- United States

- /

- Biotech

- /

- NasdaqGM:FOLD

How Executive Share Sales and Strong Q3 Results at Amicus Therapeutics (FOLD) Have Altered Its Investment Story

Reviewed by Sasha Jovanovic

- In the past week, multiple executives at Amicus Therapeutics, including the CEO, Chief People Officer, Chief Legal Officer, and Chief Development Officer, sold shares under pre-arranged trading plans.

- These transactions coincided with Amicus Therapeutics reporting third-quarter 2025 financial results that surpassed analyst expectations, driven by higher-than-anticipated sales of its rare disease treatments Galafold and Pombiliti/Opfolda.

- We’ll examine how the company’s stronger-than-expected earnings, fueled by robust product sales, affect its investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Amicus Therapeutics Investment Narrative Recap

To own shares of Amicus Therapeutics, investors need confidence in its ability to grow sales of its rare disease treatments Galafold and Pombiliti/Opfolda, sustain profitability, and successfully expand its pipeline. Insider share sales by several executives last week occurred alongside the company’s strong third-quarter performance and do not materially impact the main near-term catalyst, which remains the pace of market adoption for its core products. The concentration of revenue in just a few therapies is still a key risk for the business.

The most relevant recent announcement is Amicus’s third-quarter 2025 financial results, which showed a return to profitability with EPS of US$0.06 on revenue of US$169.1 million. This update highlighted the critical role that accelerating sales of Galafold and Pombiliti/Opfolda play in driving financial results and supporting Amicus’s expectation for continued growth and profitability. These products underpin the company’s investment thesis while reinforcing the importance of broadening its portfolio.

Yet, despite positive financial momentum, investors should be aware that any interruption in the uptake or competitive positioning of Galafold and Pombiliti/Opfolda could...

Read the full narrative on Amicus Therapeutics (it's free!)

Amicus Therapeutics' outlook forecasts $995.5 million in revenue and $234.9 million in earnings by 2028. This implies annual revenue growth of 20.3% and an earnings increase of $273 million from the current earnings of -$38.1 million.

Uncover how Amicus Therapeutics' forecasts yield a $15.60 fair value, a 57% upside to its current price.

Exploring Other Perspectives

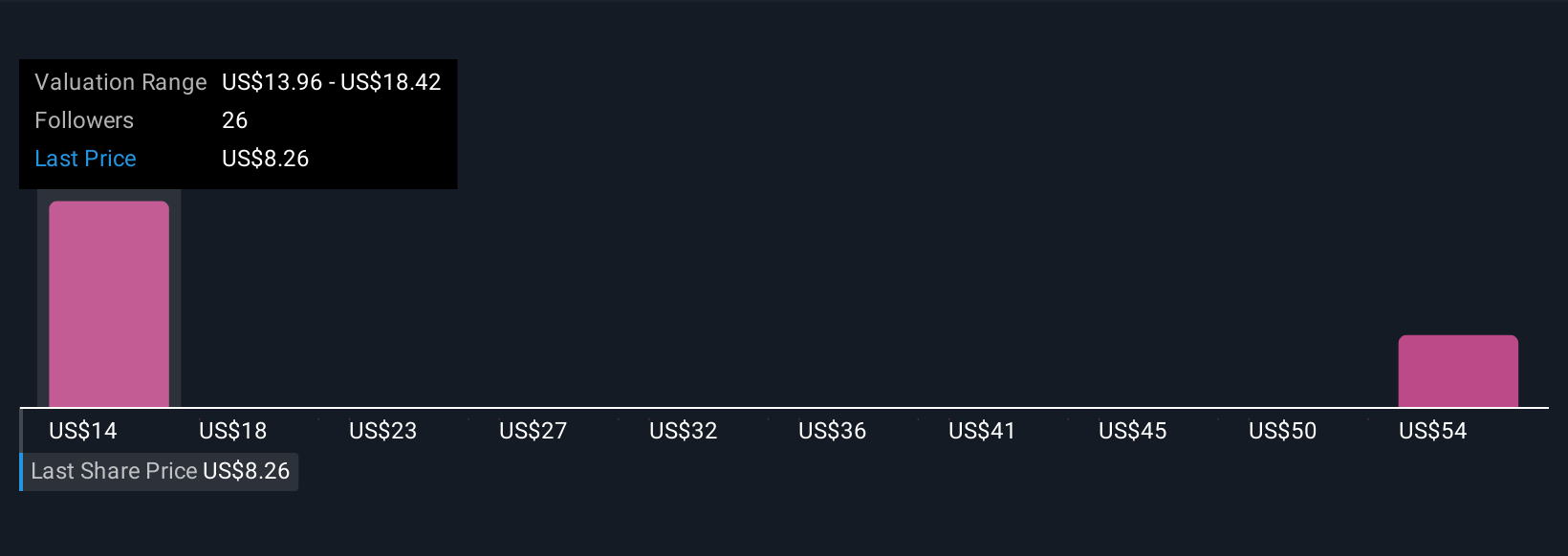

Private investors in the Simply Wall St Community estimate Amicus’s fair value between US$13.96 and US$54.29 across four distinct views. Market concentration in just two key therapies remains a crucial consideration and is reflected in these wide-ranging opinions on future performance.

Explore 4 other fair value estimates on Amicus Therapeutics - why the stock might be worth just $13.96!

Build Your Own Amicus Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amicus Therapeutics research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Amicus Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amicus Therapeutics' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FOLD

Amicus Therapeutics

A biotechnology company, focuses on discovering, developing, and delivering novel medicines for rare diseases in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026