- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Is Gilead’s (GILD) Positive Phase 3 HIV Regimen Data Shaping Its Long-Term Innovation Story?

Reviewed by Sasha Jovanovic

- Gilead Sciences recently announced positive topline results from the Phase 3 ARTISTRY-1 trial, showing that its investigational single-tablet HIV regimen of bictegravir/lenacapavir (BIC/LEN) was non-inferior to existing complex antiretroviral therapies and generally well tolerated with no significant safety concerns.

- This finding highlights Gilead's progress in addressing the needs of people with HIV who have comorbidities and require simpler medication regimens, underlining the company’s ongoing efforts to expand advanced treatment options.

- We will now explore how Gilead’s Phase 3 HIV regimen results may strengthen its long-term investment narrative, particularly in portfolio innovation.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Gilead Sciences Investment Narrative Recap

To be a Gilead Sciences shareholder, you need to believe in the company's ability to defend and expand its core position in HIV therapies while successfully launching next-generation treatments that support portfolio growth and long-term earnings. The positive ARTISTRY-1 trial results for its new single-tablet HIV regimen are an incremental boost to the innovation story, but do not materially change the most important short-term catalyst, which remains evidence of rapid commercial uptake or regulatory progress for new portfolio additions. The biggest current risk still centers on policy and pricing headwinds that could limit Gilead’s ability to sustain revenue growth despite product pipeline momentum.

Of Gilead’s recent announcements, the steady progress of Livdelzi for primary biliary cholangitis stands out in context. While unrelated to the HIV franchise, Livdelzi’s growing clinical evidence showcases Gilead’s continued pipeline diversification. Successful development and adoption outside of HIV remain crucial catalysts for reducing earnings concentration risk, especially as pricing uncertainty and competitive pressures shape long-term prospects for its leading antiviral portfolio.

However, investors should also be aware that, despite robust trial results, success in one area does not offset the complexities of future regulatory-driven price controls, which may limit...

Read the full narrative on Gilead Sciences (it's free!)

Gilead Sciences' outlook anticipates $32.3 billion in revenue and $10.0 billion in earnings by 2028. This scenario is based on a projected 3.8% annual revenue growth rate and a $3.7 billion increase in earnings from the current level of $6.3 billion.

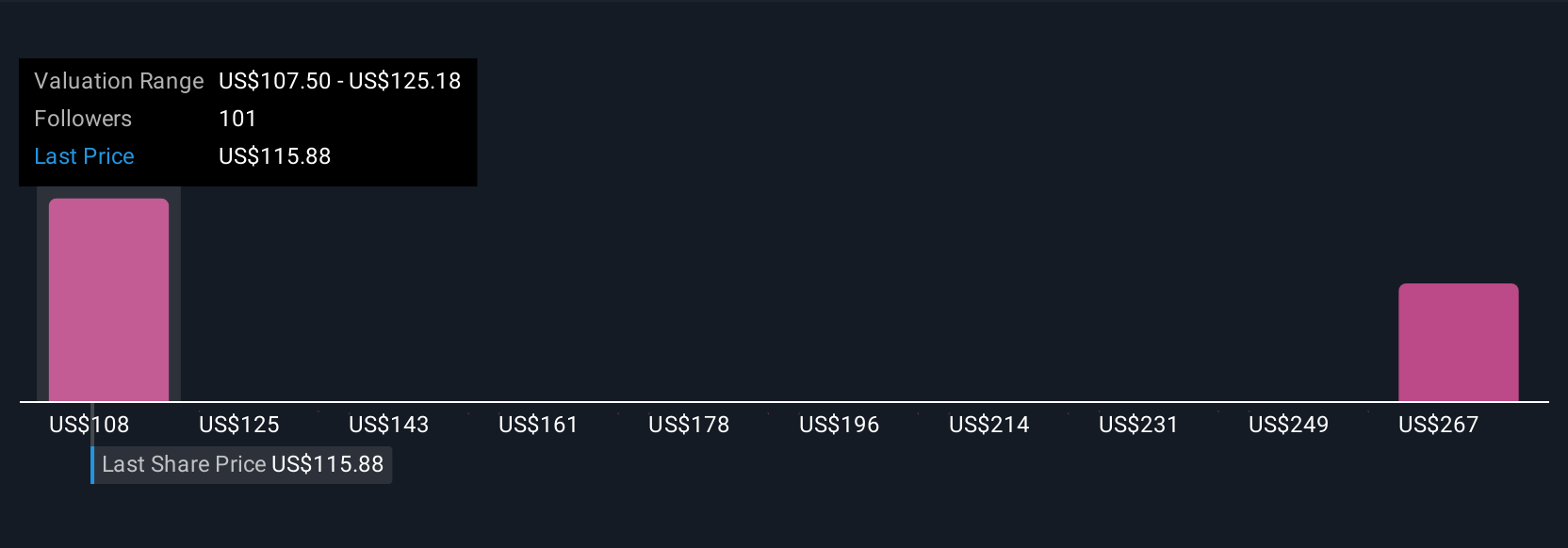

Uncover how Gilead Sciences' forecasts yield a $129.51 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Some analysts are much more optimistic, forecasting Gilead's revenue at US$33.9 billion and earnings of US$10.8 billion by 2028. The most bullish call out faster growth from new launches and less risk from pricing pressures. Depending on your outlook, you may see the recent news as potentially supporting or challenging these higher targets, so it’s helpful to compare both perspectives before making assumptions.

Explore 11 other fair value estimates on Gilead Sciences - why the stock might be worth 23% less than the current price!

Build Your Own Gilead Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gilead Sciences research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gilead Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gilead Sciences' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives