- United States

- /

- Pharma

- /

- NasdaqGM:HRMY

Harmony Biosciences Holdings (HRMY) Is Up 16.8% After Raising 2025 Revenue Guidance on WAKIX Strength

Reviewed by Sasha Jovanovic

- In October 2025, Harmony Biosciences Holdings raised its 2025 revenue guidance to a range of US$845–US$865 million following strong third-quarter performance, driven by significant growth in its WAKIX® franchise and a record number of patients treated.

- This upward revision in expectations highlights rising demand for WAKIX in the narcolepsy market and signals management’s increased confidence in ongoing commercial expansion.

- We’ll now explore how Harmony’s raised revenue guidance, resulting from stronger than anticipated WAKIX patient growth, may influence its long-term investment narrative.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Harmony Biosciences Holdings Investment Narrative Recap

To be a shareholder in Harmony Biosciences Holdings, you need to believe in the company’s ability to sustain and grow its leadership in narcolepsy treatments with WAKIX, while managing future product concentration risk. The recent upward revision in revenue guidance, following strong patient growth and WAKIX franchise expansion, reinforces confidence in near-term momentum but does not materially diminish the most important short-term catalyst, the ongoing traction and resilience of WAKIX in the face of rising competitive threats. The biggest risk remains the company’s reliance on a single lead asset, especially as generic competition and new entrants edge closer.

Among recent announcements, Harmony’s finalized settlement with Lupin regarding WAKIX patent litigation stands out as highly relevant. With exclusivity for WAKIX now secure through 2030, this development provides greater revenue visibility over the medium term, directly supporting the heightened revenue guidance, while also sharpening focus on pipeline progress to address future market share and diversification risks.

But even with stronger revenue expectations, investors should be aware that increased WAKIX patient numbers do not fully eliminate the long-term risk from emerging competitors and patent expiry…

Read the full narrative on Harmony Biosciences Holdings (it's free!)

Harmony Biosciences Holdings is projected to reach $1.2 billion in revenue and $333.5 million in earnings by 2028. This outlook requires a 17.0% annual revenue growth rate and an earnings increase of $152.6 million from the current $180.9 million.

Uncover how Harmony Biosciences Holdings' forecasts yield a $44.55 fair value, a 47% upside to its current price.

Exploring Other Perspectives

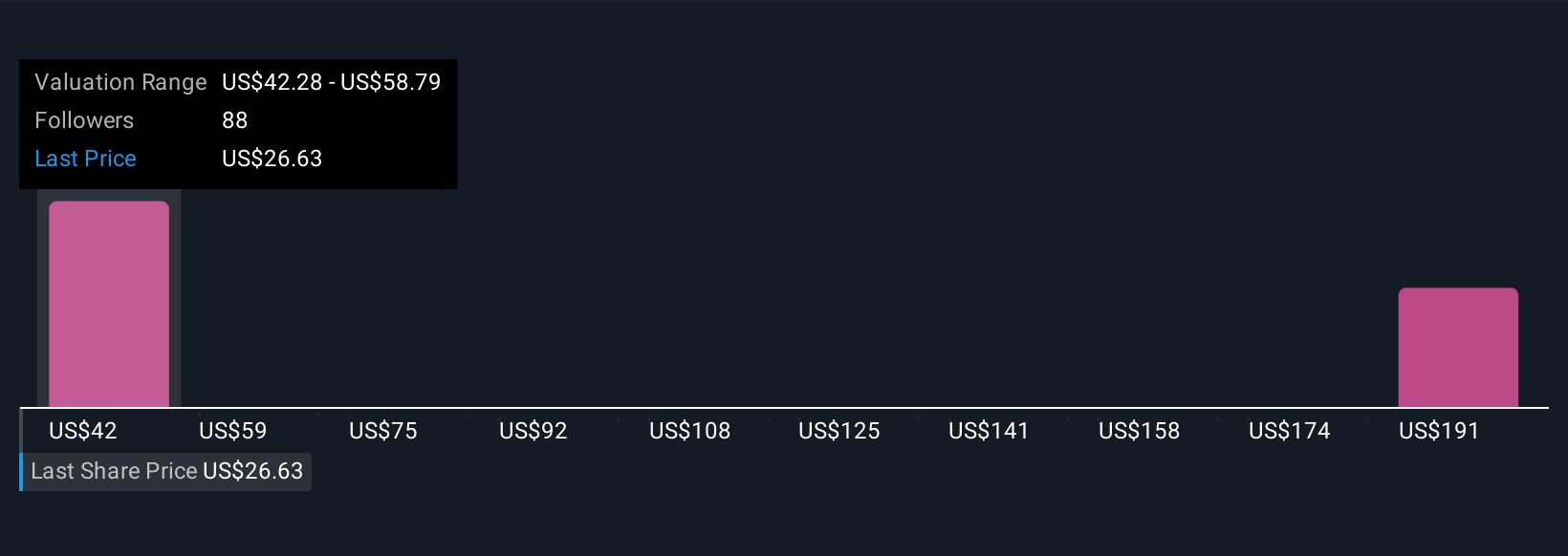

Simply Wall St Community members set fair values for Harmony Biosciences spanning US$42 to over US$207 per share across seven estimates. While some see substantial upside, the heavy reliance on WAKIX remains a key factor that can shape the company’s long-term performance; you can compare these perspectives and uncover which risk each investor weighs most.

Explore 7 other fair value estimates on Harmony Biosciences Holdings - why the stock might be worth just $42.28!

Build Your Own Harmony Biosciences Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmony Biosciences Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Harmony Biosciences Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmony Biosciences Holdings' overall financial health at a glance.

No Opportunity In Harmony Biosciences Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmony Biosciences Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HRMY

Harmony Biosciences Holdings

A commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives