- United States

- /

- Biotech

- /

- NasdaqGM:FOLD

The Amicus Therapeutics (NASDAQ:FOLD) Share Price Has Soared 388%, Delighting Many Shareholders

It might be of some concern to shareholders to see the Amicus Therapeutics, Inc. (NASDAQ:FOLD) share price down 11% in the last month. But that doesn't undermine the fantastic longer term performance (measured over five years). In fact, during that period, the share price climbed 388%. Impressive! Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Amicus Therapeutics

Amicus Therapeutics isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, Amicus Therapeutics can boast revenue growth at a rate of 66% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 37% per year in that time. It's never too late to start following a top notch stock like Amicus Therapeutics, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

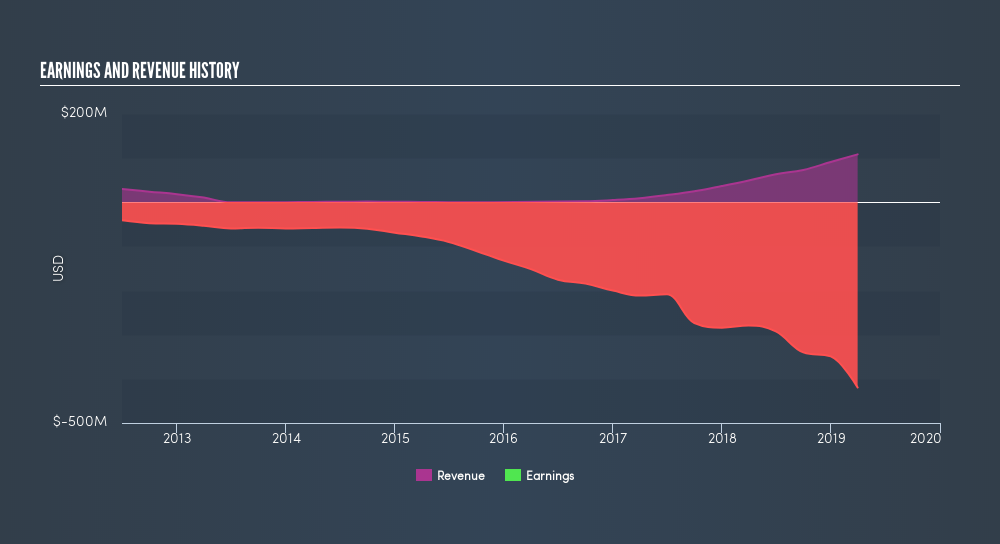

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 5.1% in the last year, Amicus Therapeutics shareholders lost 26%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 37% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:FOLD

Amicus Therapeutics

A biotechnology company, focuses on discovering, developing, and delivering novel medicines for rare diseases in the United States and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives