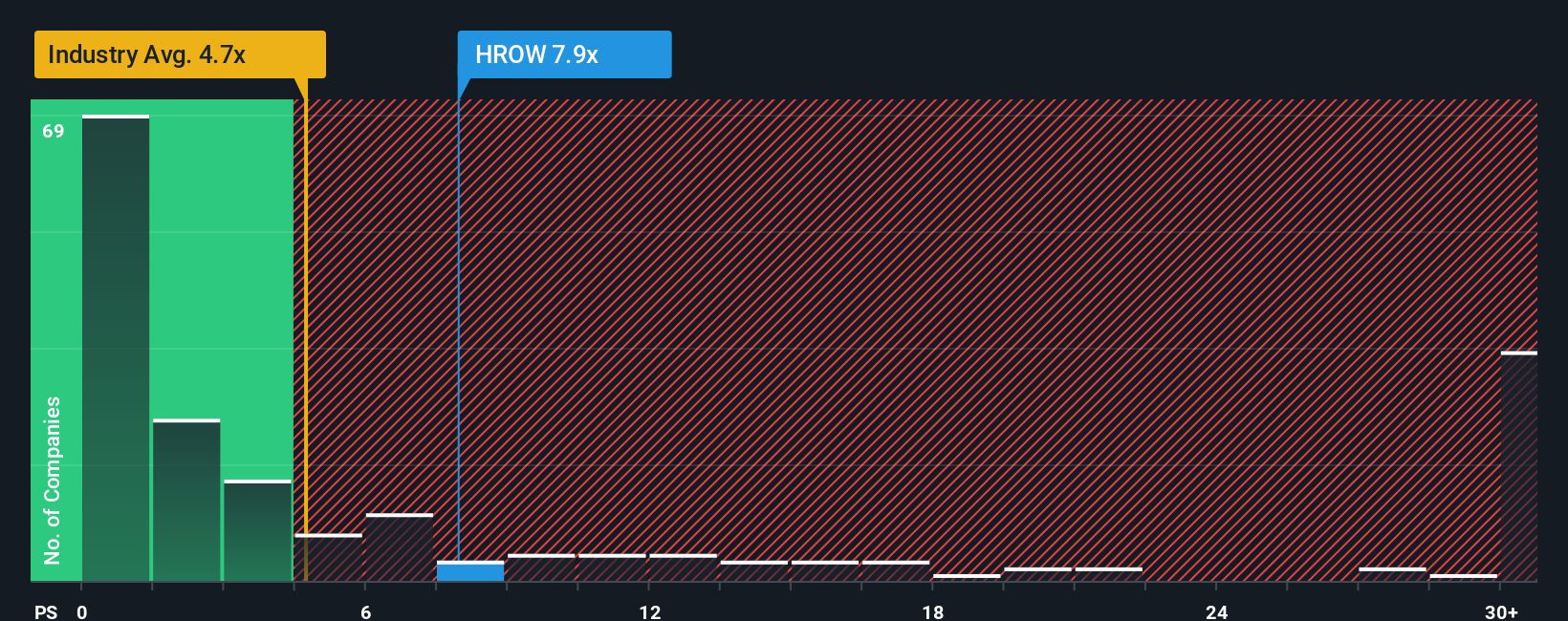

Taking a step back from narrative fair value, the market’s favorite valuation benchmark tells a different story. Harrow trades at a price-to-sales ratio of 6.1x, which is higher than both its U.S. peer average (5.1x) and industry average (4.2x). This premium suggests that investors are anticipating strong growth, but it can introduce risk if future results do not meet expectations. Whether Harrow's next phase of expansion will justify this higher multiple or if market expectations will adjust remains to be seen.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Harrow Narrative

If you see the numbers differently or want to test your own investment thesis, you can craft a personalized Harrow story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Harrow.

Looking for more investment ideas?

Smart investors always keep their options open, so now is the perfect time to unlock new opportunities. The Simply Wall Street Screener helps you stay ahead of the curve and ensures you don’t miss out on tomorrow’s smart moves.

- Target steady income streams by checking out these 15 dividend stocks with yields > 3% that consistently deliver yields above 3% for your portfolio.

- Capitalize on exponential sector growth and see how these 25 AI penny stocks are driving innovations across industries.

- Jump on market opportunities with these 927 undervalued stocks based on cash flows, your shortcut to stocks trading below their fair value based on cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HROW

Harrow

An eyecare pharmaceutical company, engages in the discovery, development, and commercialization of ophthalmic pharmaceutical products.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success