- United States

- /

- Biotech

- /

- OTCPK:HOOK

HOOKIPA Pharma Inc.'s (NASDAQ:HOOK) 26% Dip In Price Shows Sentiment Is Matching Revenues

HOOKIPA Pharma Inc. (NASDAQ:HOOK) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 30% in that time.

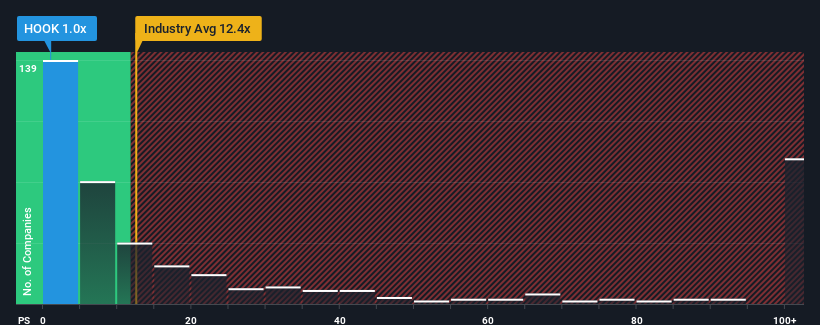

Following the heavy fall in price, HOOKIPA Pharma's price-to-sales (or "P/S") ratio of 1x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 12.4x and even P/S above 68x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for HOOKIPA Pharma

How Has HOOKIPA Pharma Performed Recently?

HOOKIPA Pharma certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on HOOKIPA Pharma.How Is HOOKIPA Pharma's Revenue Growth Trending?

In order to justify its P/S ratio, HOOKIPA Pharma would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 228% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 162% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 14% per annum over the next three years. With the industry predicted to deliver 146% growth per year, that's a disappointing outcome.

With this information, we are not surprised that HOOKIPA Pharma is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Having almost fallen off a cliff, HOOKIPA Pharma's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's clear to see that HOOKIPA Pharma maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, HOOKIPA Pharma's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you settle on your opinion, we've discovered 4 warning signs for HOOKIPA Pharma that you should be aware of.

If these risks are making you reconsider your opinion on HOOKIPA Pharma, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if HOOKIPA Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:HOOK

HOOKIPA Pharma

A clinical stage biopharmaceutical company, develops immunetherapeutics targeting infectious diseases based on its proprietary arenavirus platform.

Flawless balance sheet with low risk.

Market Insights

Community Narratives