- United States

- /

- Biotech

- /

- NasdaqGS:DNLI

Should You Reconsider Denali Therapeutics After This Year’s Collaboration and FDA News?

Reviewed by Bailey Pemberton

- Ever wondered if Denali Therapeutics is a hidden gem or just another biotech story on your watchlist? Let’s dive into whether the price tag matches the potential.

- It’s been a volatile ride recently, with the stock falling 8.2% over the last week and down 28.4% year-to-date, prompting fresh questions about both risk and growth prospects.

- Investors are reacting not just to price charts, but also to recent headlines as Denali’s collaboration updates and FDA-related news spark debate around its drug pipeline. These developments are keeping both optimists and skeptics on their toes as the biotech landscape rapidly shifts.

- On the valuation front, Denali Therapeutics scores a 2 out of 6 on our key measures for undervaluation, which means there’s more to unpack than headlines and price swings. Ahead, we’ll walk through the different ways to value the company, and at the end share a smarter approach you won’t want to miss.

Denali Therapeutics scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Denali Therapeutics Discounted Cash Flow (DCF) Analysis

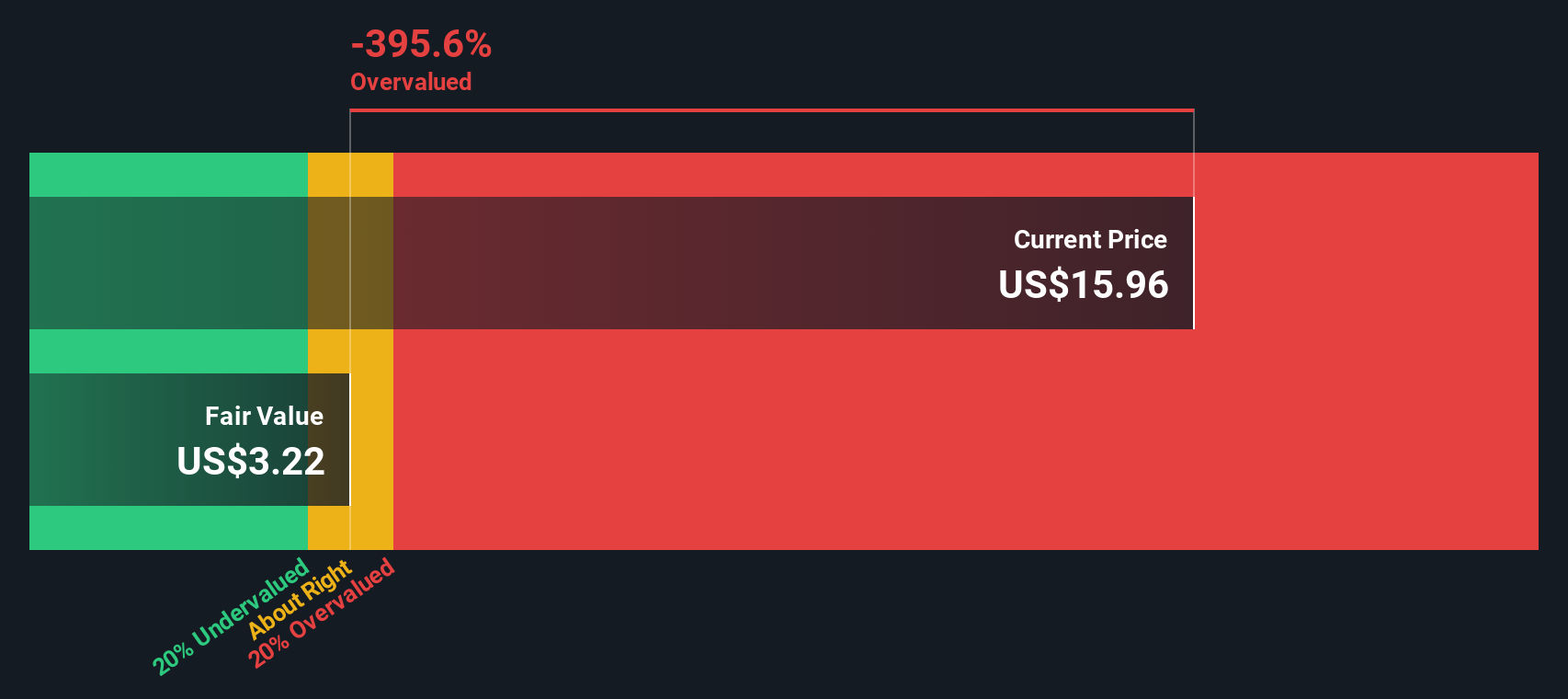

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and then discounting those projections back to today's value. This approach aims to gauge what Denali Therapeutics is worth right now based on its expected future ability to generate cash.

Currently, Denali Therapeutics reported a Free Cash Flow (FCF) of -$367.95 million. Analyst estimates predict that FCF will remain negative for several years, but it is projected to turn positive by 2029, when FCF is expected to reach $22.24 million. Beyond analyst coverage, future FCFs up to 2035 are extrapolated, indicating modest growth and staying in the millions rather than billions of dollars.

According to the DCF model, the fair intrinsic value per share for Denali Therapeutics is estimated at $3.27. With the current share price significantly above this mark, the stock appears to be overvalued by 356.3%. This suggests that market expectations may be outpacing the company's forecasted cash generation, at least by this valuation metric.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Denali Therapeutics may be overvalued by 356.3%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Denali Therapeutics Price vs Book

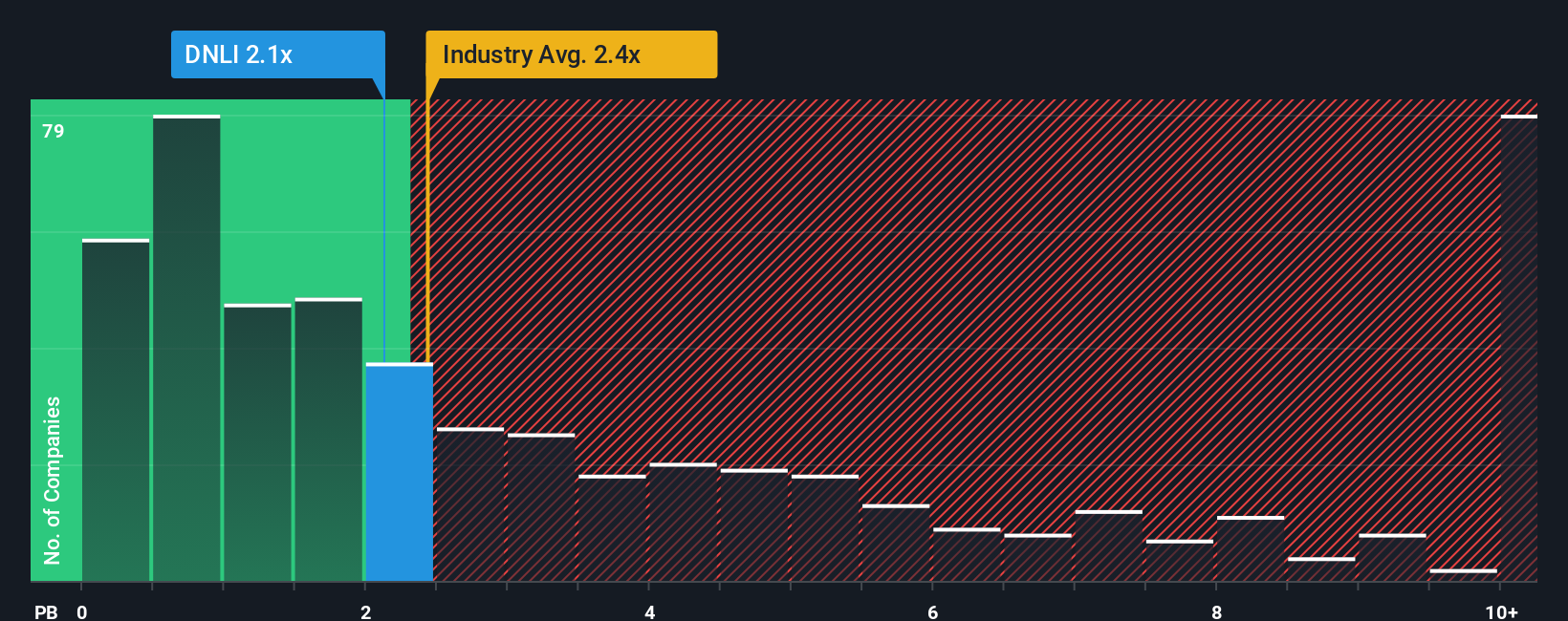

For many biotech companies, the Price-to-Book (PB) ratio is a preferred valuation metric, especially when profitability remains elusive but asset values are significant. The PB ratio helps investors gauge whether the market is pricing the company’s assets attractively in relation to its book value. This is particularly relevant for companies with variable earnings like Denali Therapeutics.

While higher growth potential or unique assets can justify a premium PB ratio, elevated risk or lackluster growth prospects might warrant a lower figure. For context, Denali Therapeutics is currently trading at a PB ratio of 2.13x. This compares to an industry average of 2.39x and a peer average at a notably higher 5.78x. This suggests that Denali is trading below most of its comparables based on this metric.

To get a clearer read, however, it makes sense to look beyond simple average comparisons. Simply Wall St’s Fair Ratio calculates a “custom-fit” multiple by factoring in Denali's own growth profile, risk factors, profit margins, and market capitalization alongside broader industry characteristics. This tailored approach offers a more precise valuation barometer than generic industry or peer benchmarking, which may overlook company-specific details.

Since the difference between Denali’s current PB ratio and its Fair Ratio is less than 0.10, the stock appears to be valued about right relative to its book value when considering all key fundamentals.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

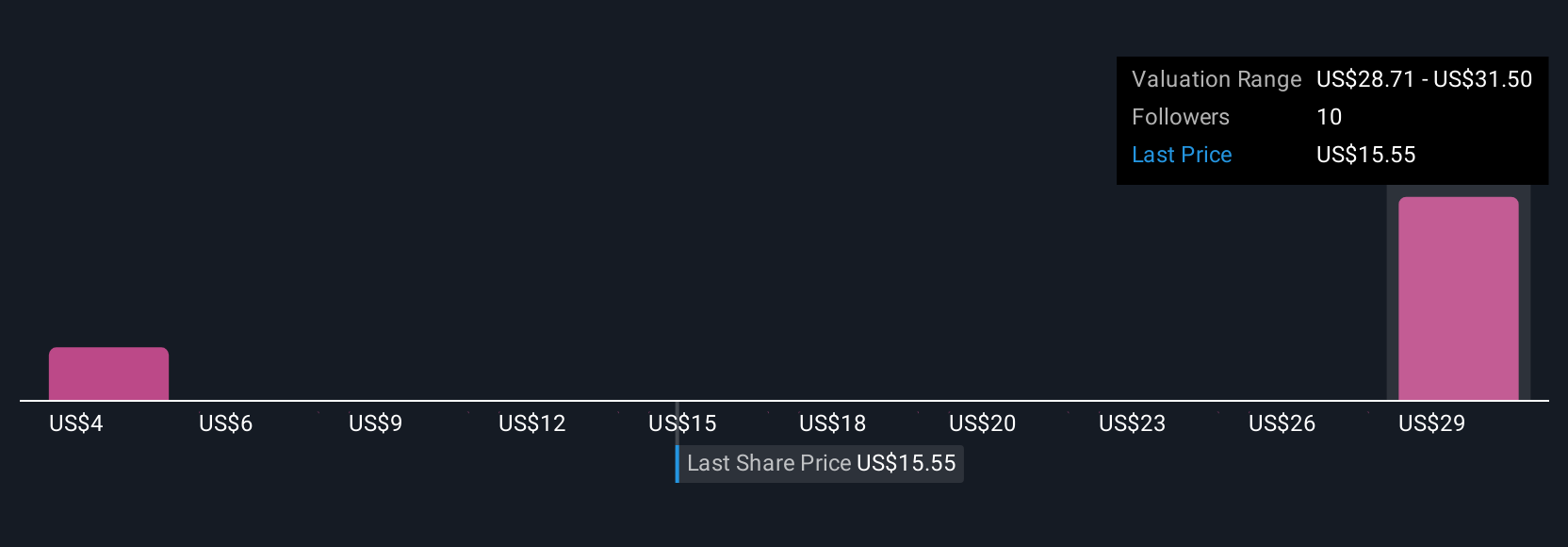

Upgrade Your Decision Making: Choose your Denali Therapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, accessible way to attach your own story or perspective to the numbers behind a stock, including your estimates for future revenue, earnings, profit margins, and what you think the fair value really is.

Instead of just relying on static ratios or forecasts, Narratives let you connect your view of Denali Therapeutics’ business. From upcoming drug launches to regulatory milestones, you can tie these directly to a custom financial forecast and valuation. Narratives are available on Simply Wall St’s Community page, a popular hub already used by millions of investors to share and compare their views.

With Narratives, you can easily see how your assumptions stack up against others and make more informed decisions about when to buy or sell by comparing your Fair Value to the current Price. As news and earnings are released, Narratives update automatically. This keeps your analysis current and relevant without extra work.

For example, in the Denali Therapeutics Community, one investor’s Narrative may set a much higher fair value based on optimistic pipeline success. Another could see a lower value if they are more skeptical about future approvals.

Do you think there's more to the story for Denali Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DNLI

Denali Therapeutics

A biopharmaceutical company, discovers and develops therapeutics to treat neurodegenerative and lysosomal storage diseases.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives