- United States

- /

- Biotech

- /

- NasdaqGS:HALO

After Recent Drug Partnership Deals, Is Halozyme Still a Hidden Gem in 2025?

Reviewed by Bailey Pemberton

- Wondering if Halozyme Therapeutics is a hidden gem or already priced to perfection? You are not alone as investors are taking a closer look at what this biotech innovator is really worth.

- This year has been especially rewarding for shareholders, with the stock up 41.8% year-to-date despite a recent 6.5% dip over the last week and a steady 40.5% gain in the past 12 months.

- Recent headlines point to strong momentum surrounding new drug partnerships and FDA approvals, both of which have fueled optimism and help explain much of the recent price volatility. As industry excitement continues to build, analysts and investors are recalibrating their expectations for future growth.

- The company currently holds a valuation score of 5 out of 6, meaning it appears undervalued in several key areas. Next, we will examine the standard valuation approaches, but be sure to stick around as there may be an even better way to judge Halozyme's true value by the end of this article.

Approach 1: Halozyme Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common approach to company valuation that projects future cash flows and then discounts them back to today’s value, giving a present-day estimate of what the company is truly worth. This method helps investors look past short-term price swings by focusing on the actual cash the business is expected to generate over time.

Halozyme Therapeutics currently generates $596.8 Million in Free Cash Flow (FCF). Analysts estimate the company will produce $437 Million in FCF for 2024, with long-term projections showing steady growth. By 2035, Halozyme’s annual FCF is estimated to rise to $1.34 Billion, according to Simply Wall St extrapolations. These projections highlight the company’s potential to generate increasingly larger cash flows over the next decade.

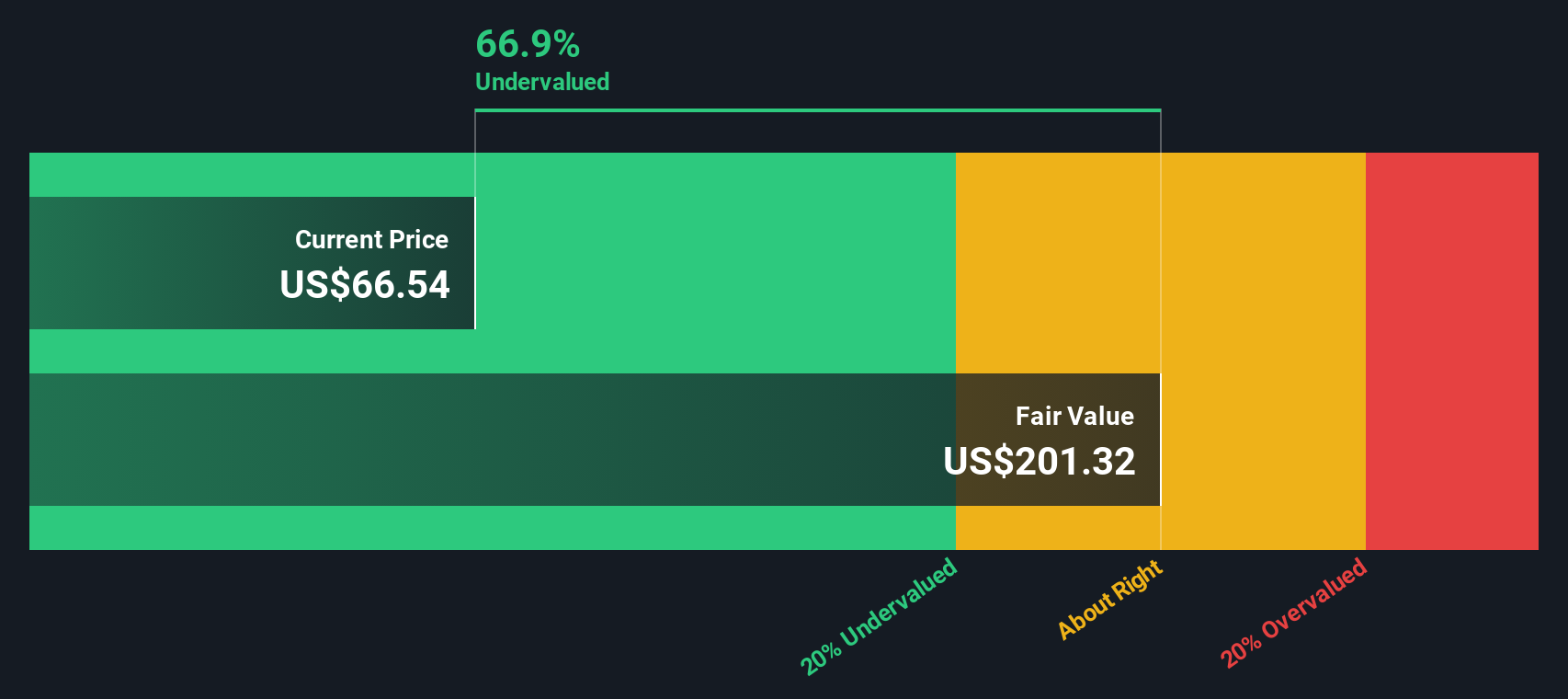

Based on this two-stage DCF model, which extrapolates and discounts future cash flows, Halozyme's intrinsic fair value is calculated at $200.70 per share. With the DCF indicating a 66.1% discount to this intrinsic value, the stock appears notably undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Halozyme Therapeutics is undervalued by 66.1%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Halozyme Therapeutics Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Halozyme Therapeutics, as it shows how much investors are willing to pay for each dollar of earnings. This makes it particularly relevant for firms with strong and consistent profit generation, offering a clear sense of whether the stock’s valuation aligns with its underlying performance.

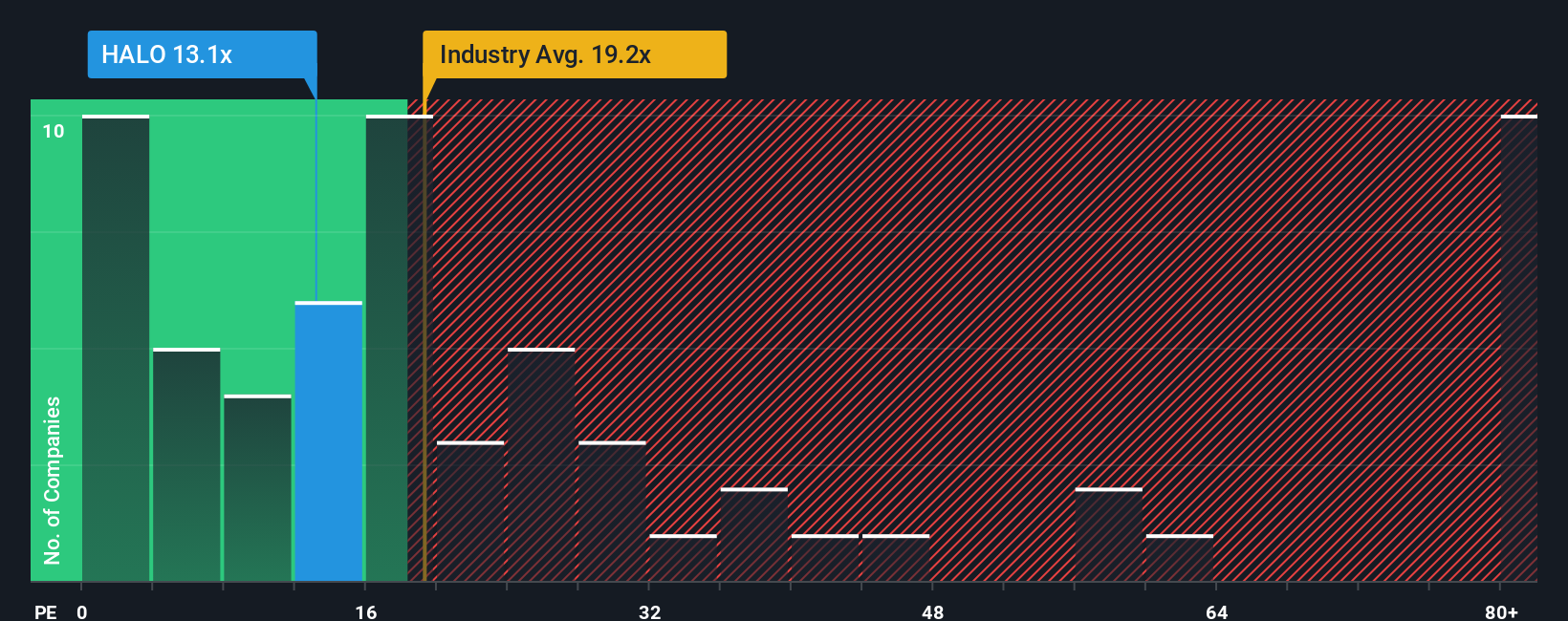

Typically, growth expectations and risk play a key role in what PE ratio is considered “normal.” Fast-growing, lower-risk companies are often assigned higher PE multiples by the market, while firms with more modest prospects or risks may see lower valuations. Halozyme currently trades at a PE ratio of 13.4x, comfortably below the Biotechs industry average of 18.7x and the average for its closest peers at 20.3x.

To provide a more tailored benchmark, Simply Wall St has developed a "Fair Ratio" for each stock. In this case, that figure is 21.6x for Halozyme. This proprietary metric considers not just industry and peer levels, but also factors such as the company’s earnings growth outlook, market cap, risks, and profit margins. As a result, the Fair Ratio offers a more holistic and accurate valuation comparison than simply using general market or industry averages.

Comparing Halozyme’s current 13.4x PE ratio to its Fair Ratio of 21.6x suggests the shares are undervalued, based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Halozyme Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is an investor’s story, their unique perspective on a company, that connects expectations about Halozyme Therapeutics’ future revenue, earnings, and margins directly to a personal estimate of fair value.

Rather than relying only on traditional valuation ratios, Narratives allow you to tie the company’s real-world strengths, strategies, and risks to a forecast of financial results, making investment decisions more dynamic and meaningful. Using Narratives on the Simply Wall St Community page is straightforward; anyone can try out different stories or scenarios and see how they impact estimated fair value, just like the millions of investors who already use this tool.

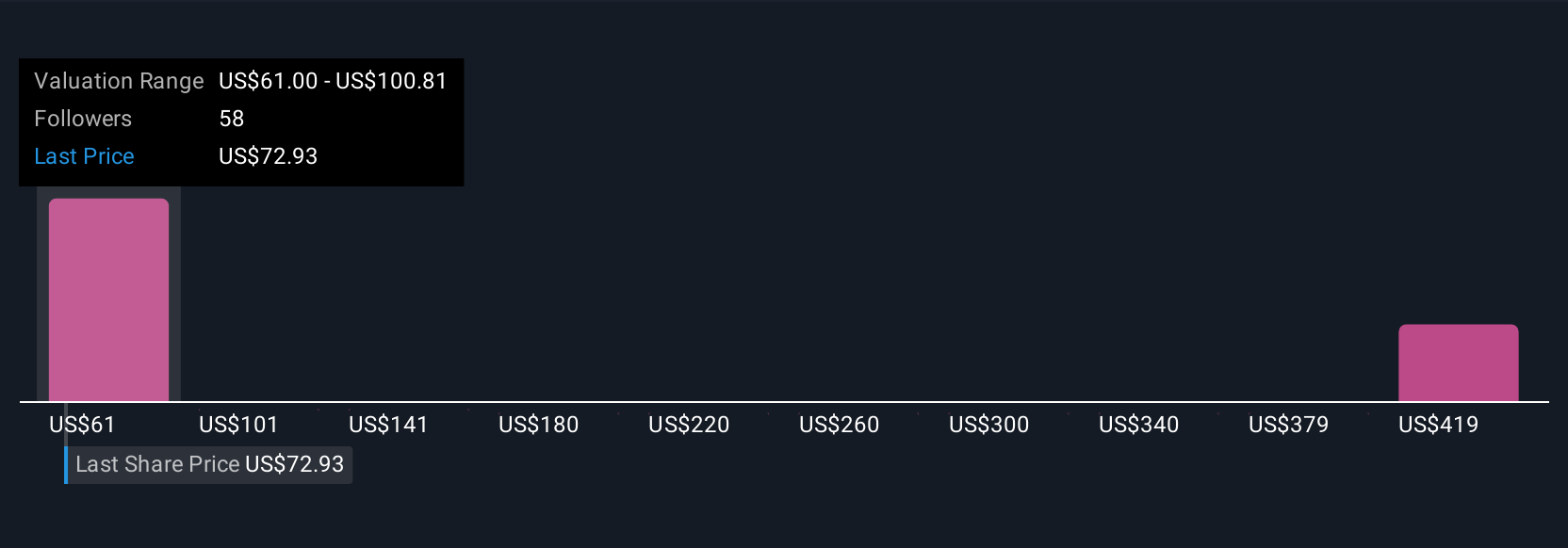

Narratives also empower you to act: by tracking how your fair value compares to the latest market price and automatically updating as news, earnings, or analyst targets change, they keep your position current without endless manual research. For example, one investor might build a bullish Narrative based on strong platform adoption and assign a fair value near a recent $91 price target, while another, more cautious investor may focus on patent risks and assign a lower fair value around $51. Both approaches help each investor decide whether Halozyme Therapeutics is truly a buy, hold, or sell, and encourage you to develop your own informed viewpoint.

Do you think there's more to the story for Halozyme Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halozyme Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HALO

Halozyme Therapeutics

A biopharmaceutical company, researches, develops, and commercializes of proprietary enzymes and devices in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026