- United States

- /

- Life Sciences

- /

- NasdaqGM:HBIO

If You Had Bought Harvard Bioscience (NASDAQ:HBIO) Stock Three Years Ago, You Could Pocket A 34% Gain Today

Buying a low-cost index fund will get you the average market return. But across the board there are plenty of stocks that underperform the market. For example, the Harvard Bioscience, Inc. (NASDAQ:HBIO) share price return of 34% over three years lags the market return in the same period. Unfortunately, the share price has fallen 16% over twelve months.

See our latest analysis for Harvard Bioscience

Harvard Bioscience isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

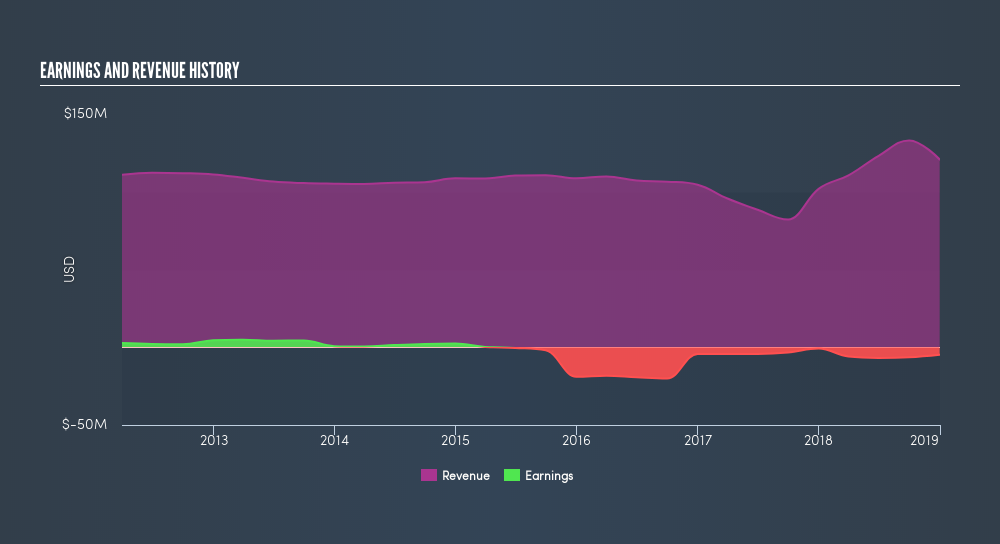

In the last 3 years Harvard Bioscience saw its revenue grow at 5.0% per year. Considering the company is losing money, we think that rate of revenue growth is uninspiring. The market doesn't seem too pleased with the revenue growth rate, given the modest 10% annual share price gain over three years. A closer look at the revenue and profit trends could uncover help us understand if the company will be profitable in the future.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

This free interactive report on Harvard Bioscience's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 0.9% in the last year, Harvard Bioscience shareholders lost 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3.3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Harvard Bioscience in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:HBIO

Harvard Bioscience

Develops, manufactures, and sells technologies, products, and services for life science applications in the United States, Germany, and internationally.

Fair value low.

Similar Companies

Market Insights

Community Narratives