- United States

- /

- Biotech

- /

- NasdaqCM:ENGN

enGene Holdings (ENGN) Valuation in Focus Following Promising Phase 2 Bladder Cancer Trial Results

Reviewed by Simply Wall St

enGene Holdings (ENGN) is drawing attention after announcing positive preliminary results from the pivotal cohort of its Phase 2 LEGEND trial. The data showed a high complete response rate and a favorable safety profile in challenging bladder cancer cases.

See our latest analysis for enGene Holdings.

enGene Holdings’ impressive momentum really kicked in after its recent LEGEND trial data sent the stock soaring, highlighted by a 40% seven-day share price return and a staggering 129% gain over the past three months. Despite some short-term bumps, the longer-term picture remains constructive, with total shareholder return for the past year coming in at 6.3% and positive sentiment fueled by regulatory progress and upgraded analyst outlooks.

If strong biotech breakouts catch your eye, this could be a great moment to explore other innovators in the sector. See the full list with our See the full list for free..

With such optimism and rapid gains, investors are asking the core question: Is enGene Holdings’ current price still attractive, or has the recent clinical excitement already been factored into the stock’s valuation, leaving little room for additional upside?

Price-to-Book of 2.2: Is it justified?

With enGene Holdings trading at a price-to-book (P/B) ratio of 2.2, the stock appears attractively valued compared to both its peers and the industry average. Its last close price was $8.43.

The price-to-book ratio compares a company’s market price to its book value, providing insight into how much investors are paying for the company’s net assets. This measure is commonly used in biotech, where profits are often elusive and tangible assets can anchor valuations.

For enGene Holdings, a P/B of 2.2 is notable, especially when compared to the US Biotechs industry average of 2.6 and a peer average of 3.9. Such a discount indicates that the market might be underestimating the company’s asset base or its potential, despite clinical progress and momentum. If valuations move closer to peer or industry benchmarks, there could be meaningful upside from current levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 2.2 (UNDERVALUED)

However, risks remain, including competition from other biotech firms and the uncertainty of future clinical trial outcomes, which could quickly shift sentiment.

Find out about the key risks to this enGene Holdings narrative.

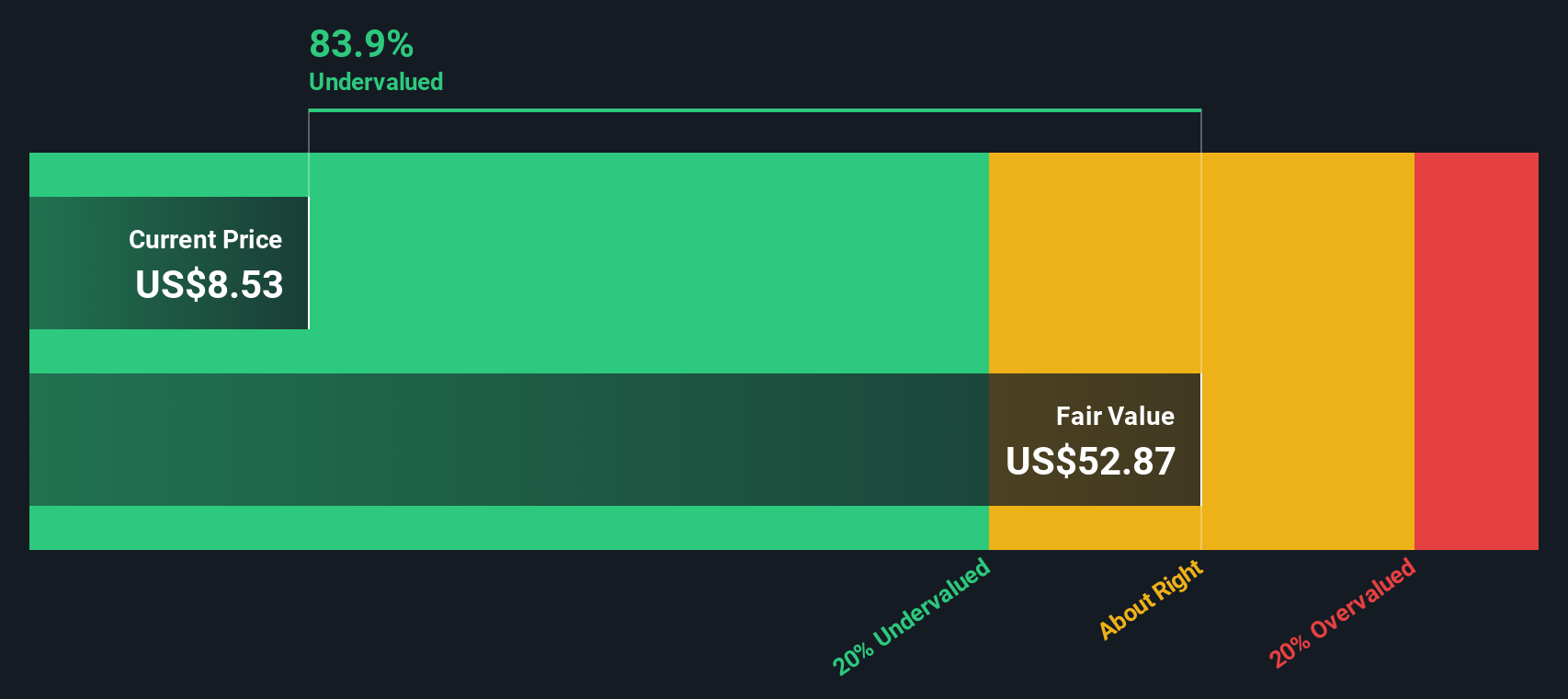

Another View: DCF Model Signals Big Undervaluation

While the price-to-book ratio makes enGene Holdings look attractively valued, our SWS DCF model presents an even more striking perspective. According to this method, the stock’s fair value could be as high as $65.92, which means shares are currently trading 87.2% below this estimate. This raises the question: Is the market missing something, or is the risk higher than it appears?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out enGene Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own enGene Holdings Narrative

Ultimately, if you want to dig into the numbers or take a different view, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your enGene Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by while focusing on just one stock. Powerful market shifts are happening, and your next winner could be just a click away.

- Capitalize on market mispricings by targeting value stocks through these 874 undervalued stocks based on cash flows, which are trading below their intrinsic worth.

- Target future-focused healthcare disruptors with these 31 healthcare AI stocks, where AI breakthroughs are transforming patient care and diagnostics.

- Grow your income stream by finding high-yield companies with these 15 dividend stocks with yields > 3%, offering stable dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ENGN

enGene Holdings

Through its subsidiary enGene, Inc., operates as a clinical-stage biotechnology company that develops genetic medicines to help patients suffering from bladder cancer.

Excellent balance sheet and good value.

Market Insights

Community Narratives