- United States

- /

- Biotech

- /

- NasdaqCM:VRDN

Exploring 3 High Growth Tech Stocks in the US Market

Reviewed by Simply Wall St

As the U.S. market kicks off a holiday-shortened week with significant gains, investors are buoyed by optimism around potential Federal Reserve rate cuts and a rally in tech stocks, particularly those related to artificial intelligence. In this environment of heightened market activity and shifting economic indicators, identifying high-growth tech stocks requires a keen understanding of innovation trends and the ability to navigate volatility effectively.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Palantir Technologies | 27.16% | 29.98% | ★★★★★★ |

| Sanmina | 31.01% | 33.24% | ★★★★★☆ |

| Workday | 11.16% | 32.14% | ★★★★★☆ |

| Pelthos Therapeutics | 47.44% | 126.65% | ★★★★★☆ |

| Circle Internet Group | 26.03% | 84.68% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.80% | 40.68% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.61% | 116.48% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Viridian Therapeutics (VRDN)

Simply Wall St Growth Rating: ★★★★★☆

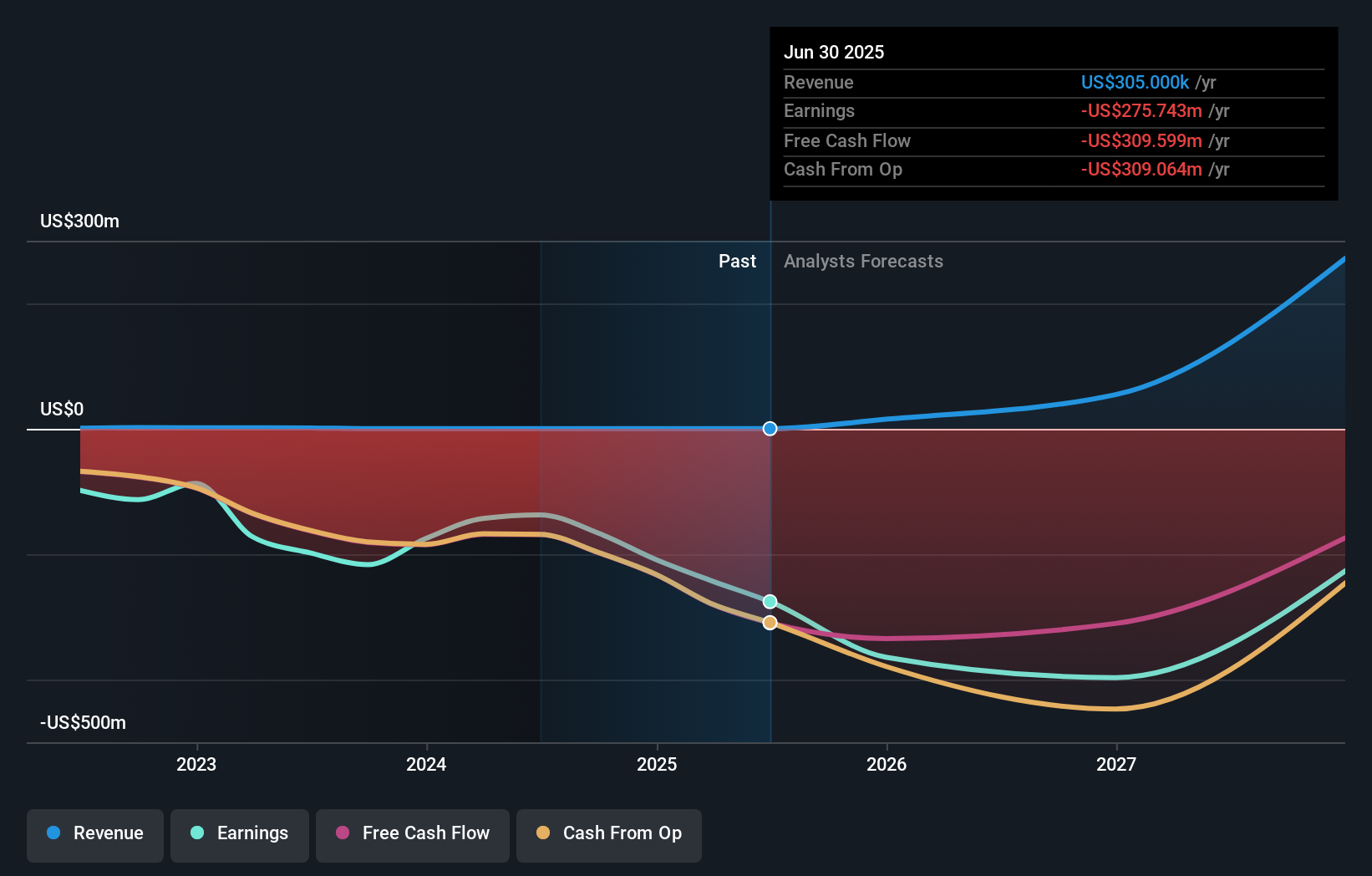

Overview: Viridian Therapeutics, Inc. focuses on discovering, developing, and commercializing treatments for serious and rare diseases with a market cap of approximately $2.90 billion.

Operations: Viridian Therapeutics generates revenue primarily from its efforts in discovering, developing, and commercializing potential best-in-class medicines for serious and rare diseases, amounting to $70.79 million.

Viridian Therapeutics, showcasing a remarkable annual revenue growth of 56.3%, significantly outpaces the broader U.S. market's average of 10.4%. This biotech firm is on a trajectory to profitability within three years, buoyed by an impressive forecasted earnings growth rate of 54.1% per annum. Recent pivotal phase 3 trials for its thyroid eye disease treatments—veligrotug and VRDN-003—have met all primary and secondary endpoints, underscoring Viridian's potential in revolutionizing therapeutic options in this domain. The company has also strategically expanded its financial flexibility through recent equity offerings totaling over $251 million, enhancing its ability to sustain ongoing and future clinical developments.

- Click to explore a detailed breakdown of our findings in Viridian Therapeutics' health report.

Understand Viridian Therapeutics' track record by examining our Past report.

Viant Technology (DSP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Viant Technology Inc. is an advertising technology company with a market capitalization of $612.47 million.

Operations: Viant Technology generates revenue primarily from its Enterprise Technology Platform, which contributes $324.13 million.

Viant Technology, with a 13.3% annual revenue growth, is navigating the competitive tech landscape by focusing on innovations in Connected TV (CTV) and programmatic advertising. The company's recent earnings report highlighted a modest increase in sales to $85.58 million for Q3 2025, up from $79.92 million the previous year, reflecting steady market penetration despite a slight dip in net income to $0.996 million from $1.51 million year-over-year. Strategic partnerships, like the new multi-year deal with Molson Coors and integration with Magnite's SpringServe platform, underscore Viant's commitment to enhancing ad delivery and effectiveness across digital formats. These collaborations not only expand Viant’s reach but also solidify its position in driving future growth through direct-to-publisher advertising solutions and advanced data-driven strategies for CTV ecosystems.

Dynavax Technologies (DVAX)

Simply Wall St Growth Rating: ★★★★☆☆

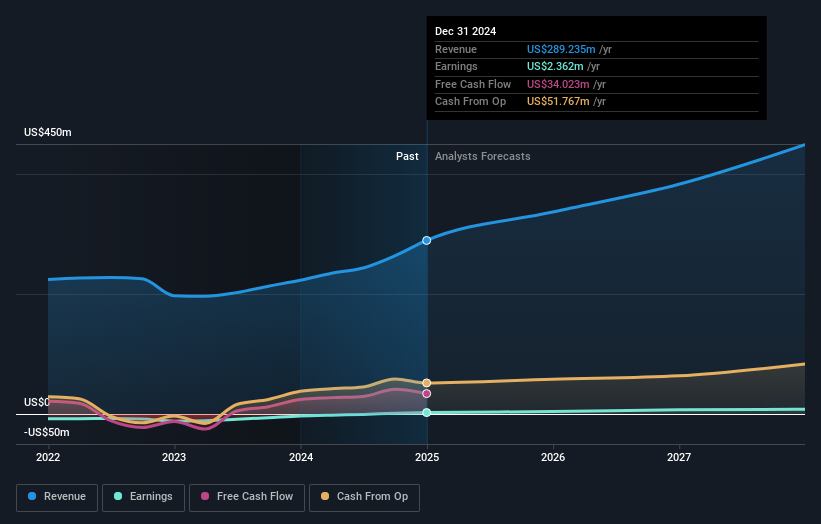

Overview: Dynavax Technologies Corporation is a commercial-stage biopharmaceutical company that specializes in developing and commercializing vaccines both in the United States and internationally, with a market cap of approximately $1.31 billion.

Operations: The company generates revenue primarily from the discovery, development, and commercialization of novel vaccines, totaling $330.51 million.

Dynavax Technologies has demonstrated robust growth, with a notable 17.7% increase in third-quarter revenue year-over-year, reaching $94.88 million. This performance is bolstered by strategic advancements in its vaccine portfolio, particularly the promising clinical trial outcomes of its shingles vaccine candidate, Z-1018. The company's commitment to innovation is further underscored by its recent $100 million stock repurchase plan, reflecting confidence in its financial health and future prospects. Moreover, Dynavax's forward-looking R&D initiatives are set to enhance its competitive edge in the biotech sector, aligning with industry shifts towards more targeted and efficient healthcare solutions.

- Navigate through the intricacies of Dynavax Technologies with our comprehensive health report here.

Assess Dynavax Technologies' past performance with our detailed historical performance reports.

Make It Happen

- Dive into all 74 of the US High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRDN

Viridian Therapeutics

Engages in discovering, developing, and commercializing treatments for serious and rare diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success