- United States

- /

- Biotech

- /

- NasdaqCM:ENGN

Could a Shift in enGene (ENGN) Trial Endpoints Reveal New Priorities in Its Clinical Strategy?

Reviewed by Sasha Jovanovic

- enGene Holdings recently reported additional preliminary efficacy data from its pivotal Phase 2 LEGEND trial for detalimogene voraplasmid in patients with high-risk, BCG-unresponsive non-muscle invasive bladder cancer, along with a protocol amendment changing the primary clinical endpoint after discussions with the FDA.

- This update reveals that earlier patients in the study experienced a lower 12-month complete response rate compared to FDA-approved therapies, leading to significant regulatory guidance and potential implications for enGene's late-stage drug pipeline.

- We'll examine how the trial's revised primary endpoint after FDA input could reshape enGene Holdings' investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is enGene Holdings' Investment Narrative?

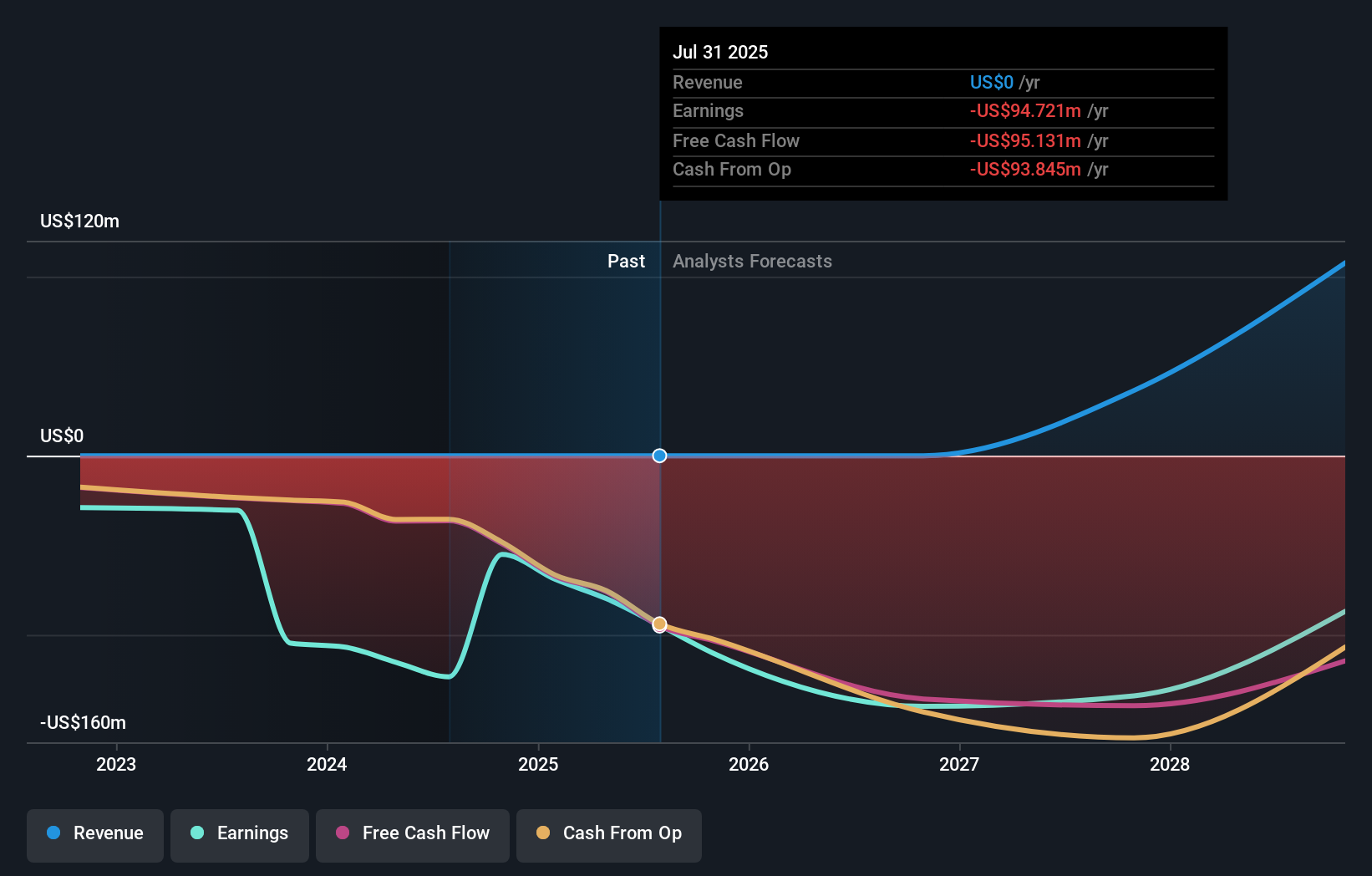

To believe in enGene Holdings means being comfortable with the risks and rewards typical of clinical-stage biotech companies. The company’s story hinges on its non-viral genetic medicine platform and the prospects for detalimogene voraplasmid in high-risk, BCG-unresponsive non-muscle invasive bladder cancer, which recently received expedited development designations from the FDA. However, the latest LEGEND trial update has shifted the near-term catalyst and risk profile: disappointing 12-month response rates and an amended primary endpoint, following FDA input, introduce fresh uncertainty into how the pivotal data will be interpreted. This pivot could affect regulatory timelines and market perceptions, which matter greatly in a business with US$0 revenue and widening losses. The recent follow-on equity offering may also impact share price volatility as the company navigates late-stage trial challenges and cash needs.

But investors should also be aware of the unpredictability around how these revised trial outcomes will be received by regulators. enGene Holdings' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on enGene Holdings - why the stock might be worth just $23.70!

Build Your Own enGene Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your enGene Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free enGene Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate enGene Holdings' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ENGN

enGene Holdings

Through its subsidiary enGene, Inc., operates as a clinical-stage biotechnology company that develops genetic medicines to help patients suffering from bladder cancer.

Excellent balance sheet and good value.

Market Insights

Community Narratives