- United States

- /

- Biotech

- /

- NasdaqCM:EXAS

Exact Sciences Corporation's (NASDAQ:EXAS) Share Price Boosted 37% But Its Business Prospects Need A Lift Too

Despite an already strong run, Exact Sciences Corporation (NASDAQ:EXAS) shares have been powering on, with a gain of 37% in the last thirty days. The last 30 days bring the annual gain to a very sharp 64%.

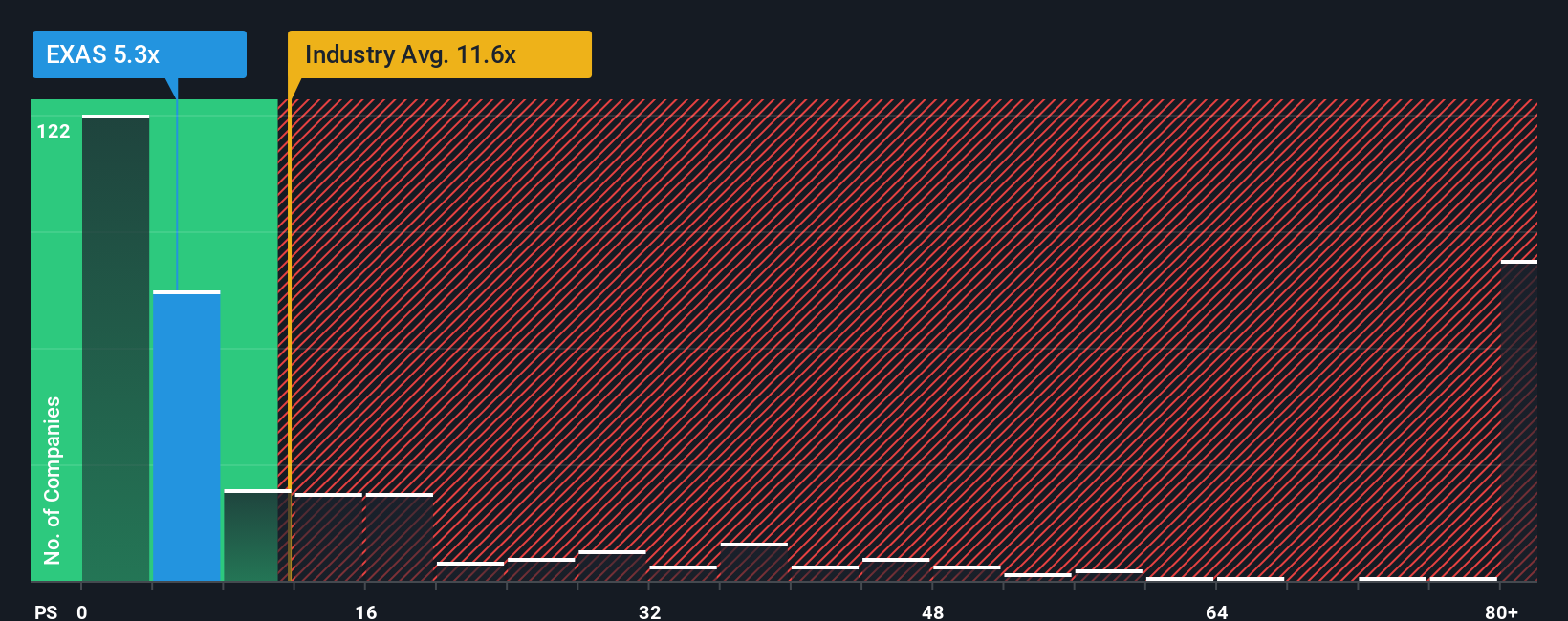

Even after such a large jump in price, Exact Sciences may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 5.3x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.6x and even P/S higher than 100x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Exact Sciences

How Exact Sciences Has Been Performing

With revenue growth that's inferior to most other companies of late, Exact Sciences has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Exact Sciences' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Exact Sciences?

The only time you'd be truly comfortable seeing a P/S as depressed as Exact Sciences' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The latest three year period has also seen an excellent 54% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 12% per annum over the next three years. That's shaping up to be materially lower than the 124% each year growth forecast for the broader industry.

With this in consideration, its clear as to why Exact Sciences' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Exact Sciences' P/S Mean For Investors?

Exact Sciences' recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Exact Sciences maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Exact Sciences with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Exact Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EXAS

Exact Sciences

Provides cancer screening and diagnostic test products in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives