- United States

- /

- Biotech

- /

- NasdaqCM:EXAS

How Investors Are Reacting To Exact Sciences (EXAS) Landmark Data on Oncoguard Liver Cancer Test

Reviewed by Sasha Jovanovic

- Earlier this month, Exact Sciences announced pivotal results from its ALTUS study showing its Oncoguard Liver blood test achieved far higher early-stage and overall detection rates for hepatocellular carcinoma compared to ultrasound, with the findings presented as late-breaking data at the AASLD's Liver Meeting on November 11, 2025.

- This outcome, from the largest real-world prospective trial of its kind in the US, highlights the Oncoguard Liver test's potential to change liver cancer surveillance for diverse high-risk populations.

- We'll now explore how this clinical advancement may shape Exact Sciences' investment narrative, especially regarding its expansion into blood-based cancer diagnostics.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Exact Sciences Investment Narrative Recap

To be a shareholder in Exact Sciences, you need to believe that expanding and validating its blood-based cancer diagnostics, like the new Oncoguard Liver results, can drive adoption beyond Cologuard, diversify revenue, and support margin improvement. While the ALTUS liver study results strengthen the company’s innovation narrative, they have limited immediate impact on the key short-term catalyst: broader payer support and guideline inclusion for blood-based cancer screening. The largest risk remains Exact’s ongoing R&D and acquisition spend, which continues to pressure earnings improvements.

The recent announcement of an exclusive license agreement for Freenome’s blood-based colorectal cancer screen ties directly to near-term catalysts, as it strengthens Exact Sciences’ position in non-invasive cancer testing. If this test receives first-line FDA approval, the company could expand its competitive footprint in CRC screening, capitalizing on growing demand for blood-based options.

By contrast, investors should be mindful of the risk that even strong clinical data may not immediately translate into payer coverage or favorable screening guideline changes, especially if...

Read the full narrative on Exact Sciences (it's free!)

Exact Sciences' outlook anticipates $4.1 billion in revenue and $277.2 million in earnings by 2028. This is based on analysts forecasting 11.6% annual revenue growth and an earnings increase of $1.3 billion from current earnings of -$1.0 billion.

Uncover how Exact Sciences' forecasts yield a $82.10 fair value, a 18% upside to its current price.

Exploring Other Perspectives

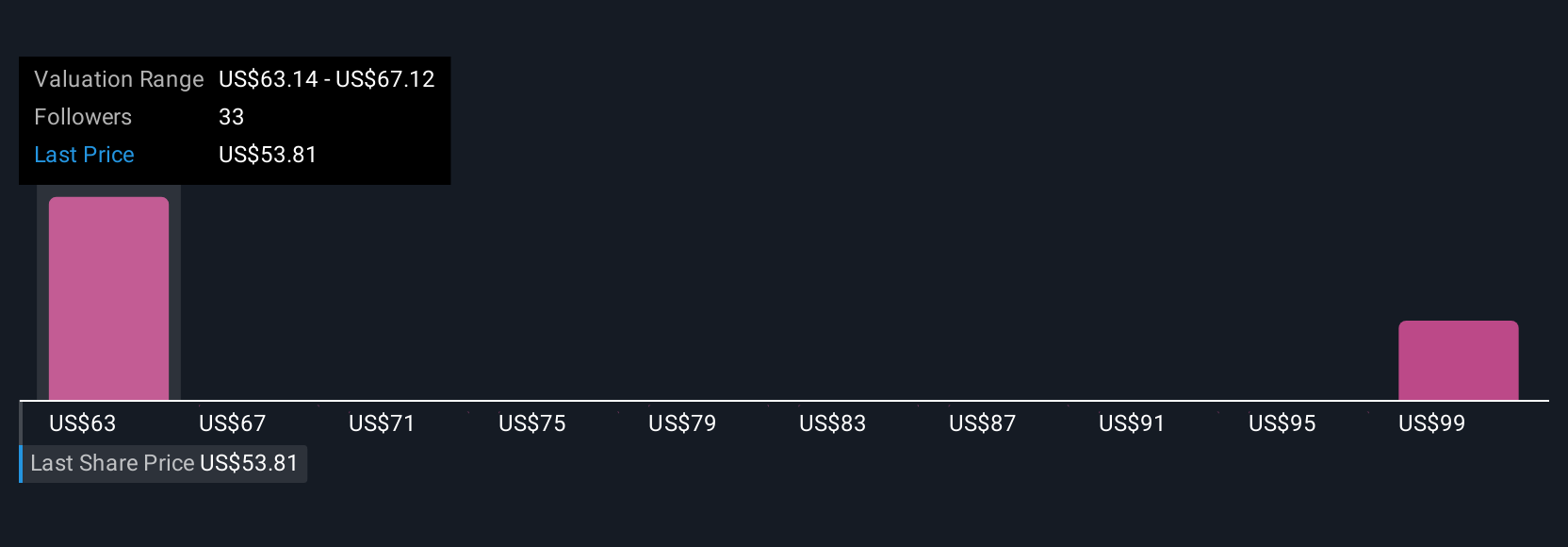

Five estimates from the Simply Wall St Community place Exact Sciences’ fair value between US$80 and US$116.82 per share. As clinical and regulatory outcomes continue to shift, your own perspective on margin pressures and payer adoption could make all the difference.

Explore 5 other fair value estimates on Exact Sciences - why the stock might be worth just $80.00!

Build Your Own Exact Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exact Sciences research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Exact Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exact Sciences' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exact Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EXAS

Exact Sciences

Provides cancer screening and diagnostic test products in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives