- United States

- /

- Biotech

- /

- NasdaqCM:ETHZ

Could ETHZilla's (ETHZ) Stock Split and New Executive Point to a Shift in Investor Relations Strategy?

Reviewed by Sasha Jovanovic

- ETHZilla Corporation recently completed a 1-for-10 stock split on October 20, 2025, and appointed John D. Kristoff as Senior Vice President, Corporate Communications and Investor Relations, reporting directly to Chairman and CEO McAndrew Rudisill.

- This combination of a share structure change and the creation of a high-level communications and investor relations role highlights ETHZilla's focus on expanding accessibility and strengthening its engagement with both investors and the media.

- We’ll explore how ETHZilla’s addition of a seasoned communications executive could reshape perceptions of its growth and market position.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is ETHZilla's Investment Narrative?

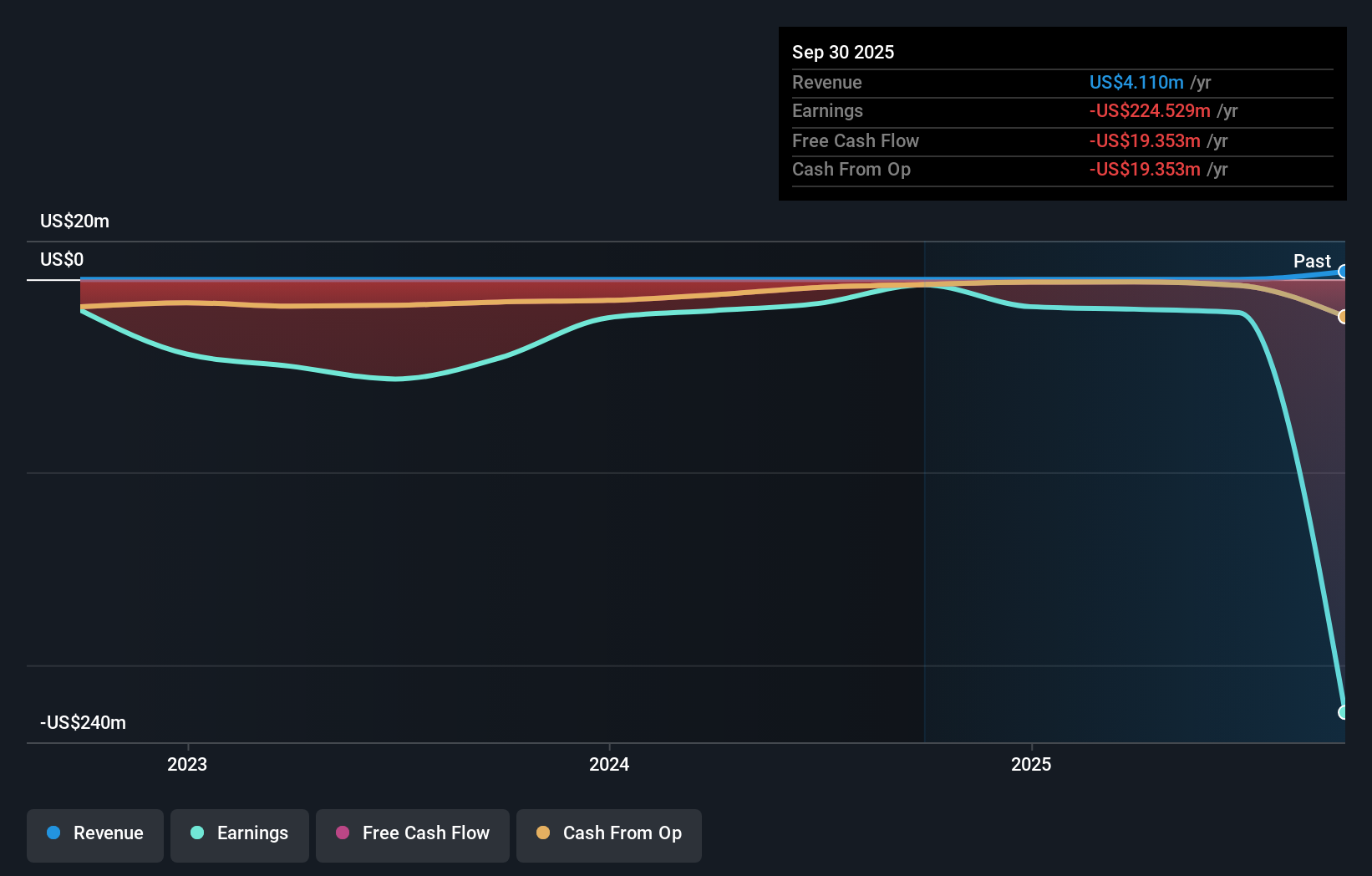

For ETHZilla shareholders, the central thesis is about believing in the company’s ambition to bridge traditional and decentralized finance, under the leadership of a newly overhauled team. The recent 1-for-10 stock split and appointment of John D. Kristoff as Senior Vice President of Corporate Communications and Investor Relations signal a push towards transparency and broader investor appeal. These changes reinforce efforts to engage with the market and improve sentiment in the short term, but the fundamentals still pose substantial hurdles: ETHZilla remains in a pre-revenue phase, is unprofitable, and continues to experience wide share price fluctuations. While the appointment of a communications executive could shape perceptions, the impact on key short-term catalysts, such as tangible revenue generation or stabilization of the share price, may be limited unless followed by operational improvements. The risk of further dilution also remains pertinent for shareholders.

But it’s worth noting that dilution risk has not gone away, despite stronger communication efforts. Our expertly prepared valuation report on ETHZilla implies its share price may be too high.Exploring Other Perspectives

Explore 4 other fair value estimates on ETHZilla - why the stock might be worth less than half the current price!

Build Your Own ETHZilla Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ETHZilla research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free ETHZilla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ETHZilla's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ETHZilla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ETHZ

ETHZilla

Operates as a technology company in the decentralized finance industry.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion