- United States

- /

- Pharma

- /

- NasdaqGS:EWTX

Will Edgewise Therapeutics (EWTX) Gain a Commercial Edge With Its New Board Appointment?

Reviewed by Sasha Jovanovic

- Edgewise Therapeutics recently appointed biotechnology executive Christopher Martin to its Board of Directors, adding significant commercial leadership expertise to its ranks.

- Martin's background in guiding companies through product launches and major acquisitions signals a focus on preparing Edgewise for its own commercialization milestones.

- We'll explore how Martin's appointment shapes Edgewise's investment narrative as the company advances toward commercializing its late-stage pipeline.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Edgewise Therapeutics' Investment Narrative?

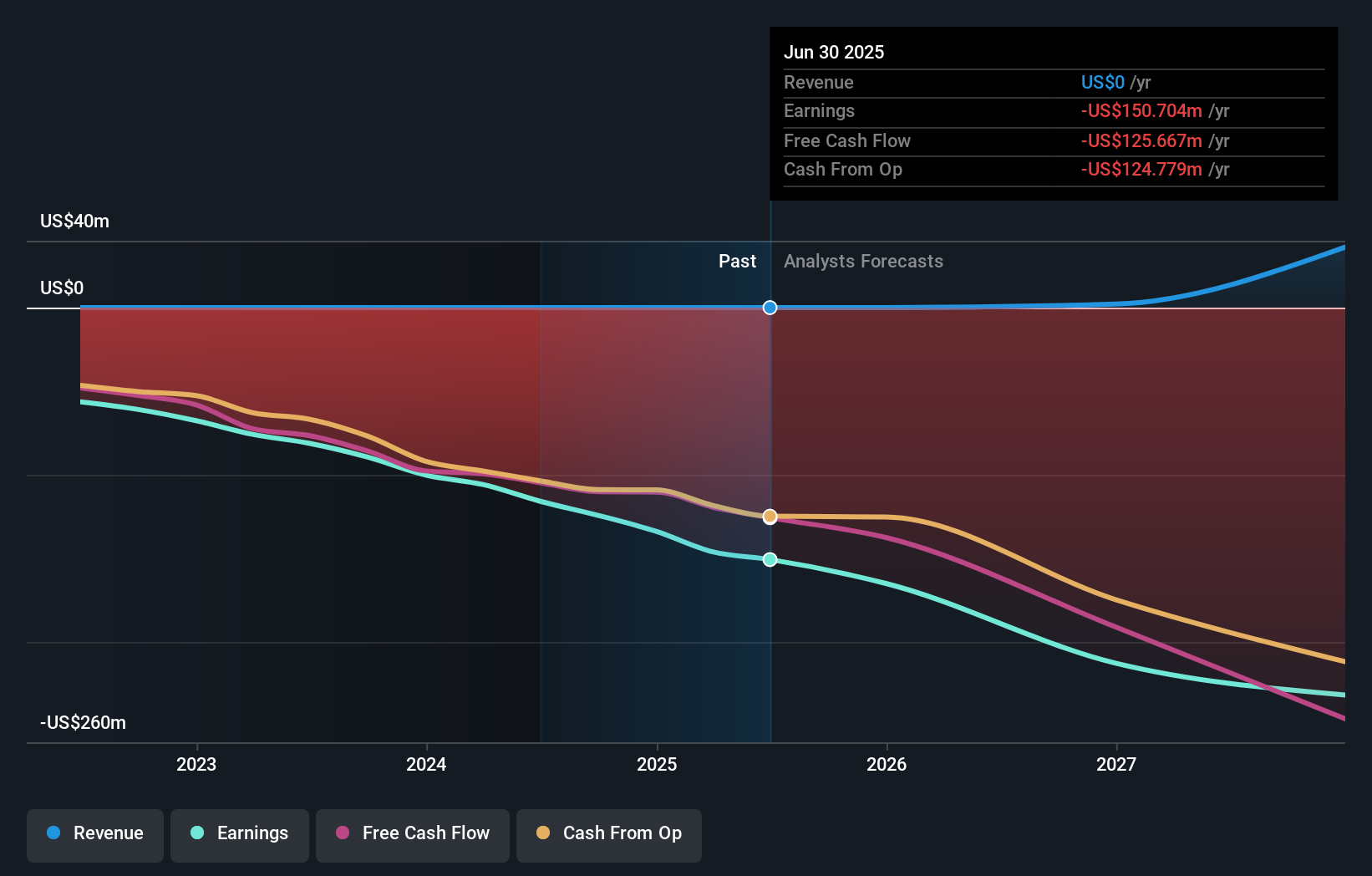

For any investor considering Edgewise Therapeutics today, the core thesis centers on the company’s ability to convert its advancing late-stage pipeline, particularly for muscular dystrophy and cardiac programs, into commercial success. The appointment of Christopher Martin to the Board stands out because his track record in product launches and big-ticket biotech acquisitions could help Edgewise address its most pressing short-term catalyst: preparing for initial commercialization with sevasemten. This is especially timely given that pivotal trial data is expected next year and groundwork must be set for launch well in advance. At the same time, the biggest risk remains the company’s ongoing losses, recent widening net loss, and a lack of revenue, all in the context of volatile share price activity. Martin’s expertise in scaling commercial operations might meaningfully mitigate execution risks, especially as Edgewise faces the operational leap from R&D to a revenue-generating business, though the fundamental hurdle of clinical and regulatory success remains. While this appointment won’t eliminate financial or trial-related uncertainties, it could shift Edgewise’s risk profile positively as the company moves closer to deciding moments for its lead candidates.

But with Edgewise's history of widening losses, that financial risk should not be overlooked. Our valuation report unveils the possibility Edgewise Therapeutics' shares may be trading at a premium.Exploring Other Perspectives

Explore another fair value estimate on Edgewise Therapeutics - why the stock might be worth as much as 72% more than the current price!

Build Your Own Edgewise Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Edgewise Therapeutics research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Edgewise Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Edgewise Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edgewise Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EWTX

Edgewise Therapeutics

A biopharmaceutical company, discovers, develops, and commercializes therapies for the treatment of muscle disorders.

Flawless balance sheet with low risk.

Market Insights

Community Narratives