- United States

- /

- Biotech

- /

- NasdaqGS:EXEL

Could Exelixis (EXEL) Pipeline Progress Signal a Turning Point for Revenue Diversification?

Reviewed by Sasha Jovanovic

- Exelixis recently announced detailed results from its pivotal phase 3 STELLAR-303 trial, showing that the investigational therapy zanzalintinib combined with atezolizumab reduced the risk of death by 20% compared to regorafenib in previously treated non-MSI-high metastatic colorectal cancer patients.

- This outcome highlights the growing clinical relevance of Exelixis's pipeline in hard-to-treat cancers and could shape perceptions of future revenue diversification beyond its current portfolio.

- We'll explore how the positive STELLAR-303 trial findings for zanzalintinib may strengthen Exelixis's investment narrative around pipeline diversification and long-term growth.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Exelixis Investment Narrative Recap

Owning Exelixis means believing the company can move beyond its heavy reliance on CABOMETYX by successfully commercializing a next wave of pipeline assets. The recent positive STELLAR-303 results for zanzalintinib are a meaningful step forward, but the company’s most important short-term catalyst remains additional pivotal trial readouts, while concentration risk in CABOMETYX is still the central business concern and is only modestly reduced by this update.

Aside from the STELLAR-303 trial, the recent regulatory progress for CABOMETYX in neuroendocrine tumors, both FDA and European approvals, carries weight for near-term revenue and offers timely support for the ongoing diversification effort. However, the central issue of market dependence on CABOMETYX for over 90% of Exelixis’ revenues still overshadows even the most upbeat pipeline news, and careful attention to exclusivity and competition remains essential.

In contrast, while new clinical successes spark optimism, the reality of concentrated product risk is something investors should...

Read the full narrative on Exelixis (it's free!)

Exelixis' narrative projects $3.1 billion in revenue and $1.1 billion in earnings by 2028. This requires 11.7% yearly revenue growth and an $497.7 million earnings increase from the current $602.3 million.

Uncover how Exelixis' forecasts yield a $44.06 fair value, a 10% upside to its current price.

Exploring Other Perspectives

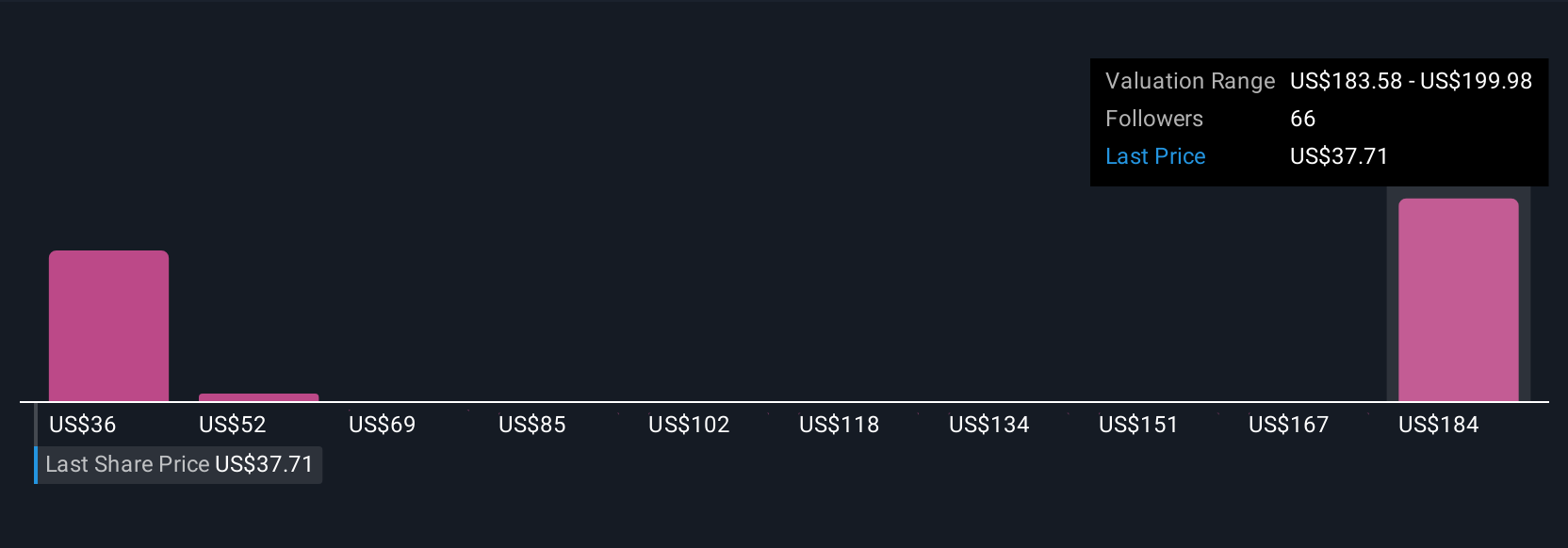

Simply Wall St Community members provided 11 fair value estimates for Exelixis ranging widely from US$36 to US$195, with several in the upper ranges. Even with pipeline breakthroughs, ongoing product concentration remains a key consideration for your view on the company’s next phase.

Explore 11 other fair value estimates on Exelixis - why the stock might be worth over 4x more than the current price!

Build Your Own Exelixis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exelixis research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Exelixis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exelixis' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelixis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXEL

Exelixis

An oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives