- United States

- /

- Biotech

- /

- NasdaqGS:GOSS

Health Check: How Prudently Does Gossamer Bio (NASDAQ:GOSS) Use Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Gossamer Bio, Inc. (NASDAQ:GOSS) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Gossamer Bio

What Is Gossamer Bio's Net Debt?

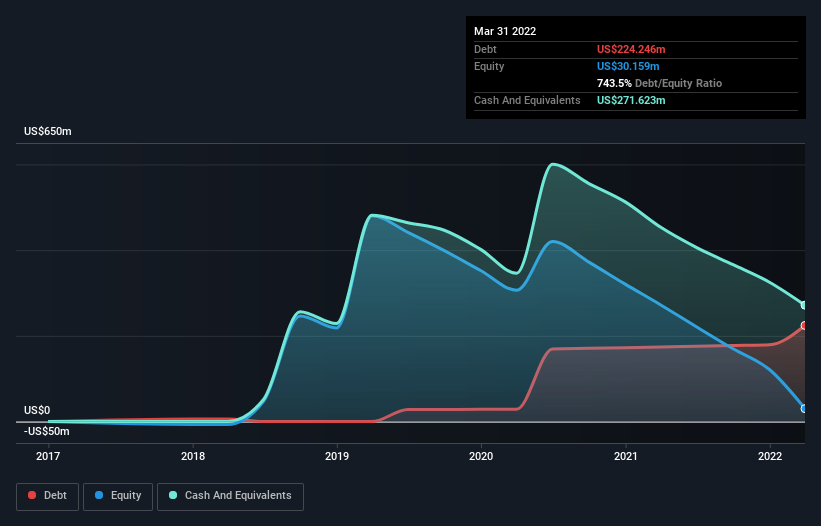

As you can see below, at the end of March 2022, Gossamer Bio had US$224.2m of debt, up from US$174.0m a year ago. Click the image for more detail. However, its balance sheet shows it holds US$271.6m in cash, so it actually has US$47.4m net cash.

How Healthy Is Gossamer Bio's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Gossamer Bio had liabilities of US$34.6m due within 12 months and liabilities of US$230.0m due beyond that. Offsetting this, it had US$271.6m in cash and US$200.0k in receivables that were due within 12 months. So it can boast US$7.30m more liquid assets than total liabilities.

Having regard to Gossamer Bio's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the US$570.7m company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, Gossamer Bio boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Gossamer Bio can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Given its lack of meaningful operating revenue, Gossamer Bio shareholders no doubt hope it can fund itself until it has a profitable product.

So How Risky Is Gossamer Bio?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Gossamer Bio lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$184m and booked a US$234m accounting loss. However, it has net cash of US$47.4m, so it has a bit of time before it will need more capital. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for Gossamer Bio (1 is potentially serious!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GOSS

Gossamer Bio

A clinical-stage biopharmaceutical company, focuses on developing and commercializing seralutinib for the treatment of pulmonary arterial hypertension (PAH) in the United States.

High growth potential and good value.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026