- United States

- /

- Biotech

- /

- NasdaqGS:DAWN

Is Day One Biopharma Set for Growth After 25% Monthly Surge and Clinical Trial News?

Reviewed by Bailey Pemberton

- Wondering if Day One Biopharmaceuticals is a smart buy right now? You are not alone, as many investors are starting to ask whether this stock's current price really reflects its future potential.

- Over the past month, Day One's stock has jumped 25.5%, even though it is still down 30.4% year-to-date and 38.2% in the last year. This has created a rollercoaster ride for shareholders and watchers alike.

- Recent headlines have focused on key clinical trial updates and new regulatory developments, sparking renewed interest from both investors and the medical community. These milestones have given the stock some momentum, signaling both opportunities and uncertainties ahead.

- As we dig into valuation, it is worth noting that Day One Biopharmaceuticals scores a 4 out of 6 on our simple value checks, which you can explore in detail here. Let’s break down how this score stacks up against standard valuation methods, and stay tuned because by the end, you will see there may be a more insightful way to spot true value.

Approach 1: Day One Biopharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This reflects the value of money over time. This approach is especially useful for companies like Day One Biopharmaceuticals, where profits are expected further out into the future.

Currently, Day One Biopharmaceuticals reports a free cash flow (FCF) of -$165.7 million, highlighting ongoing investment and early-stage operational costs. Analysts forecast an impressive turnaround, projecting FCF to reach $264.4 million in 2029. Beyond the five-year analyst estimates, future cash flows are extrapolated for another five years, showing growth consistent with sector expectations and proprietary models.

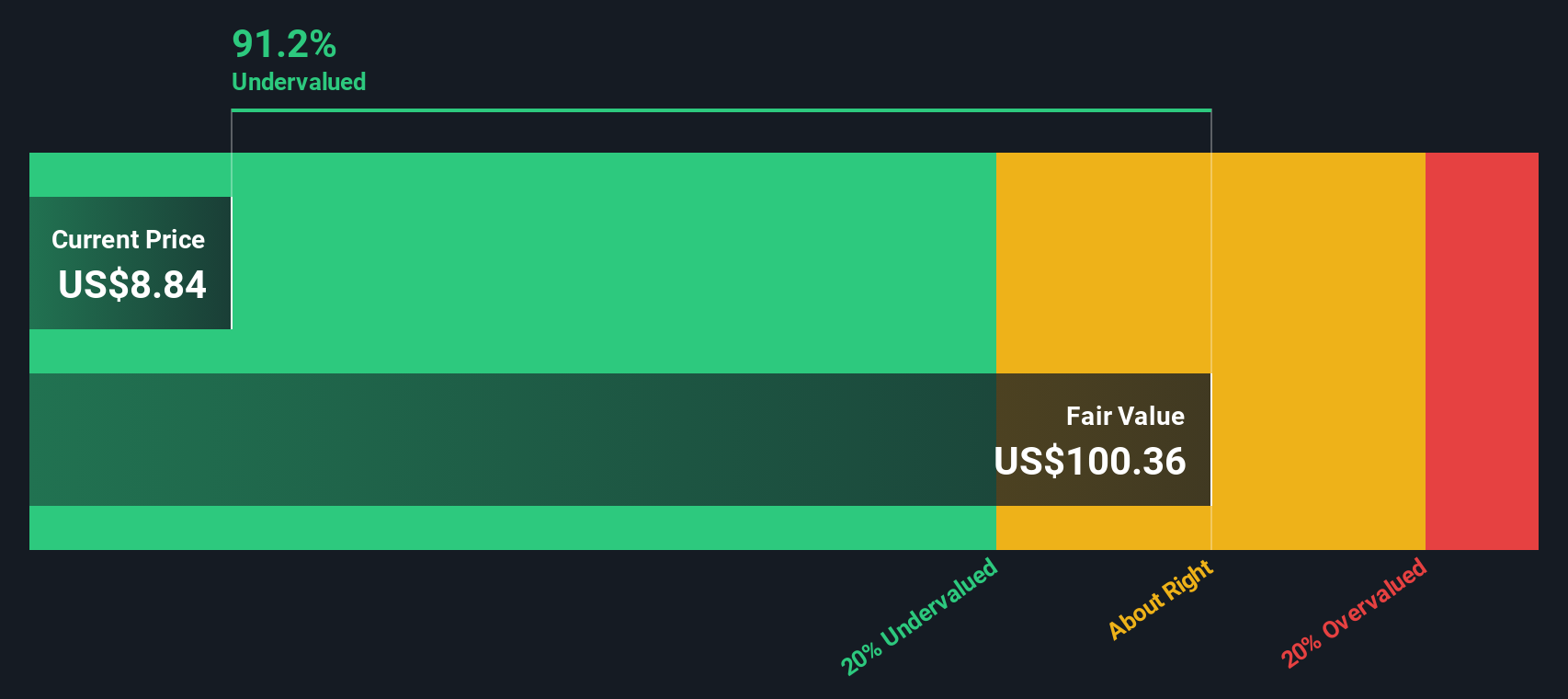

According to this model, the intrinsic value of Day One Biopharmaceuticals is estimated at $104.43 per share. Considering the DCF calculation suggests the stock is trading at a 91.5% discount to this value, it appears deeply undervalued compared to its future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Day One Biopharmaceuticals is undervalued by 91.5%. Track this in your watchlist or portfolio, or discover 868 more undervalued stocks based on cash flows.

Approach 2: Day One Biopharmaceuticals Price vs Sales

The Price-to-Sales (P/S) ratio is often used to value companies in the biotech sector, especially those not yet profitable, because it focuses on revenue rather than earnings. It is a particularly relevant metric for early-stage innovators like Day One Biopharmaceuticals, where earnings may be negative but top-line growth provides important insight into progress and potential.

Growth expectations and company risk play a big role in what is considered a "normal" or fair P/S ratio. For example, faster-growing or lower-risk companies typically command higher multiples, while increased uncertainty or slower growth tends to lower what investors are willing to pay per dollar of sales.

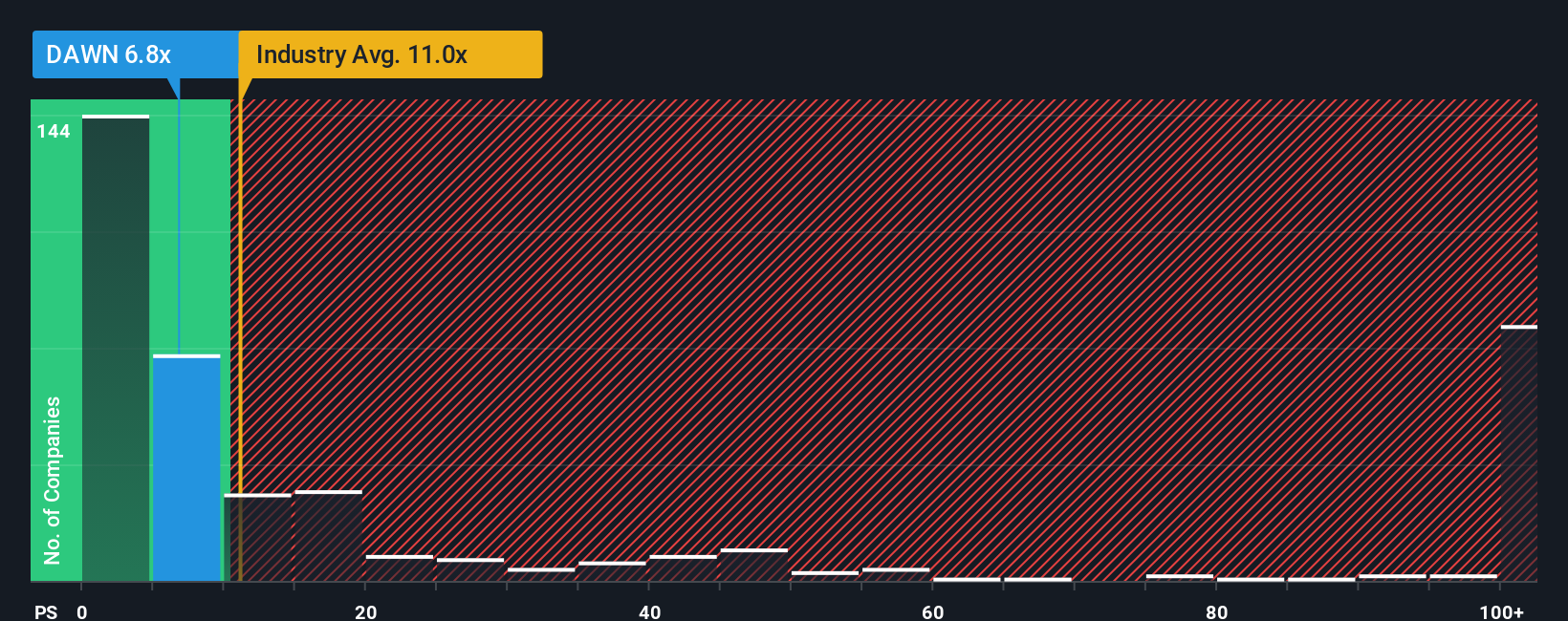

Day One Biopharmaceuticals currently trades at a P/S ratio of 6.8x, which is slightly above its peer average of 6.3x but well below the biotech industry average of 11.1x. To provide deeper insight, Simply Wall St's proprietary "Fair Ratio" for Day One stands at 10.4x. This Fair Ratio is calculated based on factors including future growth outlook, industry dynamics, profit margins, overall risks, market cap, and more. Comparing with this Fair Ratio provides greater context than industry averages alone, as it adjusts for what is reasonable for Day One Biopharmaceuticals specifically.

Given that Day One's actual P/S ratio of 6.8x is noticeably below its Fair Ratio of 10.4x, this suggests the stock may be undervalued by this approach. This indicates investors may not be fully pricing in its potential.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Day One Biopharmaceuticals Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, an approach that puts your perspective behind the numbers. A Narrative is your story about a company, combining your beliefs, assumptions, and expectations with financial forecasts and fair value estimates. Rather than just relying on ratios or consensus targets, Narratives let you connect Day One Biopharmaceuticals’ business story, such as new approvals, product launches, or competitive threats, to its future revenue, margins, and ultimately a reasonable price for the stock.

This makes Narratives a powerful and approachable tool, now available on Simply Wall St's Community page and used by millions of investors. Narratives help you decide when to buy or sell by comparing your Fair Value estimate to the current share price, and they update dynamically whenever new information emerges, like news or earnings releases.

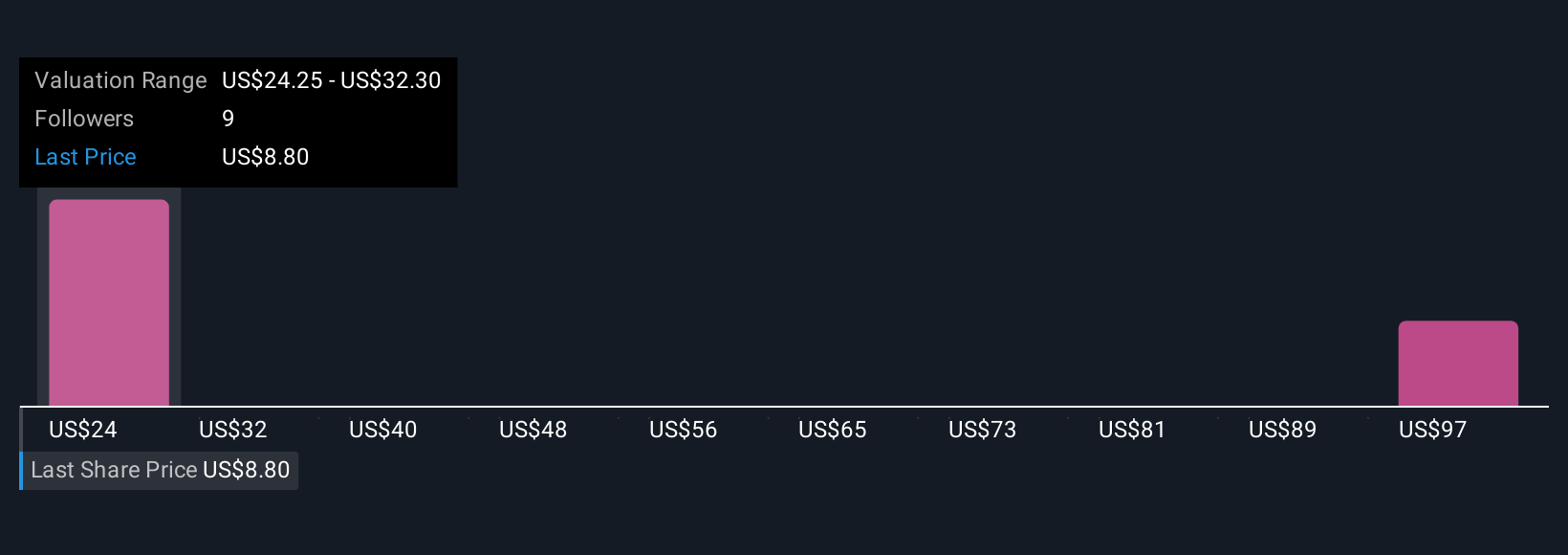

For example, one investor might see OJEMDA’s rapid clinical expansion and estimate a high fair value of $34.00, expecting strong revenue growth and margin improvement. Another may focus on pipeline risks and competition, lowering their fair value estimate to $16.00. Narratives allow you to capture these differences, empowering you to invest confidently with your own view of Day One’s future.

Do you think there's more to the story for Day One Biopharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DAWN

Day One Biopharmaceuticals

A commercial-stage company, focused on advancing class medicines for childhood and adult diseases with equal intensity in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives