- United States

- /

- Life Sciences

- /

- NasdaqGS:FTRE

Fortrea Holdings (FTRE) Losses Deepen 52.8% Annually, Undervaluation Sparks Value Debate

Reviewed by Simply Wall St

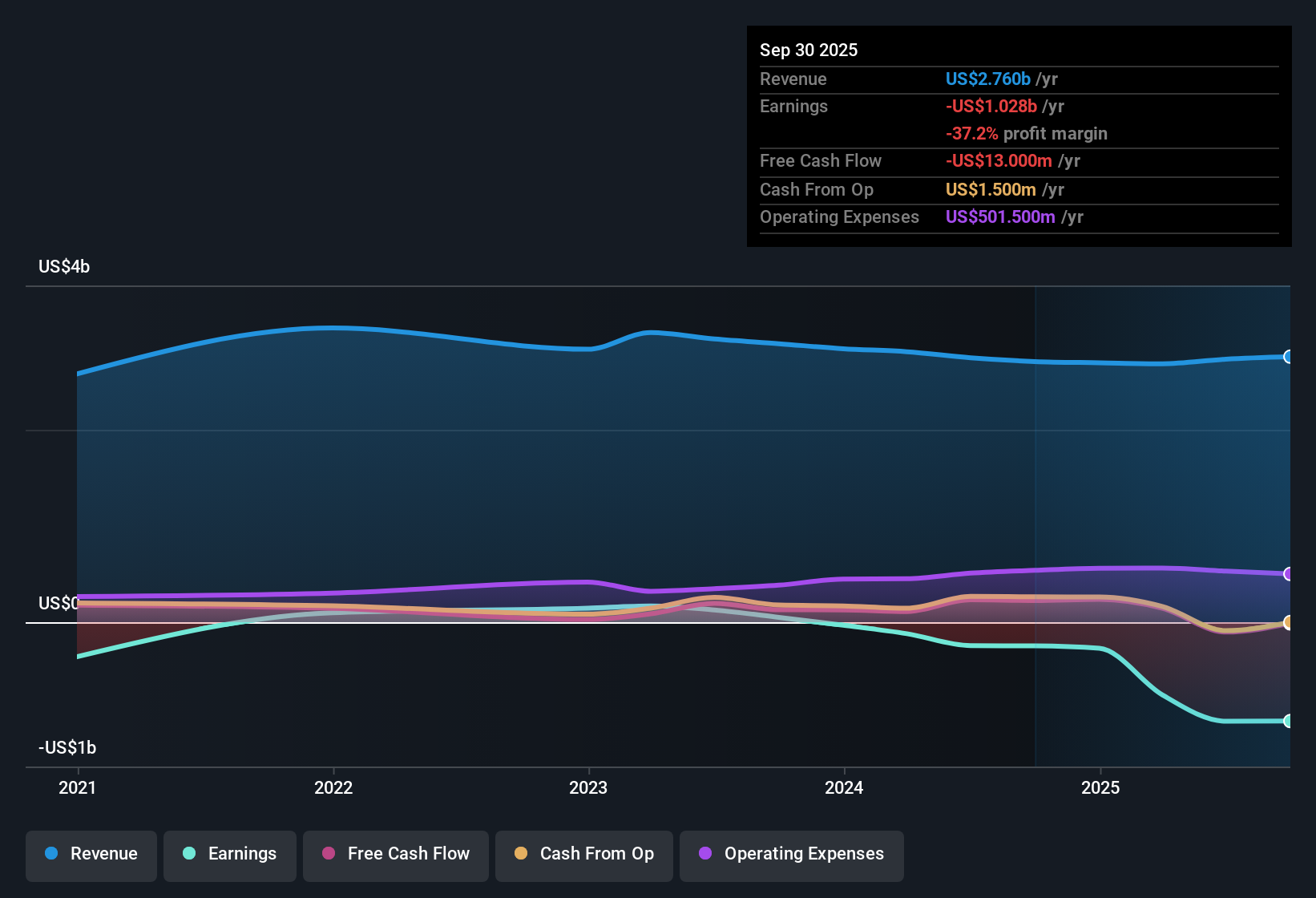

Fortrea Holdings (FTRE) remains unprofitable, with losses accelerating at a 52.8% annual rate over the past five years. Looking ahead, analysts expect the company to stay in the red for at least three more years, while revenue growth is projected at just 2.4% per year, lagging the US market’s 10.5%. Despite trading at a Price-to-Sales Ratio of 0.4x, which is well below industry and peer averages, the current share price of $11.95 sits significantly under the estimated fair value of $18.73 based on discounted cash flow models. For investors attracted by deep relative value, FTRE’s discounted multiples offer a potential opportunity; however, ongoing profitability and growth headwinds are weighing on sentiment.

See our full analysis for Fortrea Holdings.Next up, we’ll look at how the latest figures compare to the core narratives driving investor discussion, highlighting where perspectives diverge and what might come next for Fortrea Holdings.

See what the community is saying about Fortrea Holdings

Margin Expansion Hinges on AI Investments

- Consensus narrative notes that Fortrea’s AI-driven software investments, including the Accelerate platform's Risk Radar, are expected to create operational efficiencies and wider EBITDA margins in the coming years. This comes even as annual revenue is projected to decline slightly by 0.1% over the next three years.

- According to analysts' consensus view, these tech upgrades could offset the flat revenue outlook by boosting margins. This challenges doubts about near-term profitability and raises hopes for long-term earnings improvement.

- However, projected revenue stagnation means AI-led margin gains will need to be substantial in order to deliver the sustainable growth that bulls are anticipating.

High Customer Concentration Adds Revenue Risk

- Customer concentration is material. Fortrea derives 59% of its revenues from its top 10 customers, with the largest client accounting for 13.2%. This amplifies the risk should one or more major clients reduce spending or leave.

- Analysts' consensus view highlights that this elevated dependency makes future revenue less predictable, especially as industry competition heats up and new business wins in biotech remain sluggish.

- This dynamic challenges the notion of stable, recurring growth, even as demographic and R&D trends support the broader outsourcing thesis for contract research organizations.

DCF Fair Value Sits Well Above Market Price

- Fortrea’s current share price of $11.95 trades at a significant discount to its DCF fair value of $18.73. Its 0.4x Price-to-Sales ratio is far below the US Life Sciences industry average of 3.4x and the peer average of 4.2x.

- From the analysts' consensus perspective, the magnitude of this valuation gap suggests investors are heavily discounting ongoing losses and growth risks. It also means that any surprise in profitability or margin expansion could drive a sharp market rerating.

- The low Price-to-Sales ratio signals that pessimism around profitability and revenue durability has dominated market sentiment. Reversible factors like operational efficiency improvements could change that calculus quickly.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fortrea Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from a unique angle? Set your insights in motion by building your own narrative in just a few minutes. Do it your way

A great starting point for your Fortrea Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Fortrea Holdings faces challenges including slowing revenue growth, steep ongoing losses, and unpredictable earnings that add risk to long-term returns.

If you want more predictable growth and steadier results, focus on stable growth stocks screener (2074 results) to discover companies that consistently deliver expanding sales and profits through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTRE

Fortrea Holdings

A contract research organization, provides biopharmaceutical product and medical device development solutions to pharmaceutical, biotechnology, and medical device customers worldwide.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives