- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Is Gilead Worth a Closer Look After Shares Jumped 39% This Year?

Reviewed by Bailey Pemberton

- Wondering if Gilead Sciences is actually a bargain or overpriced right now? You are not alone, especially with so much chatter about the company's future outlook.

- Gilead's share price has been on the move, up nearly 39% so far this year and an impressive 42% over the last 12 months, even after some modest pullbacks in the past week.

- Recent headlines have zeroed in on advancements in Gilead's antiviral pipeline, as well as ongoing partnerships in oncology, fueling optimism about future growth. At the same time, regulatory developments and evolving market sentiment have added some volatility, offering both risk and opportunity for current and prospective investors.

- Currently, Gilead Sciences scores a 4 out of 6 on our quick valuation check, signaling areas of potential value but also a few caution flags. Up next, we will break down the standard valuation methods, and stay tuned for an even smarter way to think about what Gilead is truly worth.

Approach 1: Gilead Sciences Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those amounts back to today's terms. This method helps assess the present worth of Gilead Sciences' future cash-generating potential.

For Gilead Sciences, the latest reported Free Cash Flow is $9.1 Billion. Analysts provide projections for the next five years, with estimates continuing beyond that through a reasonable growth extrapolation. According to the forecasts, Gilead's Free Cash Flow could reach approximately $14.3 Billion by 2029. The cash flow trend remains positive, reflecting solid underlying business performance and ongoing growth expectations in the next decade, as supported by both analyst and model projections.

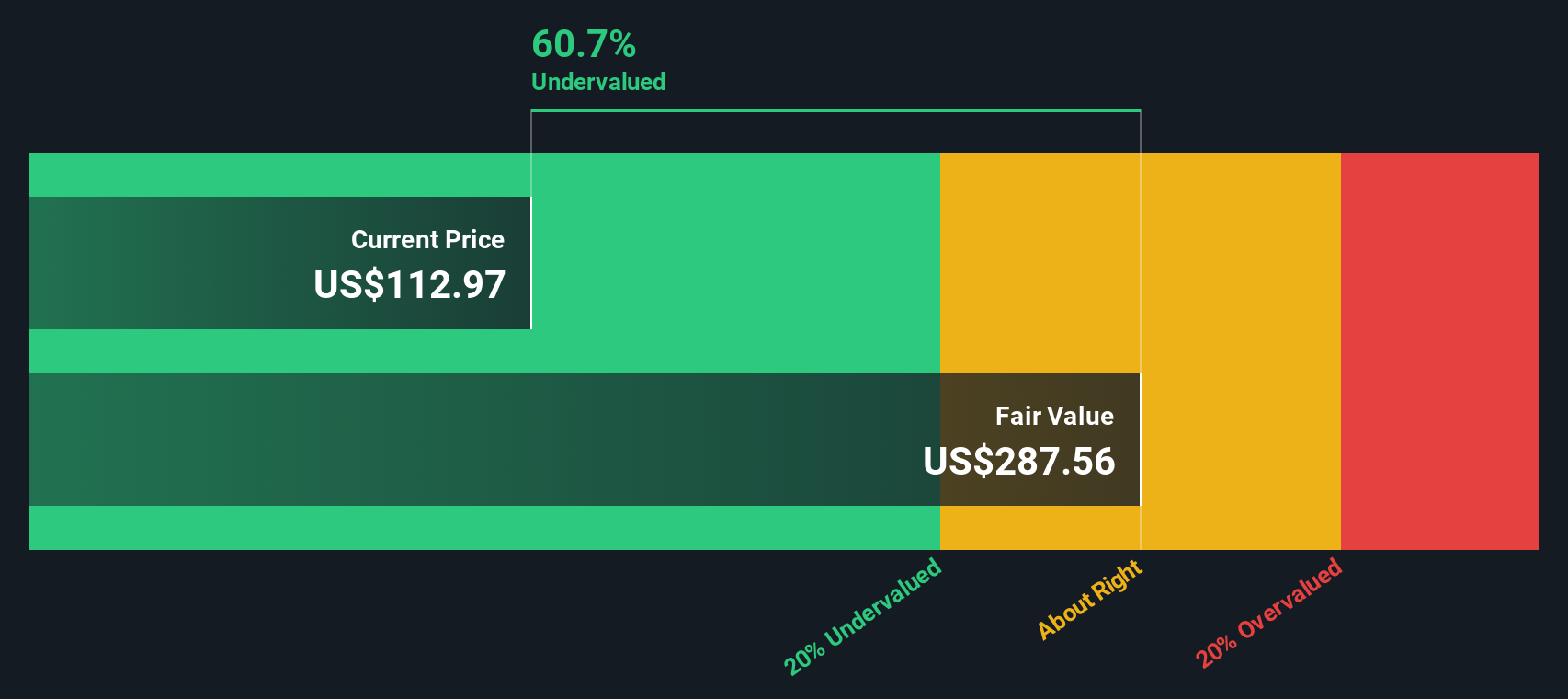

Based on this model, the resulting intrinsic value for Gilead Sciences comes out to $262.41 per share. The current share price represents a substantial 51.4% discount to this estimated fair value. As a result, the DCF analysis indicates that Gilead may be significantly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gilead Sciences is undervalued by 51.4%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Gilead Sciences Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it directly reflects what the market is willing to pay for each dollar of current earnings. For investors, the PE ratio offers a quick way to judge if a stock looks expensive or cheap compared to its profits.

What counts as a “normal” PE ratio depends heavily on expectations for a company’s growth, its risk level, and broader market sentiment. Typically, companies with faster growth, more stable earnings, and lower risk command higher PE ratios. Those with slower growth or more uncertainty tend to trade at lower multiples.

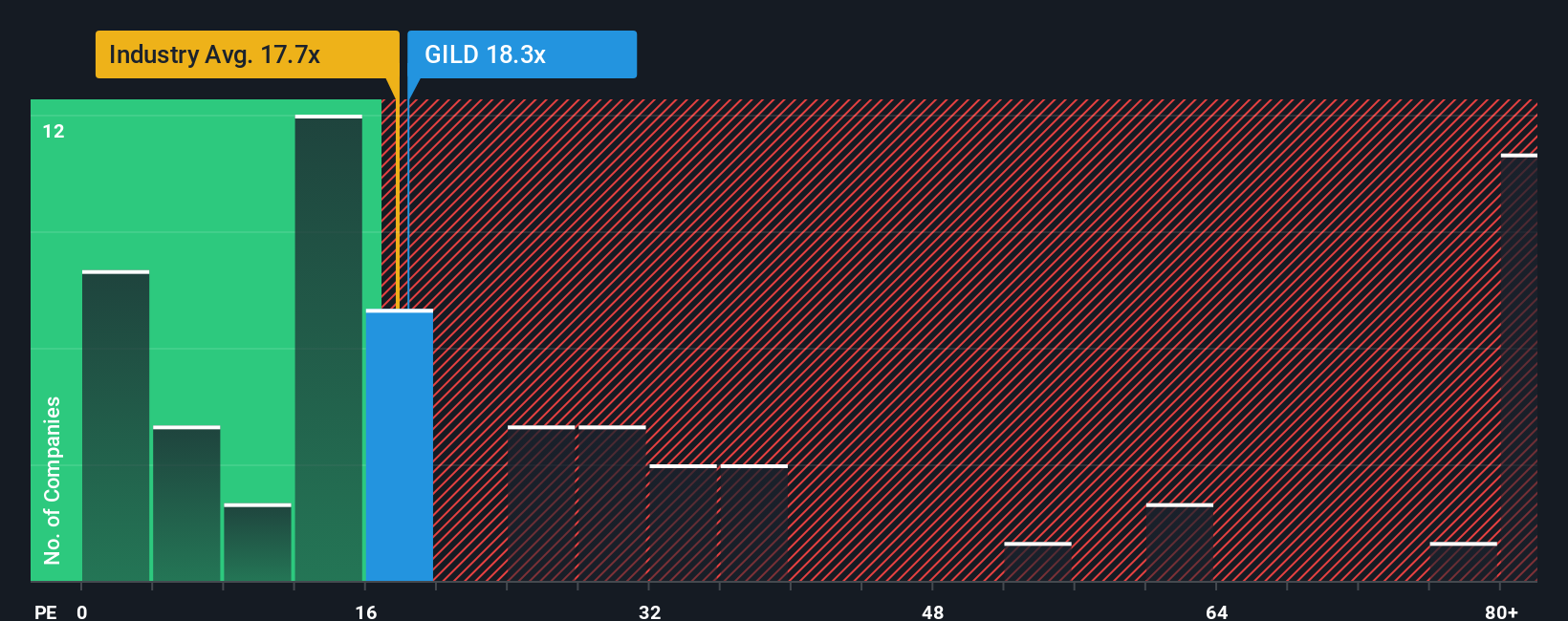

As of now, Gilead Sciences trades at a PE ratio of 19.5x. This is just above the average for the Biotechs industry, which is 19.1x. However, it stands far below the peer group average of 61.3x. This suggests that while Gilead is in line with its overall sector, it is priced much more conservatively than some direct competitors.

Simply Wall St’s proprietary “Fair Ratio” for Gilead is 26.6x. This custom metric is designed to account for elements that can move a multiple up or down, such as expected earnings growth, company size, profitability, and any specific risks. By using the Fair Ratio, investors get a more complete sense of what would be an appropriate valuation for Gilead, rather than simply relying on broad industry comparisons that may not suit the company’s unique circumstances.

Comparing Gilead’s current PE of 19.5x to the Fair Ratio of 26.6x, the shares trade well below what would be expected based on these fundamentals. This points to a stock that may be undervalued by the market using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gilead Sciences Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce Narratives. A Narrative is a simple tool that lets you explore an investment story behind the numbers, connecting your assumptions about Gilead Sciences’ future revenue, margins, and fair value into a unified financial outlook.

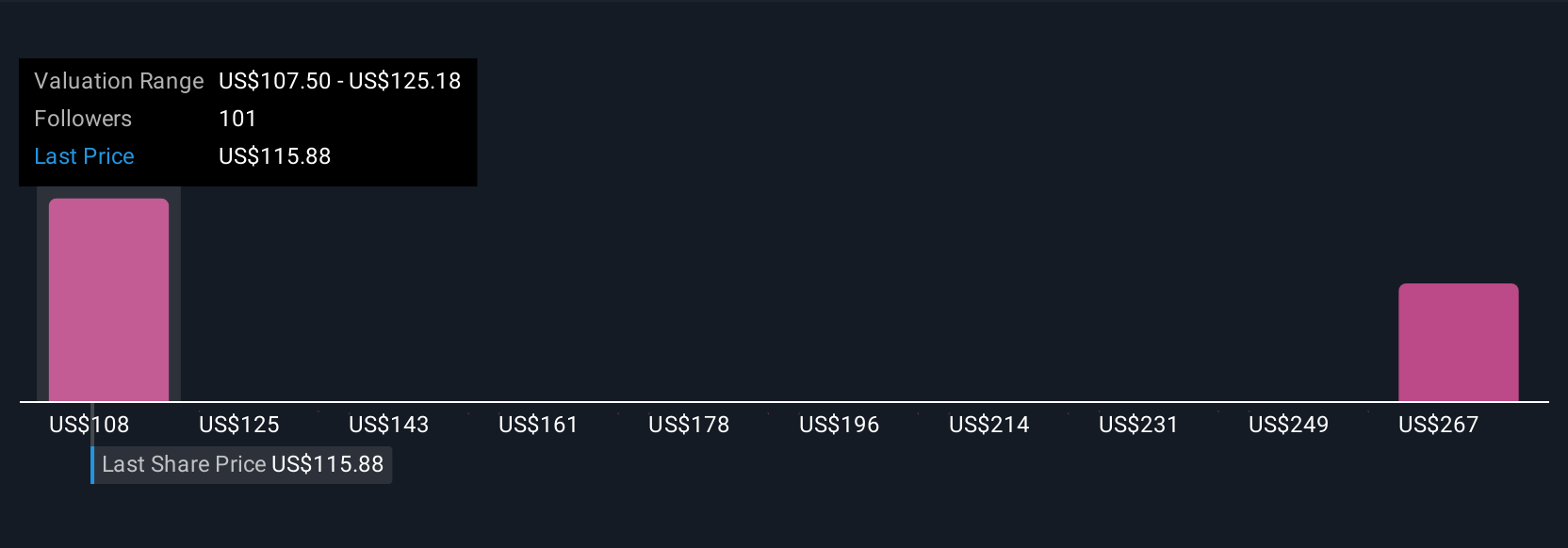

Instead of just comparing ratios, Narratives let you link your view of the company’s prospects to a complete set of forecasts and see what that means for Gilead’s fair value. You can build your own Narrative or explore others at any time on Simply Wall St’s Community page, where millions of investors share perspectives and discuss the factors that really matter.

With Narratives, you can easily decide when Gilead appears attractive by comparing the Fair Value from your Narrative to the current market price, and see in real time how the story changes as new earnings or news are released. For example, some investors see Gilead’s fair value as high as $140 based on optimism about HIV growth and new product launches, while others are more cautious and estimate it closer to $91 due to policy and innovation risks.

Do you think there's more to the story for Gilead Sciences? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success