- United States

- /

- Biotech

- /

- NasdaqCM:EXAS

How Investors May Respond To Exact Sciences (EXAS) Launching Cancerguard Multi-Cancer Blood Test

Reviewed by Sasha Jovanovic

- In October 2025, Exact Sciences presented research at the American College of Gastroenterology Annual Scientific Meeting and announced the US launch of Cancerguard, a blood test for early cancer detection covering more than 50 cancer types.

- The unveiling of Cancerguard expands Exact Sciences' diagnostic portfolio, signaling a meaningful advance in multi-cancer early detection capabilities.

- We'll examine how the launch of Cancerguard may increase growth potential in Exact Sciences' long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Exact Sciences Investment Narrative Recap

To believe in Exact Sciences as a shareholder, you need confidence that its innovations in early cancer detection, such as blood-based testing, can help it secure consistent revenue growth, control costs, and broaden its market reach beyond Cologuard. The US launch of Cancerguard increases growth potential for the long term, but its immediate impact does not remove key near-term risks, particularly the heavy dependence on Cologuard and uncertainties about reimbursement and adoption for new tests.

Among recent company news, Cancerguard’s launch and the positive clinical research presented at the American College of Gastroenterology meeting stand out. These reinforce Exact’s multi-cancer early detection ambitions and could help diversify its revenue base, though questions remain about real-world clinical utility, competition, and payer adoption as key short-term catalysts.

However, investors should also be aware that, despite new product excitement, exposure to changing screening guidelines and reimbursement...

Read the full narrative on Exact Sciences (it's free!)

Exact Sciences' narrative projects $4.1 billion revenue and $277.2 million earnings by 2028. This requires 11.6% yearly revenue growth and a $1.28 billion increase in earnings from -$1.0 billion today.

Uncover how Exact Sciences' forecasts yield a $70.25 fair value, a 9% upside to its current price.

Exploring Other Perspectives

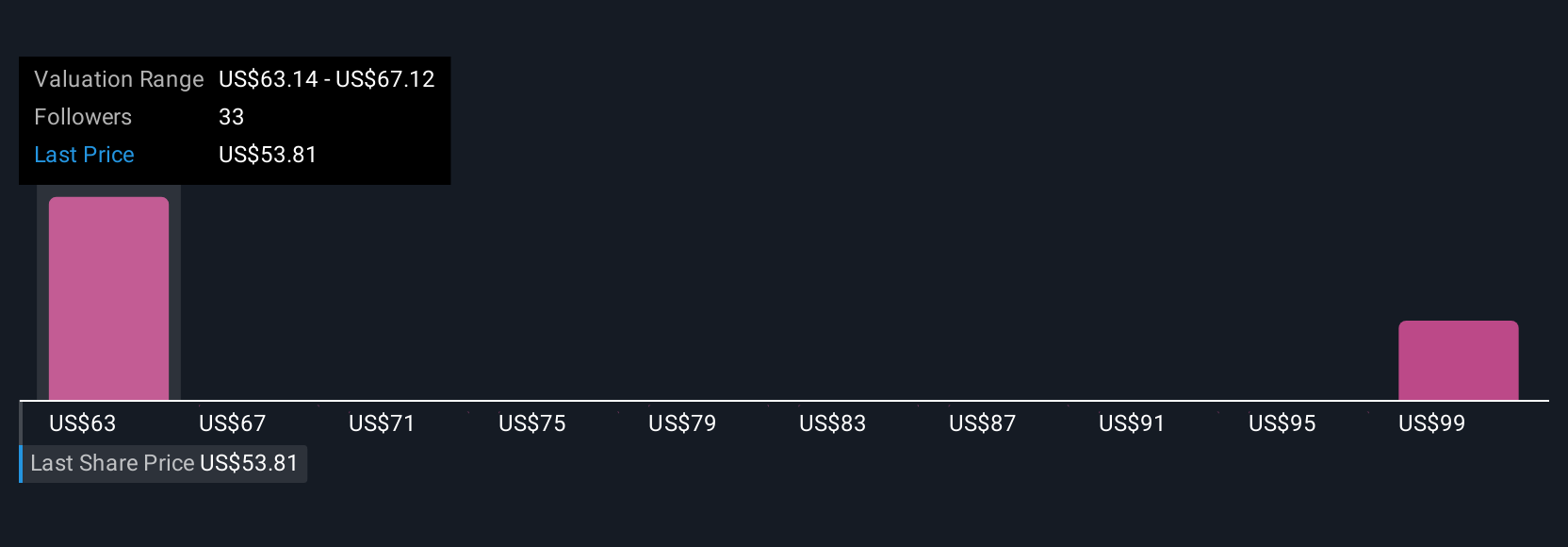

Six Simply Wall St Community members provided fair value estimates for Exact Sciences, ranging from US$70.25 to US$150.17 per share. This wide spectrum exists as questions about reimbursement and real-world adoption for new tests continue to shape expectations for sustained profit improvement.

Explore 6 other fair value estimates on Exact Sciences - why the stock might be worth over 2x more than the current price!

Build Your Own Exact Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exact Sciences research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Exact Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exact Sciences' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exact Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EXAS

Exact Sciences

Provides cancer screening and diagnostic test products in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives