- United States

- /

- Life Sciences

- /

- OTCPK:TBIO

Codex DNA, Inc. (NASDAQ:DNAY) Consensus Forecasts Have Become A Little Darker Since Its Latest Report

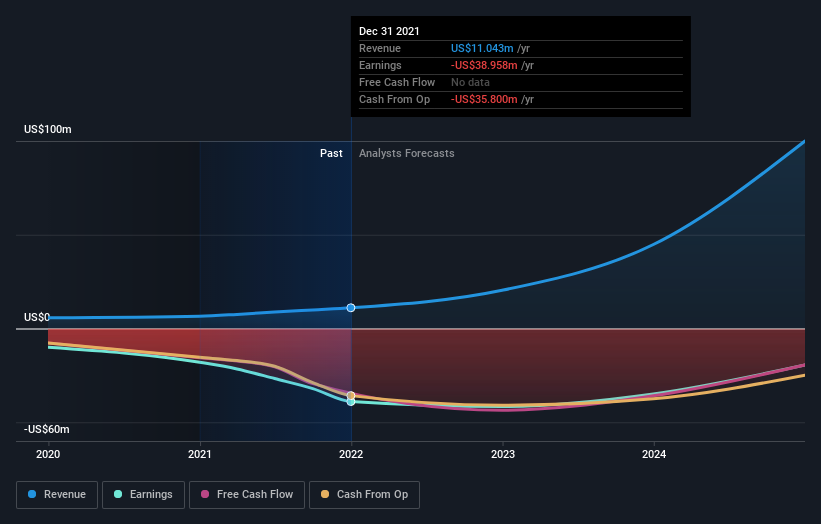

Codex DNA, Inc. (NASDAQ:DNAY) missed earnings with its latest full-year results, disappointing overly-optimistic forecasters. Revenues missed expectations somewhat, coming in at US$11m, but statutory earnings fell catastrophically short, with a loss of US$2.14 some 55% larger than what the analysts had predicted. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Codex DNA

Taking into account the latest results, the most recent consensus for Codex DNA from three analysts is for revenues of US$20.4m in 2022 which, if met, would be a substantial 84% increase on its sales over the past 12 months. Per-share losses are predicted to creep up to US$1.40. Before this earnings announcement, the analysts had been modelling revenues of US$25.2m and losses of US$1.42 per share in 2022. So there's been quite a change-up of views after the recent consensus updates, withthe analysts making a serious cut to their revenue forecasts while also making no real change to the loss per share numbers.

The average price target fell 16% to US$21.00, with the analysts clearly concerned about the weaker revenue outlook and expectation of ongoing losses. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Codex DNA at US$30.00 per share, while the most bearish prices it at US$12.00. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting Codex DNA's growth to accelerate, with the forecast 84% annualised growth to the end of 2022 ranking favourably alongside historical growth of 68% per annum over the past year. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.8% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Codex DNA to grow faster than the wider industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Codex DNA's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on Codex DNA. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Codex DNA analysts - going out to 2024, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 2 warning signs for Codex DNA you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if Telesis Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:TBIO

Telesis Bio

A synthetic biology company, manufactures and sells synthetic biology instruments, reagents, and associated products and related services, primarily to pharmaceutical and academic laboratories worldwide.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks