- United States

- /

- Biotech

- /

- NasdaqGS:DNLI

Why Denali Therapeutics (DNLI) Is Down 7.7% After Widening Losses and Key Leadership Changes

Reviewed by Sasha Jovanovic

- Denali Therapeutics recently reported third quarter and nine-month 2025 results, with net losses widening to US$126.9 million and US$383.99 million respectively, while also announcing the departure of its long-standing Chief Medical Officer, Carole Ho, M.D., who will join Eli Lilly, and naming a new board member, Tim Van Hauwermeiren.

- This combination of financial performance and leadership transition marks a pivotal period for Denali, underscoring both operational challenges and evolving governance within the company.

- We’ll explore how the leadership changes, particularly the departure of Dr. Ho, may influence Denali Therapeutics’ investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Denali Therapeutics' Investment Narrative?

For anyone considering Denali Therapeutics as an investment, the story often centers around the company’s ambition to create breakthrough therapies for neurodegenerative and rare diseases, a mission that has yet to translate into profits or revenue. The latest results, showing widening net losses and no meaningful income, reinforce questions about cash burn and the timeline to commercialization, while the delay in the FDA’s review of tividenofusp alfa introduces added uncertainty to a crucial near-term catalyst. The surprise leadership transition, with the respected Chief Medical Officer Dr. Carole Ho departing, may unsettle investor confidence regarding clinical execution, although her successor, Dr. Peter Chin, brings deep experience from both Denali and the broader biotech field. The addition of Tim Van Hauwermeiren to the board infuses outside expertise that could steady governance. Despite these changes, the biggest risks remain: clinical and regulatory setbacks, escalating losses, and the absence of near-term revenue, even as the pipeline and new leadership give hope for longer-term progress. In the near term, the FDA delay and CMO turnover will likely weigh on sentiment and put added focus on operational resilience.

But there are new operational and regulatory risks investors shouldn't ignore.

Exploring Other Perspectives

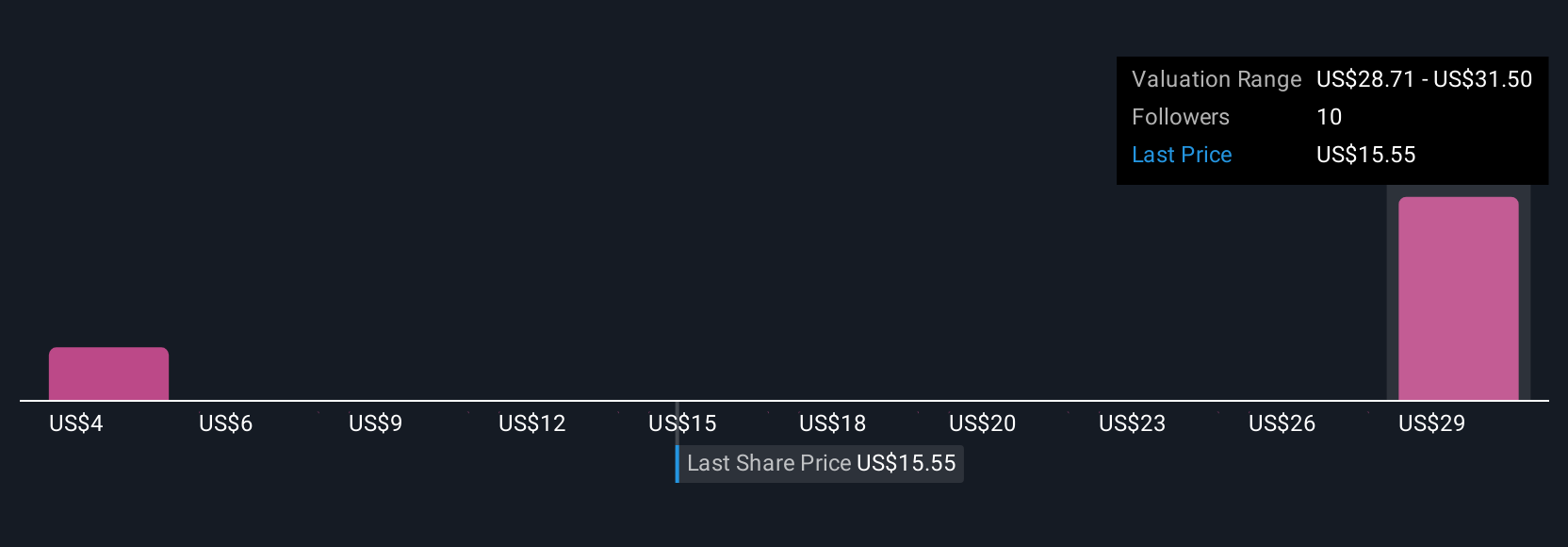

Explore 2 other fair value estimates on Denali Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Denali Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Denali Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Denali Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Denali Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DNLI

Denali Therapeutics

A biopharmaceutical company, discovers and develops therapeutics to treat neurodegenerative and lysosomal storage diseases.

Flawless balance sheet and fair value.

Market Insights

Community Narratives