- United States

- /

- Biotech

- /

- NasdaqGM:FOLD

Amicus Therapeutics, Inc. Full-Year Results Just Came Out: Here's What Analysts Are Forecasting For Next Year

Last week, you might have seen that Amicus Therapeutics, Inc. (NASDAQ:FOLD) released its annual result to the market. The early response was not positive, with shares down 7.2% to US$9.14 in the past week. Sales hit US$182m in line with forecasts, although the company reported a statutory loss per share of US$1.48 that was somewhat smaller than analysts expected. Analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what analysts' statutory forecasts suggest is in store for next year.

See our latest analysis for Amicus Therapeutics

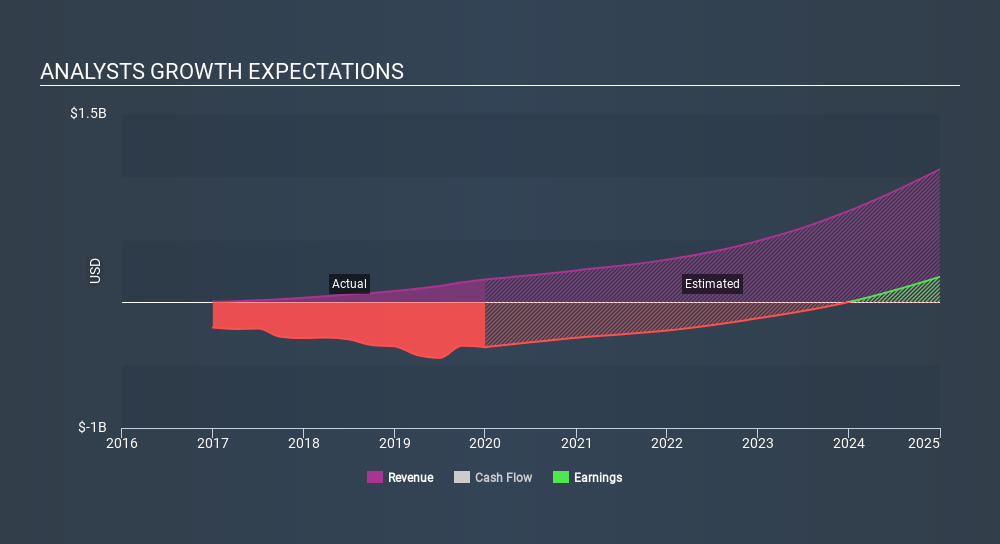

Following the latest results, Amicus Therapeutics's ten analysts are now forecasting revenues of US$254.9m in 2020. This would be a major 40% improvement in sales compared to the last 12 months. Statutory losses are forecast to balloon 27% to US$1.08 per share. Before this earnings announcement, analysts had been forecasting revenues of US$254.3m and losses of US$0.96 per share in 2020. So there's definitely been a decline in analyst sentiment after the latest results, noting the substantial drop in new EPS forecasts.

The consensus price target held steady at US$18.08, seemingly implying that the higher forecast losses are not expected to have a long term impact on the company's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Amicus Therapeutics, with the most bullish analyst valuing it at US$31.00 and the most bearish at US$10.00 per share. With such a wide range in price targets, analysts are almost certainly baking in outcomes as diverse as total success and probable failure in the underlying business. With this in mind, we wouldn't assign too much meaning to the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

It can also be useful to step back and take a broader view of how analyst forecasts compare to Amicus Therapeutics's performance in recent years. We would highlight that Amicus Therapeutics's revenue growth is expected to slow, with forecast 40% increase next year well below the historical 62%p.a. growth over the last five years. By way of comparison, other companies in this market with analyst coverage, are forecast to grow their revenue at 16% next year. Even after the forecast slowdown in growth, it seems obvious that analysts still thinkAmicus Therapeutics will grow faster than the wider market.

The Bottom Line

The most obvious conclusion is that analysts made no changes to their forecasts for a loss next year. Fortunately, analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - and our data does suggest that Amicus Therapeutics's revenues are expected to grow faster than the wider market. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Amicus Therapeutics analysts - going out to 2024, and you can see them free on our platform here.

You can also see our analysis of Amicus Therapeutics's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:FOLD

Amicus Therapeutics

A biotechnology company, focuses on discovering, developing, and delivering novel medicines for rare diseases in the United States and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives