- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Will New Data and Approvals for Livdelzi and Trodelvy Change Gilead Sciences' (GILD) Narrative?

Reviewed by Sasha Jovanovic

- In recent weeks, Gilead Sciences announced a series of product-related milestones, including new long-term data for Livdelzi (Seladelpar) in primary biliary cholangitis, positive Phase 3 results for Trodelvy in metastatic triple-negative breast cancer, and Health Canada's conditional approval of LYVDELZI for PBC treatment. The company also presented new research on its HIV, cancer, and hepatitis programs at major medical conferences in October 2025, underscoring advances across its pipeline and progress in increasing global access.

- An interesting insight is that up to 40% of people with primary biliary cholangitis do not respond to standard therapy, highlighting the significance of new treatment options like LYVDELZI, which showed a statistically significant reduction in disease markers and symptoms in clinical trials.

- We'll look at how expanded clinical data for Livdelzi and regulatory approvals could influence Gilead Sciences' long-term growth narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Gilead Sciences Investment Narrative Recap

To own Gilead Sciences stock, you need to believe the company can both navigate heavy reliance on its HIV business and successfully launch innovations in oncology and liver disease. Recent news, including the regulatory progress for Livdelzi (Seladelpar) in primary biliary cholangitis and positive clinical results in first-line triple-negative breast cancer, may contribute positively to near-term sentiment, but the largest short-term catalyst remains uptake and reimbursement of new therapies while the biggest risk is persistent policy-driven pricing pressure. For now, the impact of these announcements appears encouraging but not immediately transformational to core earnings drivers.

The conditional approval of LYVDELZI in Canada for primary biliary cholangitis stands out as a substantial recent development. With up to 40 percent of patients not responding to standard therapy, having a new option that shows significant liver biomarker and symptom improvement provides a meaningful portfolio addition. Its progress, however, is still dependent on further trials and market adoption, which represents opportunity alongside regulatory and execution risk.

Yet, consider the contrasting risk: even with innovations like Livdelzi, policy changes, such as Medicare Part D redesign, could further squeeze realized prices and threaten long-term growth, investors should be aware of the need to...

Read the full narrative on Gilead Sciences (it's free!)

Gilead Sciences' outlook estimates $32.3 billion in revenue and $10.0 billion in earnings by 2028. This reflects a 3.8% annual revenue growth rate and a $3.7 billion increase in earnings from the current $6.3 billion level.

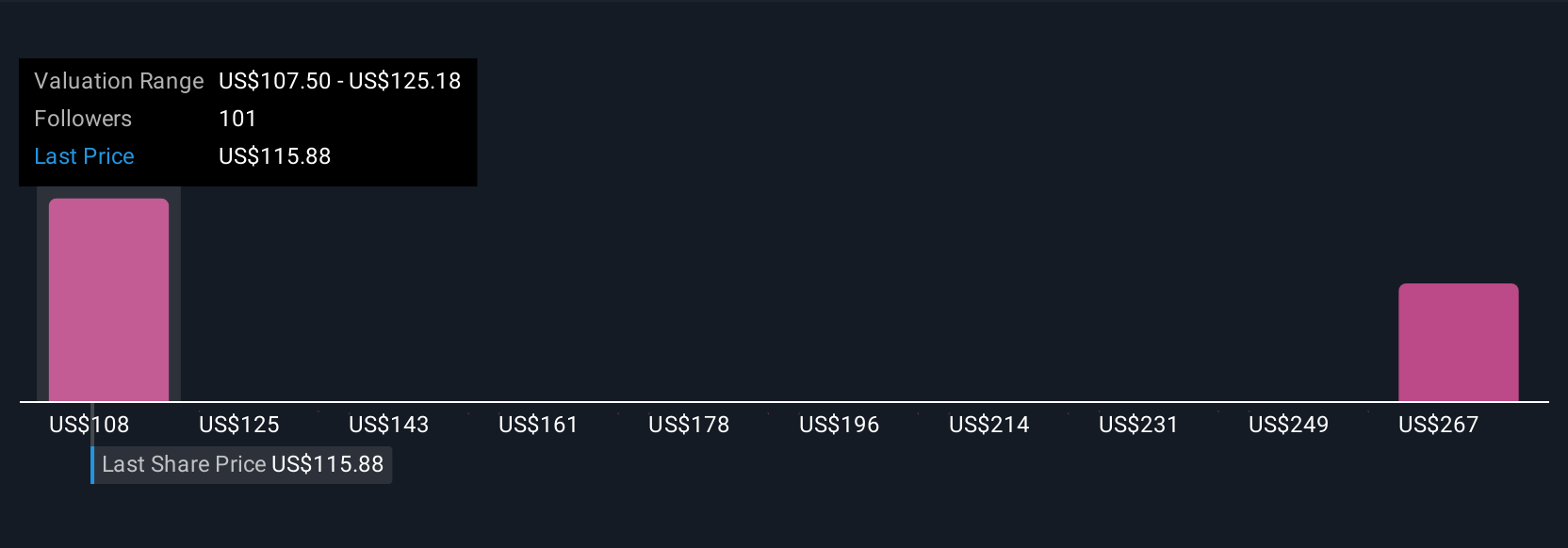

Uncover how Gilead Sciences' forecasts yield a $127.23 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Some of the highest analyst forecasts, expecting Gilead’s annual revenue to reach US$33.9 billion and profit margins approaching 32 percent, call out the optimism for rapid expansion through launches like Trodelvy and lenacapavir. This contrasts with more moderate views, showing that opinions can widely differ and that new clinical data or pricing trends could quickly shift these expectations. Explore how perspectives may change as events unfold.

Explore 11 other fair value estimates on Gilead Sciences - why the stock might be worth 20% less than the current price!

Build Your Own Gilead Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gilead Sciences research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gilead Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gilead Sciences' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives