- United States

- /

- Medical Equipment

- /

- NasdaqCM:SMTI

3 Growth Companies With Insider Ownership Up To 31%

Reviewed by Simply Wall St

As major stock indexes in the United States continue to reach new heights, driven by significant developments such as Nvidia's landmark $5 trillion market cap and anticipation around Federal Reserve decisions, investors are keenly watching for growth opportunities. In this buoyant market environment, identifying growth companies with substantial insider ownership can provide insights into potential confidence from those closest to the company.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 122.7% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11% | 30.4% |

| Celsius Holdings (CELH) | 10.8% | 31.6% |

| Atour Lifestyle Holdings (ATAT) | 18.3% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| AppLovin (APP) | 27.5% | 25.7% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Underneath we present a selection of stocks filtered out by our screen.

Sanara MedTech (SMTI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sanara MedTech Inc. is a medical technology company that develops, markets, and distributes surgical, wound, and skincare products and services to healthcare providers in the United States with a market cap of $271.48 million.

Operations: The company's revenue is primarily derived from its Sanara Surgical segment, which generated $97.22 million.

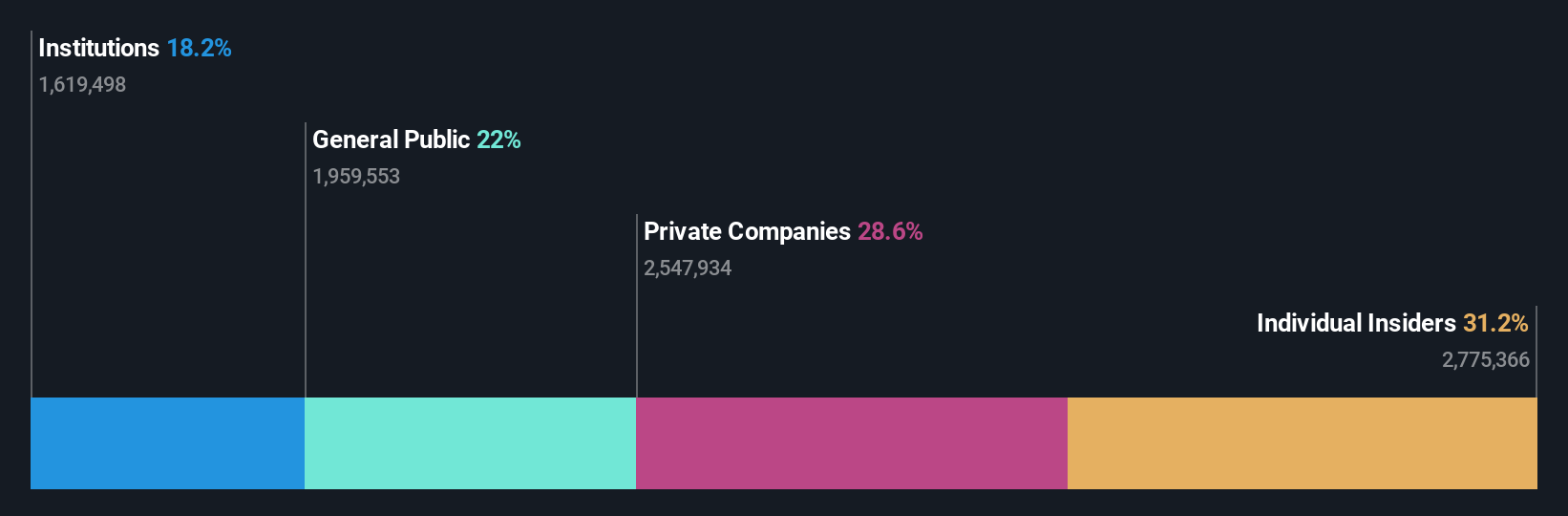

Insider Ownership: 31.2%

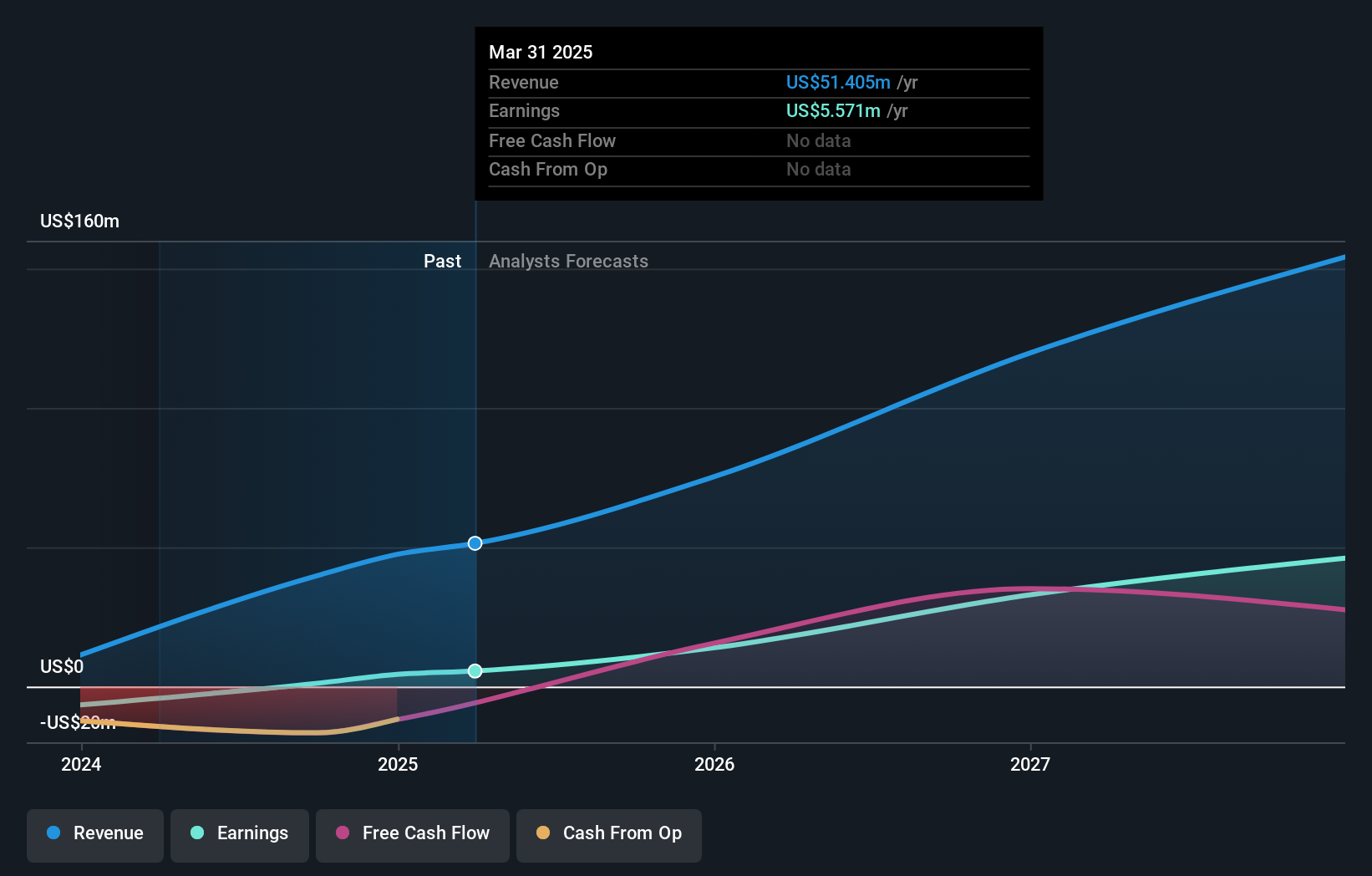

Sanara MedTech is poised for growth with expected annual earnings increase of 80.42% and revenue growth surpassing the US market at 13.2% annually. The company trades at 18.4% below its estimated fair value, indicating potential undervaluation. Recent leadership changes see Seth Yon as CEO, bringing a strong track record in commercial strategy and execution, which may bolster future performance. Despite current losses, Sanara's path to profitability within three years underscores its growth potential.

- Click to explore a detailed breakdown of our findings in Sanara MedTech's earnings growth report.

- Upon reviewing our latest valuation report, Sanara MedTech's share price might be too pessimistic.

Antalpha Platform Holding (ANTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Antalpha Platform Holding Company offers financing, technology, and risk management solutions to the crypto asset industry with a market cap of $269.21 million.

Operations: The company's revenue is primarily derived from its data processing segment, which amounts to $57.00 million.

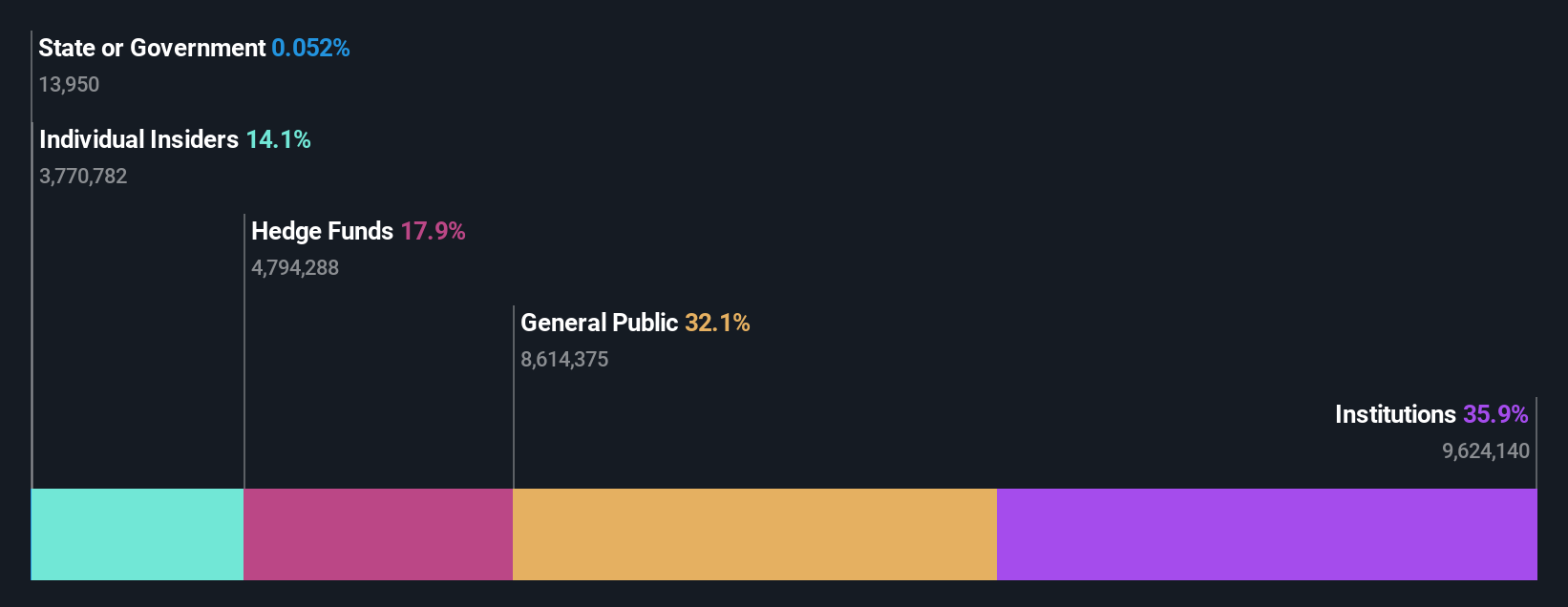

Insider Ownership: 17.9%

Antalpha Platform Holding is positioned for significant growth, with projected annual earnings and revenue increases of 47.73% and 28.2%, respectively, both outpacing the US market. Recent strategic moves include a collaboration with Tether to enhance the digital gold ecosystem and plans for a Bitcoin quantitative fund targeting US$100 million in assets under management. However, limited financial data availability poses challenges in fully assessing its long-term financial health and return on equity prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Antalpha Platform Holding.

- According our valuation report, there's an indication that Antalpha Platform Holding's share price might be on the expensive side.

Eton Pharmaceuticals (ETON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eton Pharmaceuticals, Inc. is a pharmaceutical company that develops and commercializes treatments for rare diseases, with a market cap of $495.59 million.

Operations: Eton Pharmaceuticals focuses its revenue on developing and commercializing prescription drug products, generating $58.18 million.

Insider Ownership: 14.7%

Eton Pharmaceuticals is experiencing rapid growth, with revenue projected to increase by 27.5% annually, surpassing the US market average. Recent inclusion in the S&P Global BMI Index highlights its rising prominence. Despite a net loss of US$2.59 million for Q2 2025, earnings are expected to grow significantly over the next three years as it aims for profitability. While insider activity shows more sales than purchases recently, analysts anticipate a potential stock price rise of 61.3%.

- Unlock comprehensive insights into our analysis of Eton Pharmaceuticals stock in this growth report.

- The analysis detailed in our Eton Pharmaceuticals valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Explore the 204 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SMTI

Sanara MedTech

A medical technology company, develops, markets, and distributes surgical, wound, and skincare products and services to physicians, hospitals, clinics, and post-acute care settings in the United States.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives